With ChargeAfter, we have the peace of mind that our point-of-sale financing is powered by a proven platform and deep industry expertise, so we can focus on giving our customers a superb furniture buying experience.

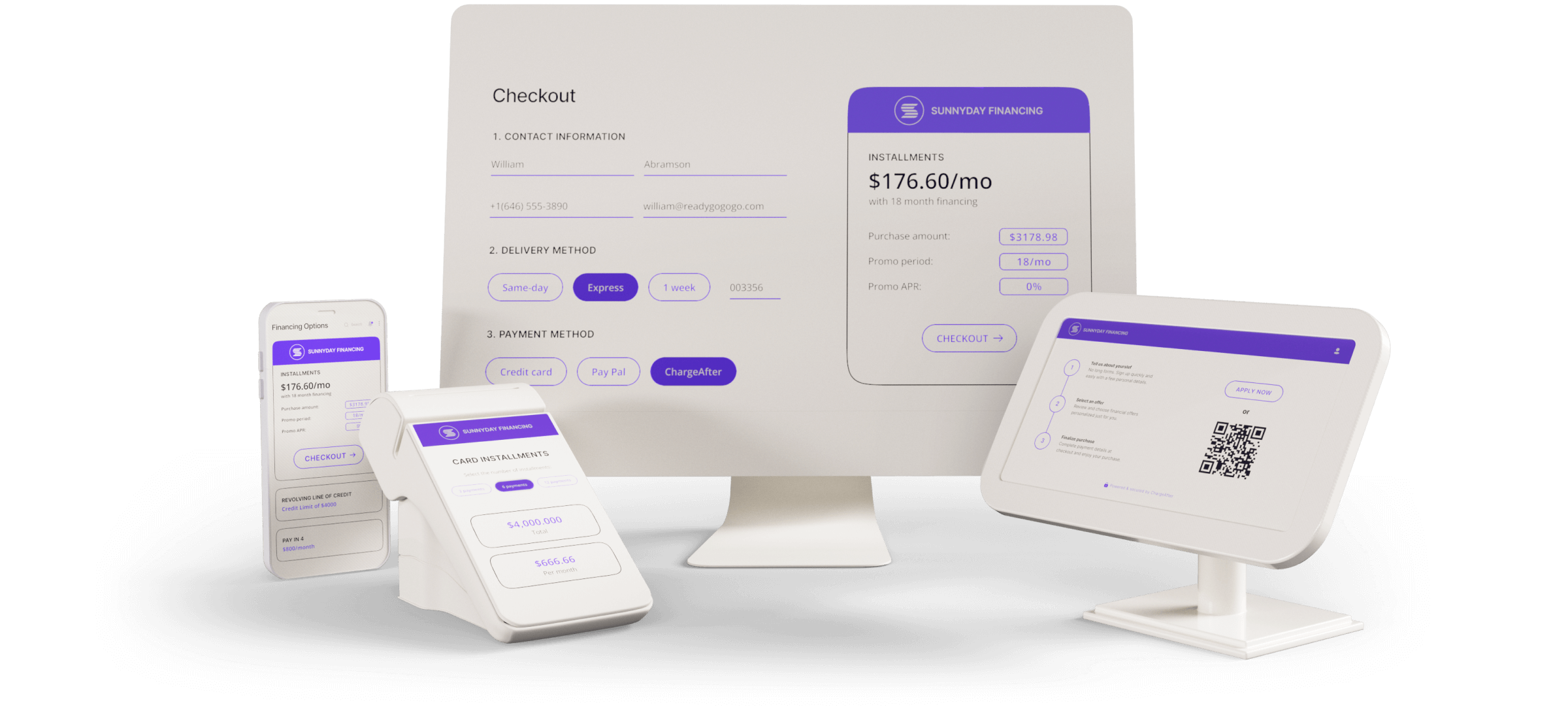

Seamlessly integrate multiple lenders into every point of sale to deliver an exceptional customer experience, maximize consumer finance approval rates, and boost sales. Delight your customers with omnichannel financing and a unified shopping journey.

