As we enter the second half of 2023, economic uncertainty shows no signs of abating. Big-ticket items, like furniture, continue to be out of reach for many shoppers. This is exacerbated by lenders adjusting their underwriting strategies and approving fewer point-of-sale (POS) financing applications. Despite this challenging environment, furniture retailers can conquer declining financing approval rates and keep their customers happy. We explore how.

Why Declining Approval Rates Continue to Matter

The current economic landscape, marked by rising inflation and increasing Merchant Discount Rates (MDRs), puts considerable financial strain on consumers. It leads to increased APRs, lower credit limits, and reduced purchasing power. At the same time, individual lenders are approving fewer applications. This makes it harder for consumers to secure financing for their purchases.

Declining approval rates are likely to continue. Lenders are driven by risk management considerations. They tend to tighten their risk models and underwriting strategies in market instability. This cautious approach aims to protect lenders’ assets and minimize potential losses. As a result, lenders may approve fewer loans, making it harder for borrowers to get credit.

Additionally, regulatory measures play a crucial role in shaping lending practices. Regulators aim to protect consumers from over-borrowing and ensure transparency. They may introduce stricter guidelines and oversight for lenders. This regulatory environment often leads to a more conservative lending landscape. The result is decreasing approval rates, particularly for riskier loan products or borrowers.

How Declining Approval Rates Impact Furniture Buyers

The decline in consumer finance approvals has clear consequences for retailers. It results in fewer sales and has a negative impact on the customer experience. Meanwhile, there is a shift occurring in shoppers’ credit profiles making the situation more complicated.

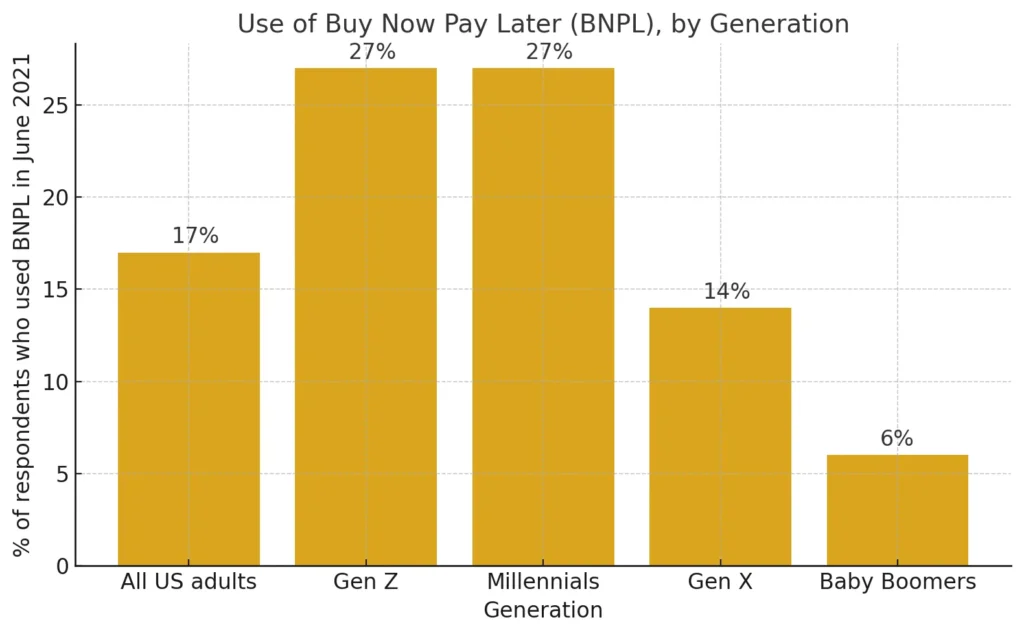

Consumers who were once approved by prime lenders at the start of 2022, now only qualify for near-prime loans; near-prime consumers are now subprime borrowers, making POS financing inaccessible for most of an already underserved population for POS financing. A survey by ChargeAfter found that only 17% of retailers offer subprime options.

Another audience to consider is B2B. Many furniture retailers are expanding to serve business clients. This way they tap into new market segments and diversify their revenue streams. Yet, point-of-sale financing for businesses often has approval rates below 15%.

The shift from a single-lender model to a multi-lender solution increases access to best-fit financing.

The Benefits of a Multi-Lender Approach

A multi-lender approach provides shoppers with financing choices. Lenders specialize in lending products usually designed for a specific credit profile. POS financing that meets the needs of the credit spectrum boosts the most important KPIs.

For example, retailers that use ChargeAfter’s platform to manage their POS financing enjoy up to 85% approval rates. ChargeAfter’s data shows that demand for POS financing increased by 62% in Q1 2023 compared to the same period the previous year, while approval rates for retailers using ChargeAfter went up by 14% despite lenders adjusting their credit boxes.

With approval rates from individual lenders fluctuating, adopting a multi-lender configuration is a critical strategy to ensure customers have consistent access to necessary funds in order to maintain and even increase approval rates.

