The Lending hub

Be the bank, ChargeAfter will do the rest

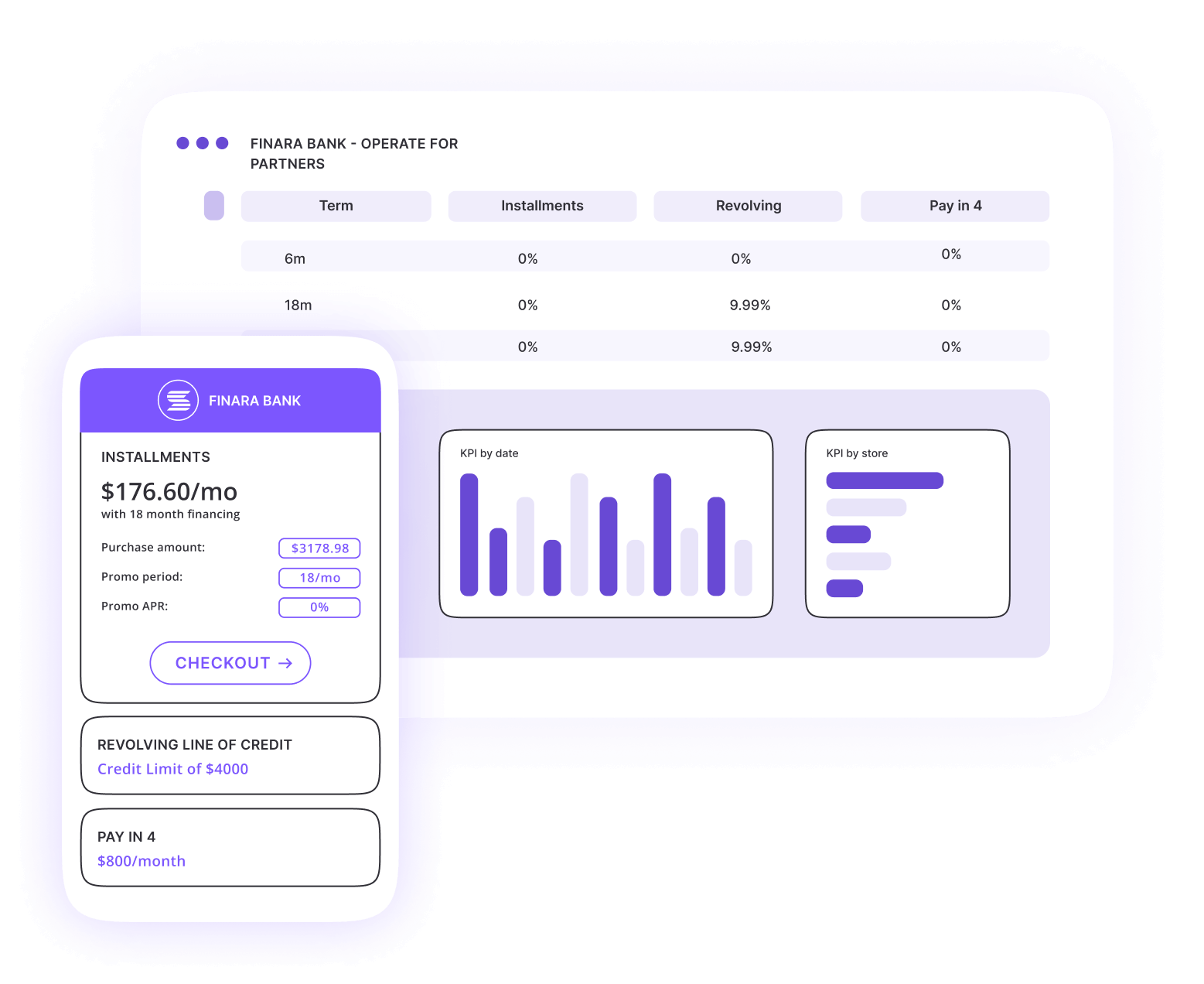

Create any point-of-sale lending product in a white-label POS system. With ChargeAfter’s embedded lending platform you can create, manage, and distribute the lending model that works for you. Whether you want a single lender model or waterfall finance, you can easily provide every lending product on a single platform with a fast go-to-market.