Book a demo

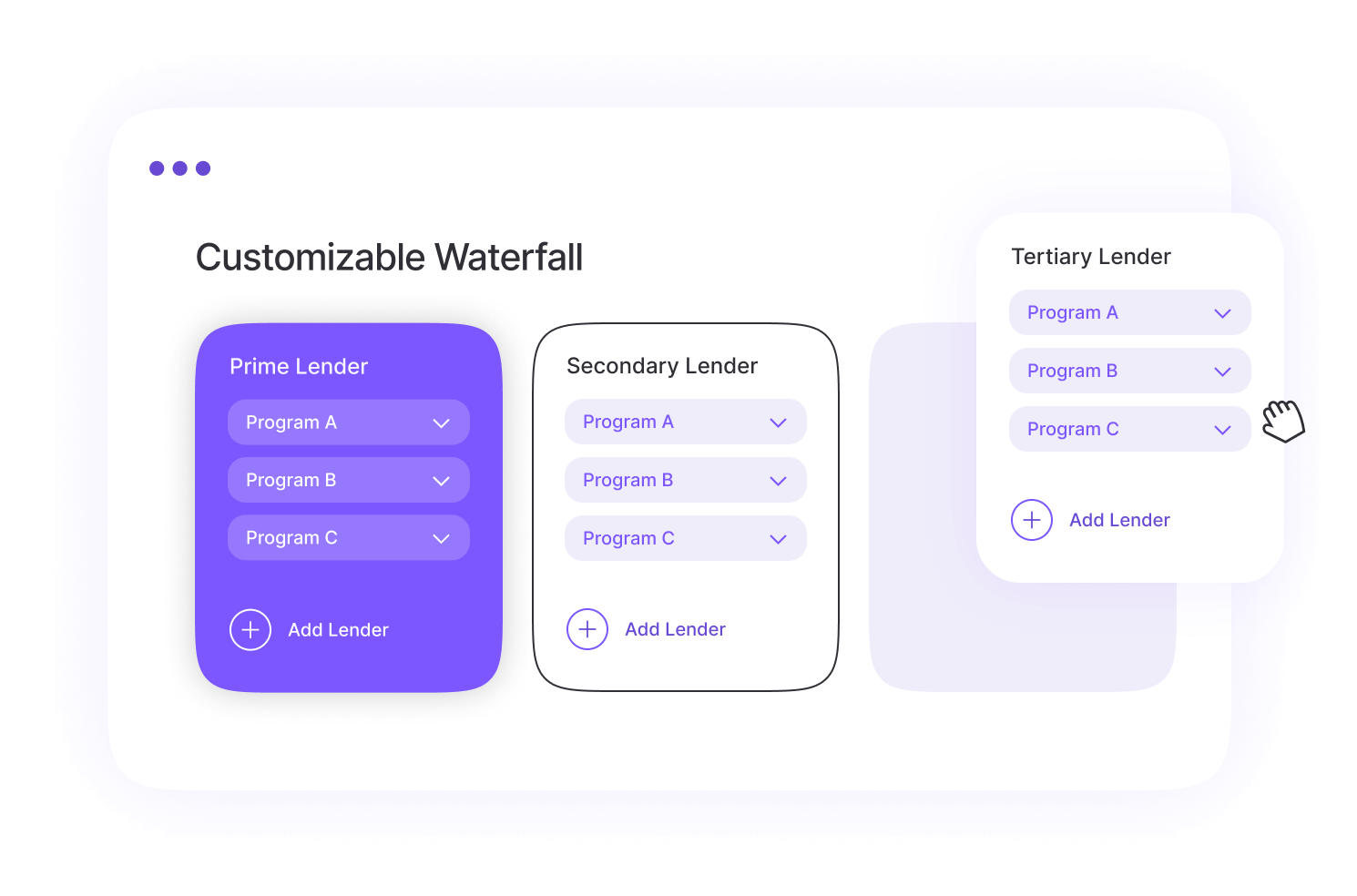

Build the perfect waterfall finance program for your business. You have complete control to add or switch lenders and financing providers and embed new financing products as they become available. Easily optimize interest rates, MDRs, and approval rates while providing your customers with a unified embedded lending experience, no matter where they shop.

