The Embedded Lending Platform

The only platform you’ll ever need to streamline the omnichannel lending journey, from application to approval to post-sale management.

Book a demo

Platform-powered financing

We connect shoppers, merchants, and financial institutions where

and when it matters most – the point of sale.

Multiple lenders & products

Full credit

spectrum coverage

Real-time matching

Extensive lending network

White label

Any product, any lender, anywhere

Effortlessly connect with lenders in multiple countries through our embedded lending network. Our platform makes it simple and straightforward to add, remove, and manage financial products.

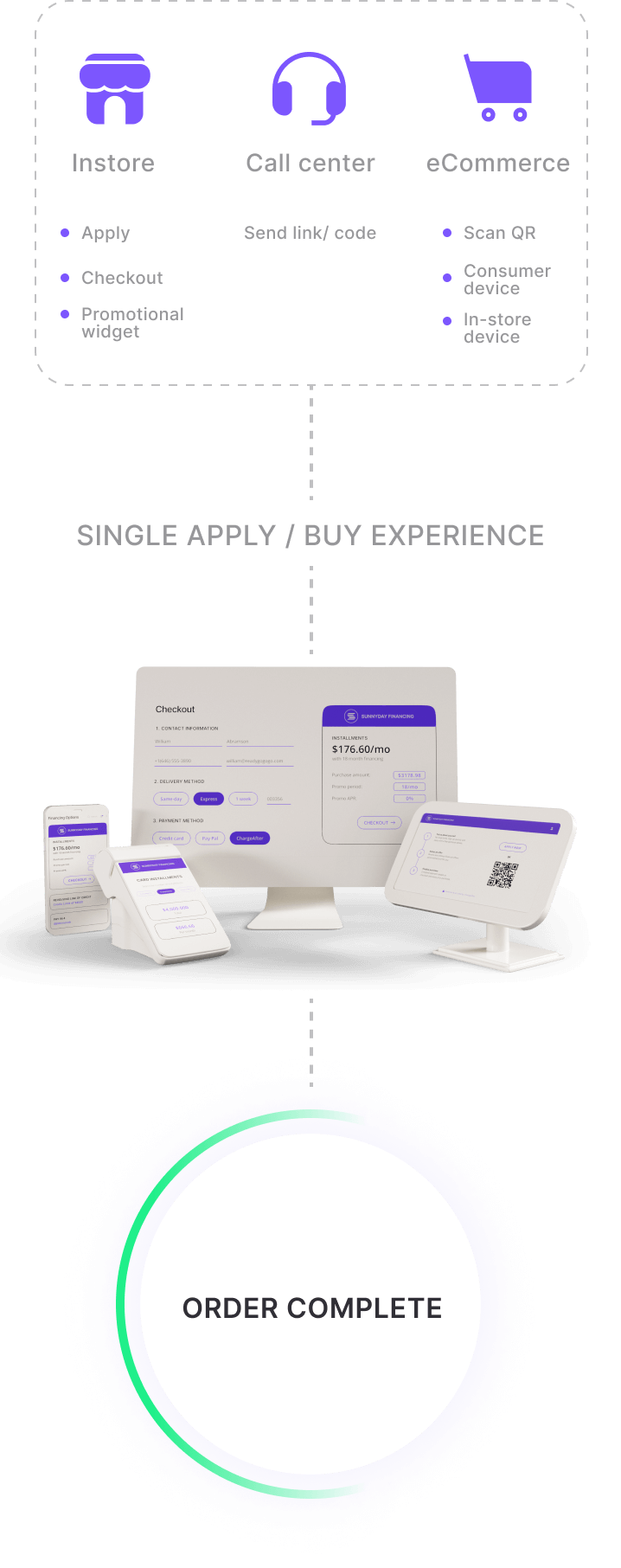

Give customers a frictionless,

omnichannel experience

Now your customers can apply for financing and be seamlessly matched with perfect-fit choices at any stage of their journey within a single platform.