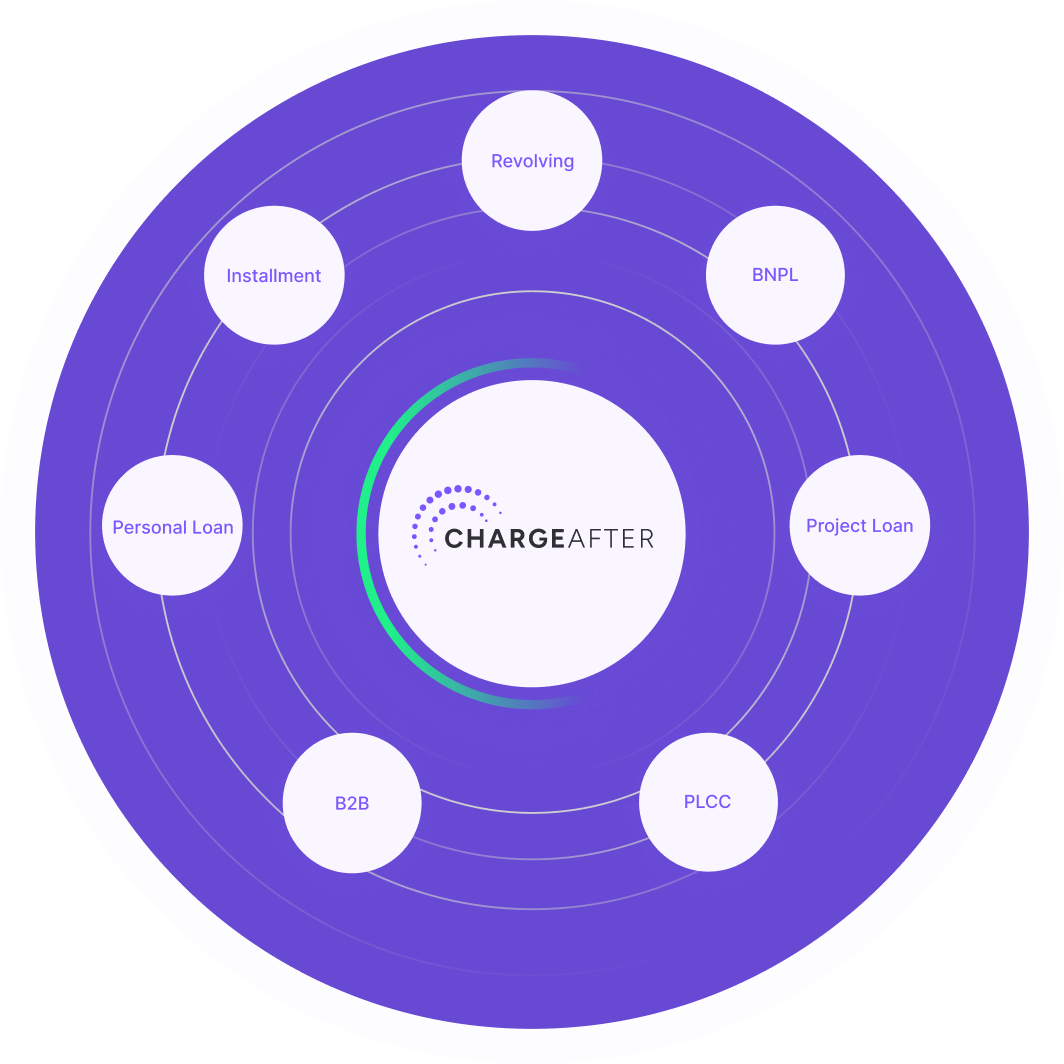

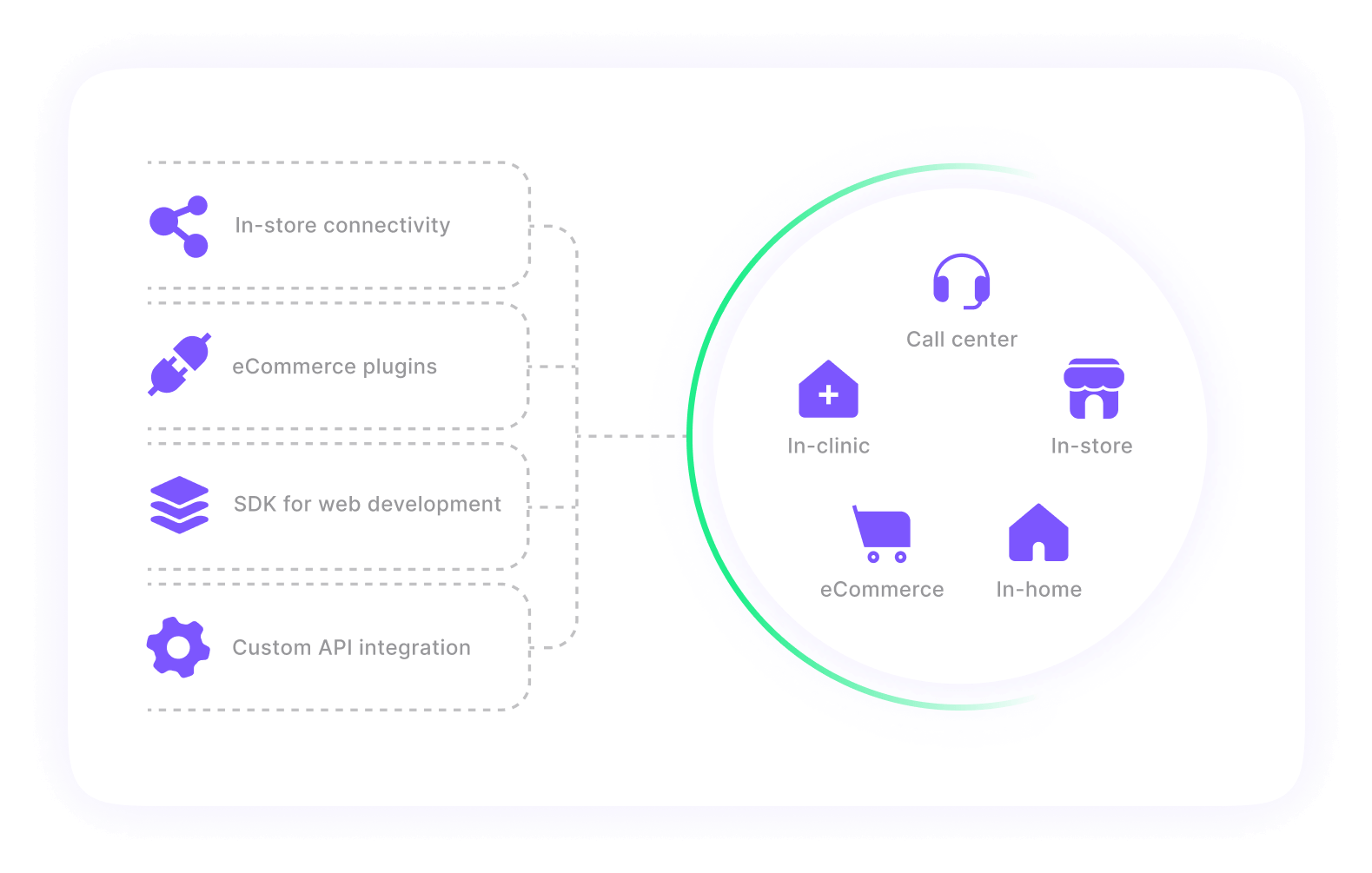

Offer short-term and long-term installments, BNPL (buy now pay later), revolving credit, private label credit cards, personal loans, project loans, and other lending assets. Our integration suite and eCommerce extension connect you to any merchant. Seamlessly.