online

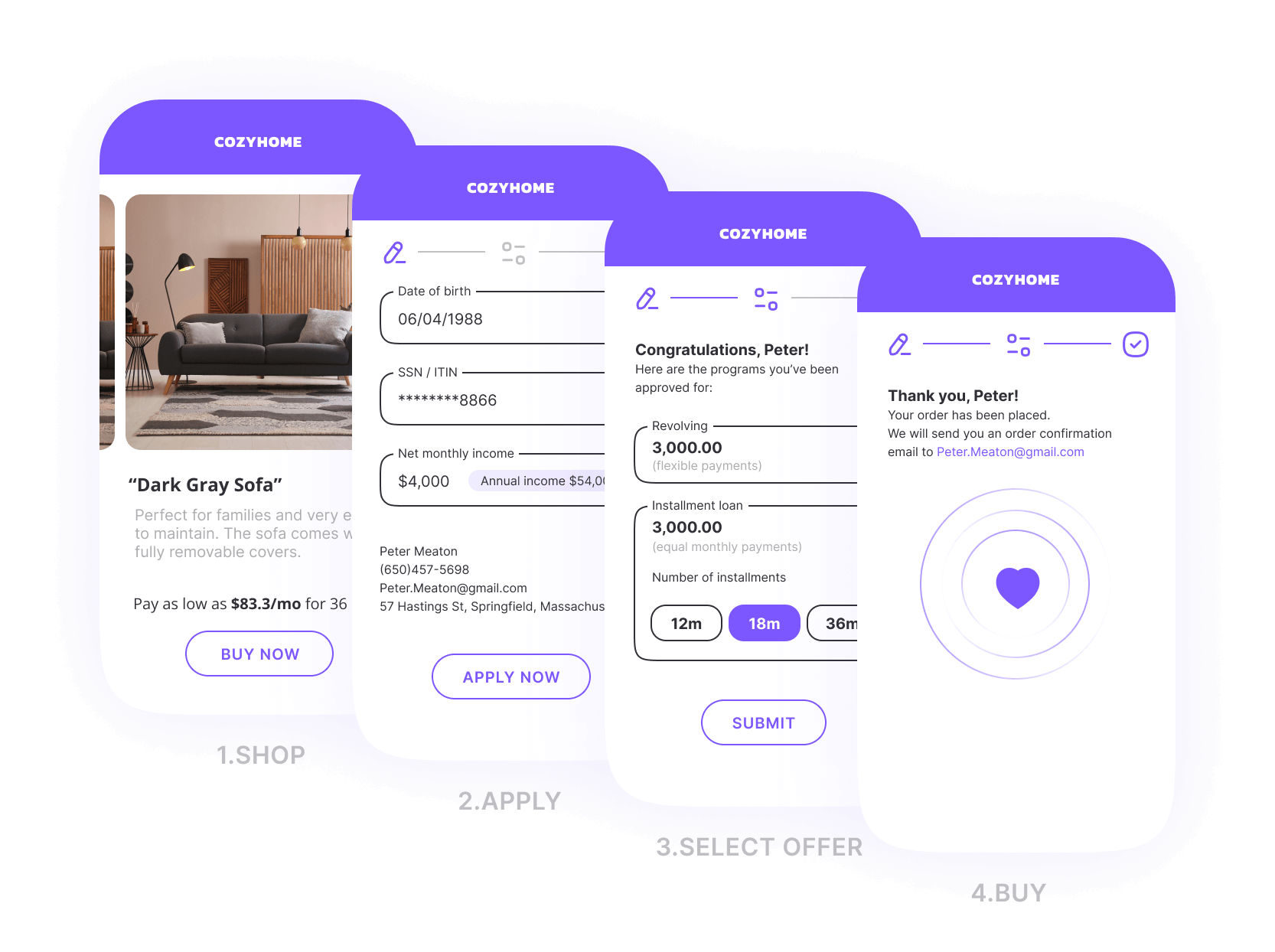

Enable your customers to apply online for consumer financing wherever they are – at home, waiting in line, or on the go. With instant online pre-qualification, shoppers can apply for POS financing now and reach checkout later with the funds in hand to complete the purchase.