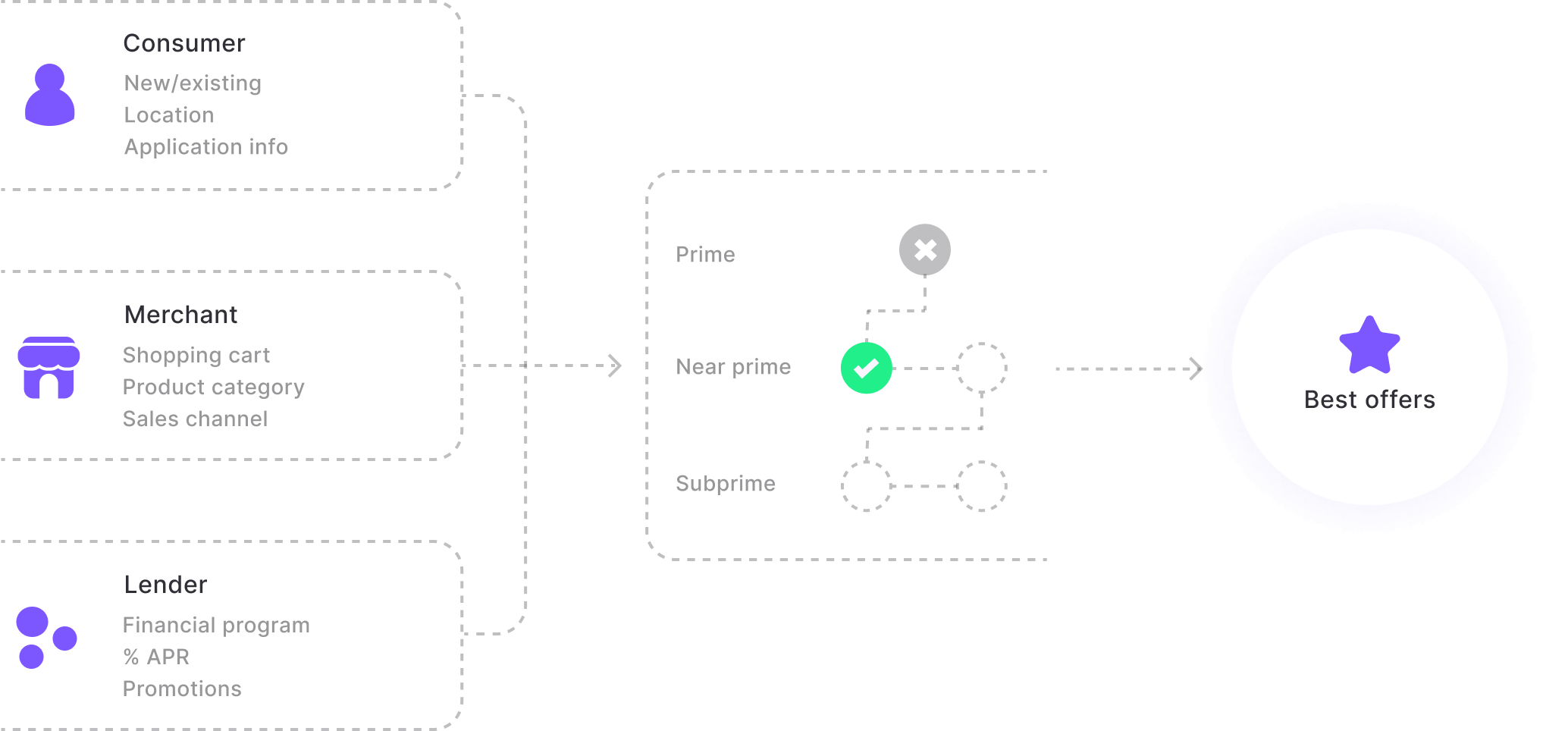

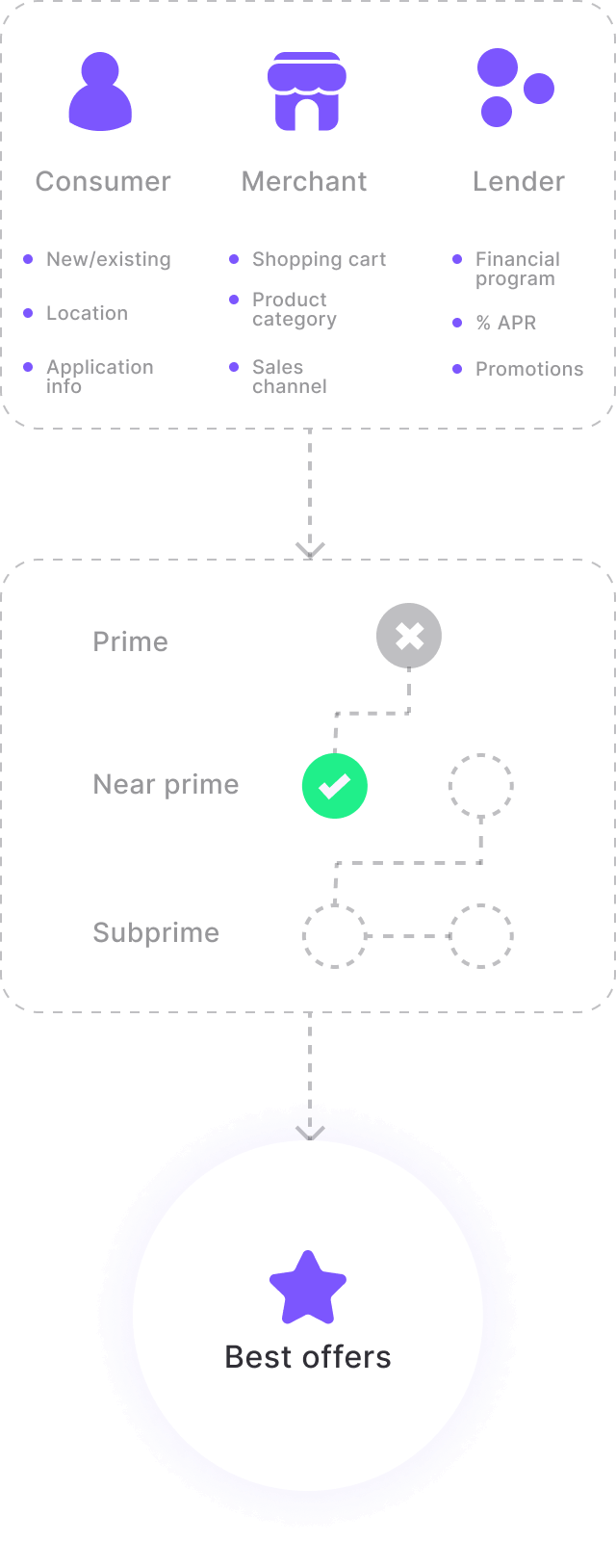

Automated real-time matchmaking

at the point of sale

Our Waterfall Matching Engine instantly analyzes loan applicants and processes their applications through a multi-lender cascade of relevant prime, near-prime, or subprime, and B2B offerings to find a perfect match.