How to Maximize Customer POS Financing Approval

In an unpredictable retail environment, maximizing customer point-of-sale financing approvals is vital. This is why retailers plan to expand their portfolio of lenders in 2023, according to a survey by ChargeAfter.

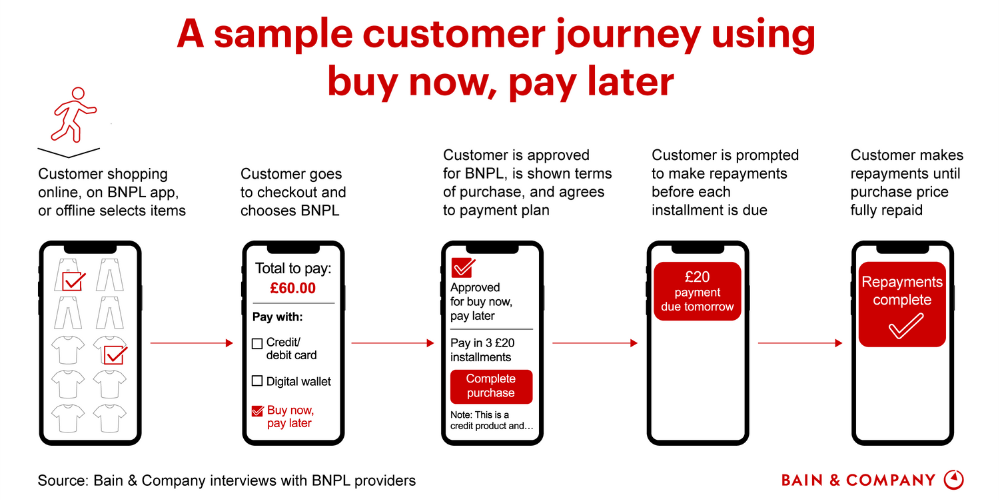

Merchants who try to stitch multiple lenders into omnichannel checkouts run into problems. The process involves complex integrations that can take months to implement. When implemented, retailers then face the complicated challenge of managing multiple systems. This approach provides a poor customer experience, since customers who are declined by one lender have to restart the process or abandon their carts, in a moment of the customer journey when speed and convenience are crucial. A streamlined, efficient application process improves sales conversion and customer satisfaction.

Retailers are simplifying the financing process with a platform-first approach, which is becoming more popular as new technologies emerge.

ChargeAfter: The Platform-First Approach to Point-of-Sale Financing

Point-of-sale (POS) financing has rapidly become a critical aspect of the customer experience, impacting approval rates, average order value (AOV), and customer loyalty. ChargeAfter’s platform-first approach to POS financing provides a robust solution.

With ChargeAfter’s platform, retailers easily embed POS financing into omnichannel purchasing journeys. This connects their customers to a network of over 40 trusted lenders that cover the full credit spectrum using a waterfall approach. The platform introduces a more seamless and efficient process for customer financing, enabling merchants to seamlessly provide a wider choice of financing options.

A vital benefit of a platform-first approach is higher approval rates. More approved applications mean more completed sales, contributing directly to retailers’ revenue growth. Furniture retailers using ChargeAfter’s waterfall platform increased AOV by 22% in the first quarter of the year in 2022 versus the same period in 2022, suggesting that consumers are turning towards financing to buy big-ticket purchases as prices rise.

A platform-first approach enhances the customer experience, offering a seamless and inclusive financing process. Shoppers enjoy less hassle, more flexibility, and financial empowerment, resulting in a more positive shopping experience and improving customer loyalty. It also provides access to data and analytics on customer financing behaviors. This enhances the understanding of customer preferences, trend(s) identification, and strategy fine-tuning.

Jerome’s Furniture, a family-owned chain of discount furniture stores in Southern California, improved its financing offer with platform first approach. Since implementing ChargeAfter, the company has seen a 67% surge in financing adoption with consistently high approval rates. The strategy has been so successful that Jerome’s Furniture leverages its financing offer in its marketing campaigns.

Investing in consumer education around alternative financing solutions could also prove beneficial. Customers will feel empowered and better equipped to navigate the financing landscape as they become more informed, increasing their purchasing confidence. Ultimately, a combination of innovative financial partnerships, consumer-centric policies, and education may bridge the gap between customer desire and purchase reality in these challenging times.

Moreover, a multi-lender platform simplifies retailers’ operational load. It makes it easy to manage disputes and chargebacks, and ensures compliance. ChargeAfter manages the complete post-sale financing cycle leaving merchants to focus on their core business.

In this economic climate, providing a choice of financing offers isn’t a service upgrade—it is a necessity. An exceptional embedded lending experience ensures the stability and longevity of retail businesses and safeguards consumer purchasing power. A multi-lender point-of-sale strategy has become essential for weathering economic uncertainty.

Conclusion

The platform-first approach to POS financing is a multifaceted solution helping retailers to optimize their financing processes. By employing a multi-lender platform like ChargeAfter, merchants can enhance their POS financing approval rates, AOV, and customer loyalty, while offering an unparalleled shopping experience.

Ready to get your financing right? Book a Demo