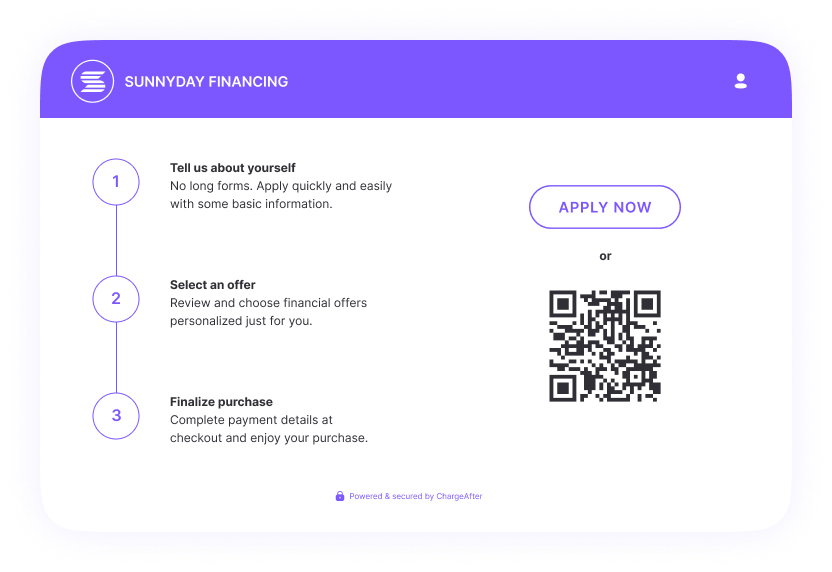

IN-STORE FINANCE

Provide an in-store point-of-sale financing experience that feels intuitive and familiar. With the convenience of in-store devices, tablets, and self-checkout counters, in-store financing has never been easier. Shoppers can even apply from the comfort of their own phones with QR codes.

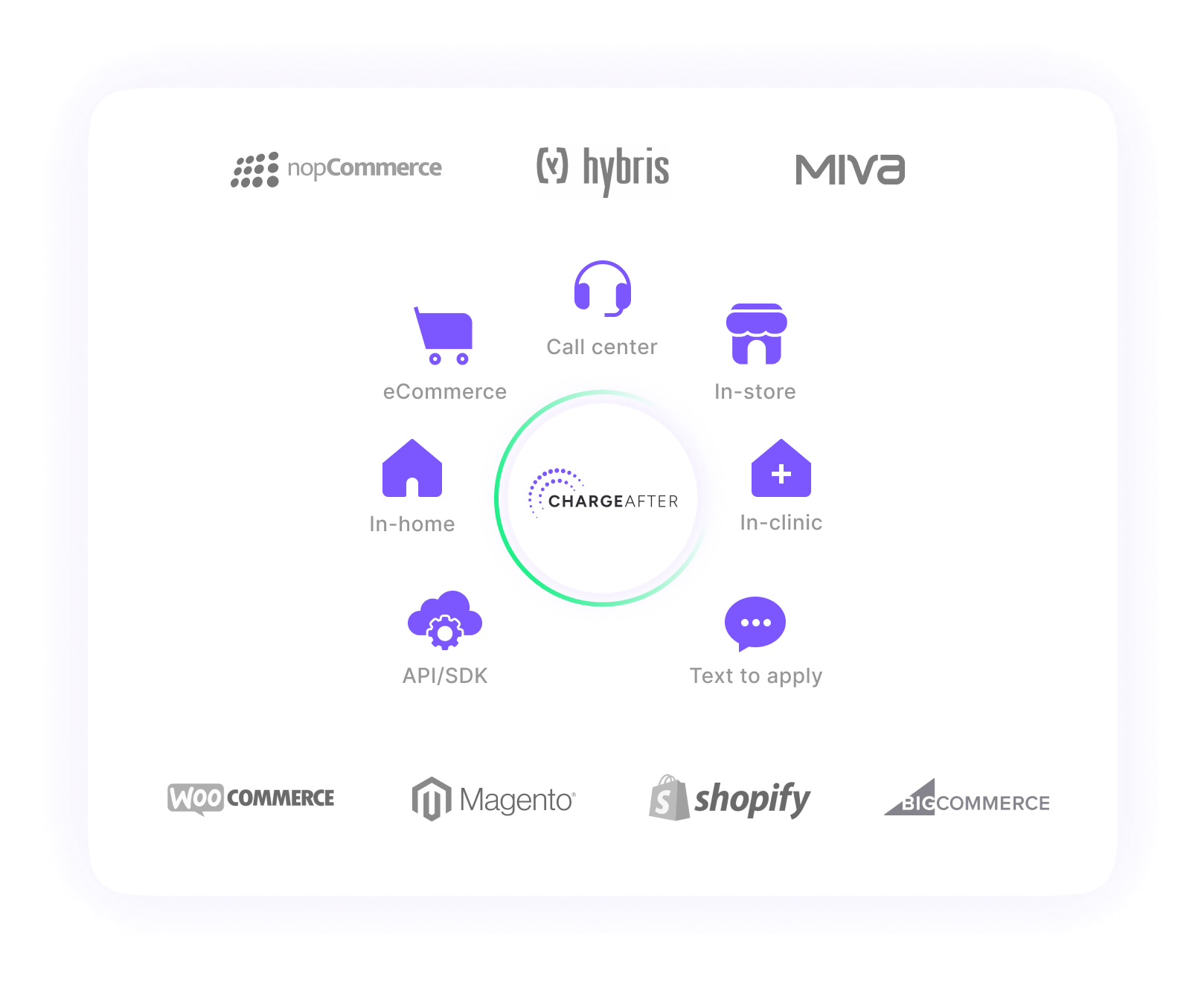

Our embedded lending platform has ominchannel financing capabilities at every point of sale. Deliver consumer finance choices to your customers as they move across different channels online, in-store or clinic and via call centers, virtual assistants, and door-to-door representatives.

Get up and running quickly with rapid integrations and accelerate time-to-market with a swift onboarding process that connects multiple lenders to every point of sale through our APIs, SDKs, and ecommerce financing extensions.

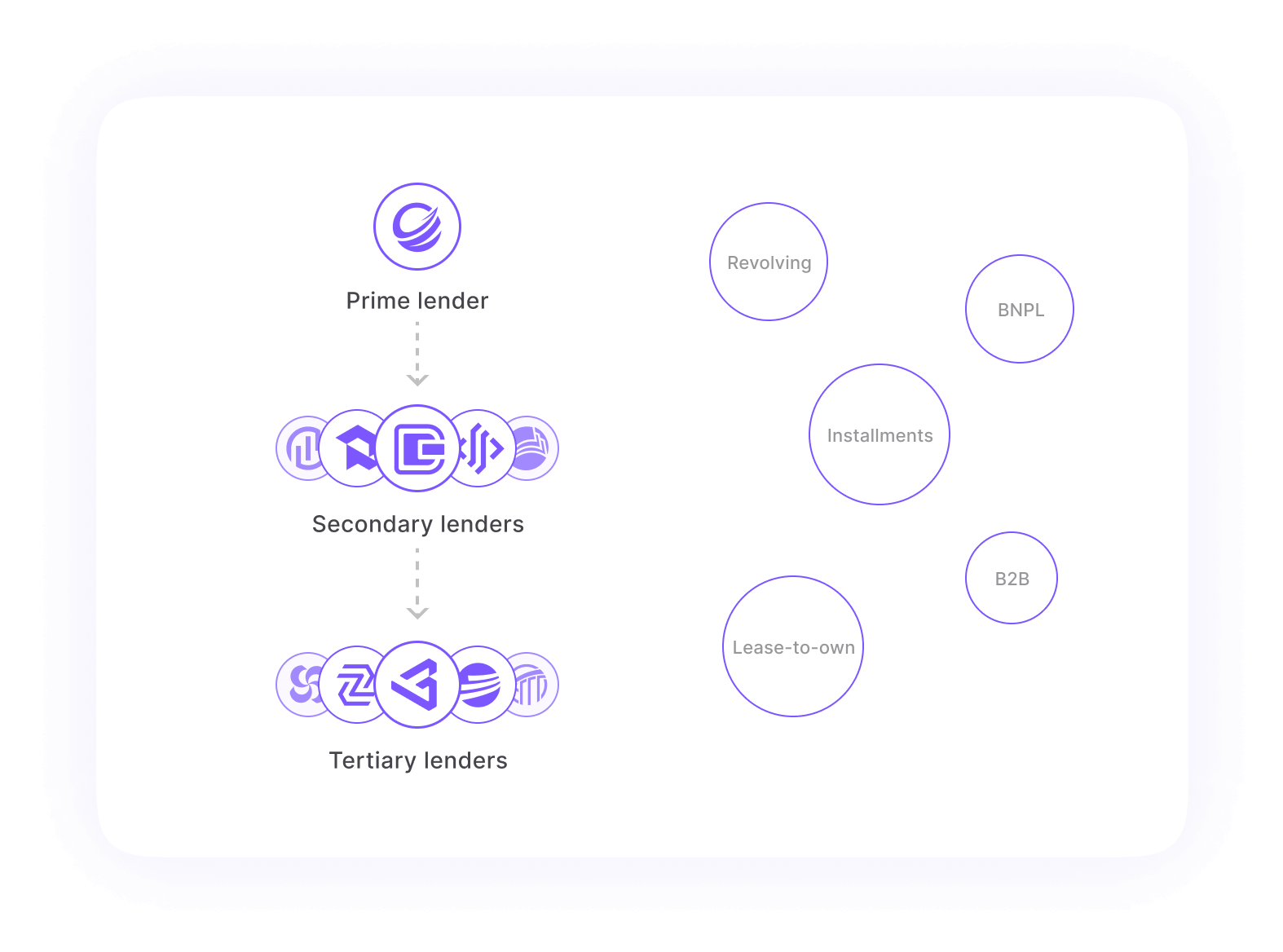

Configure your waterfall finance journey with primary, secondary, tertiary, B2B and BNPL lenders and purchase providers of your choice. Build an embedded lending offering that covers multiple segments, products, and geographic locations, tailored to your brand.

Customize the platform to adapt to any changes as they arise. Our embedded lending platform empowers you to easily switch lenders, update policies, and connect to new lending products, giving you greater flexibility and control.

Effortlessly connect with lenders in multiple countries through our embedded lending network. Our platform makes it simple and straightforward to add, remove, and manage financial products.

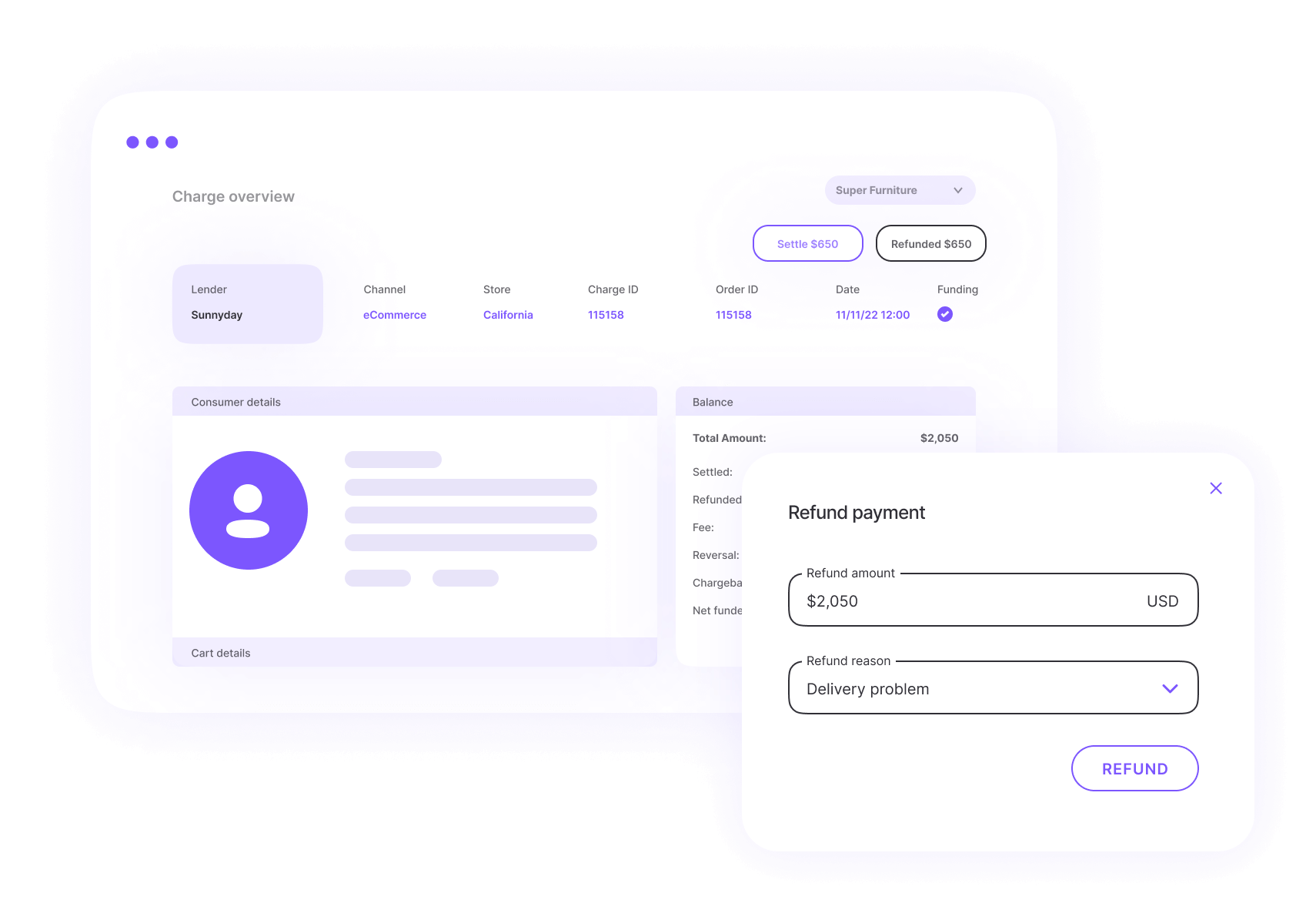

Full reporting and transparency of your consumer financing program puts you in control. Quickly and efficiently manage chargebacks, settlements, refunds, and void reconciliations in one centralized place. Leverage consumer financing data to create targeted marketing campaigns, enhance loyalty programs, and strengthen relationships with your customers.

Learn more