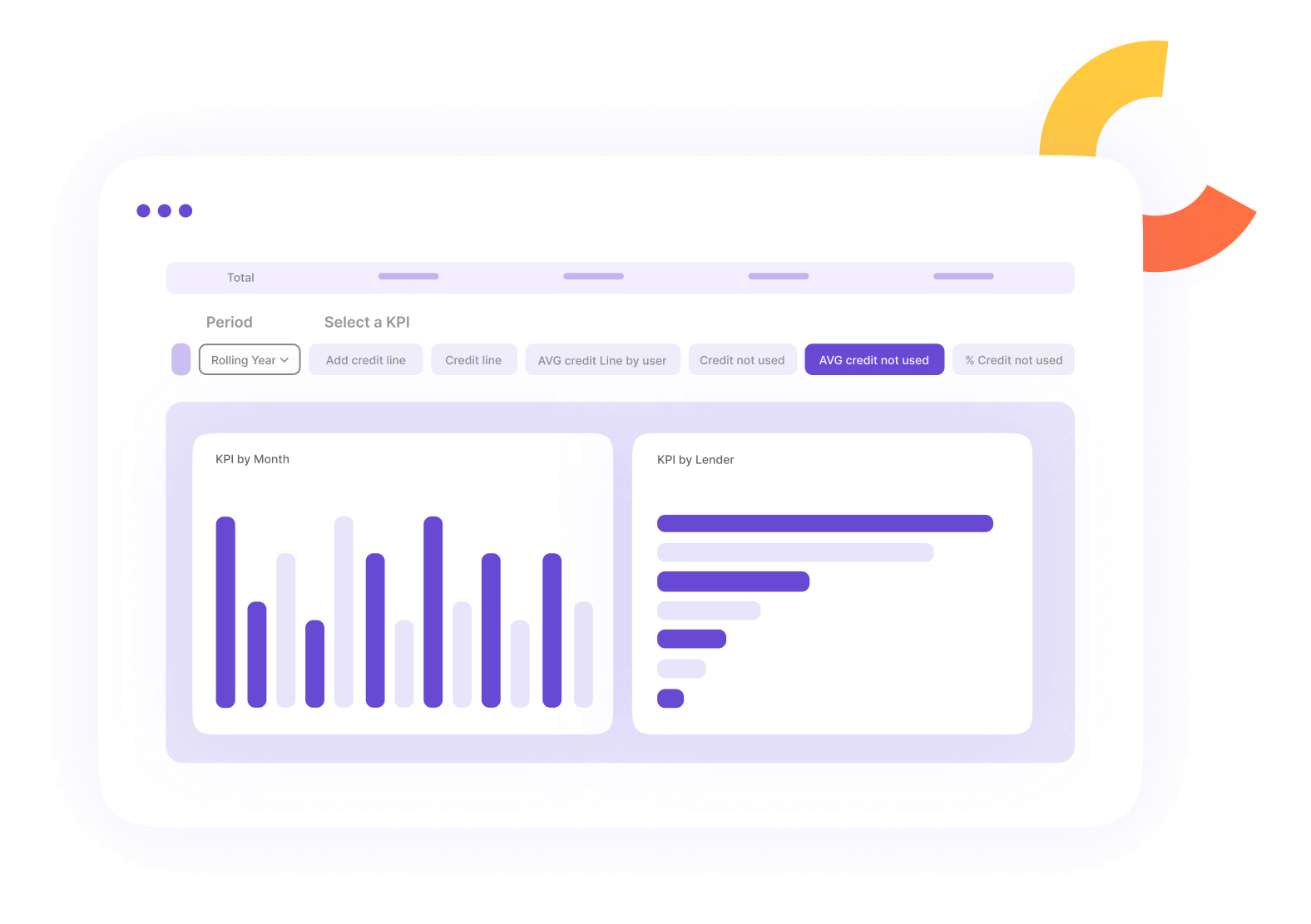

All customer financing data, at your fingertips

Drive your business decisions with point-of-sale financing data. Identify sales opportunities, personalize offerings, strengthen customer relationships, and manage the entire financing cycle end-to-end.

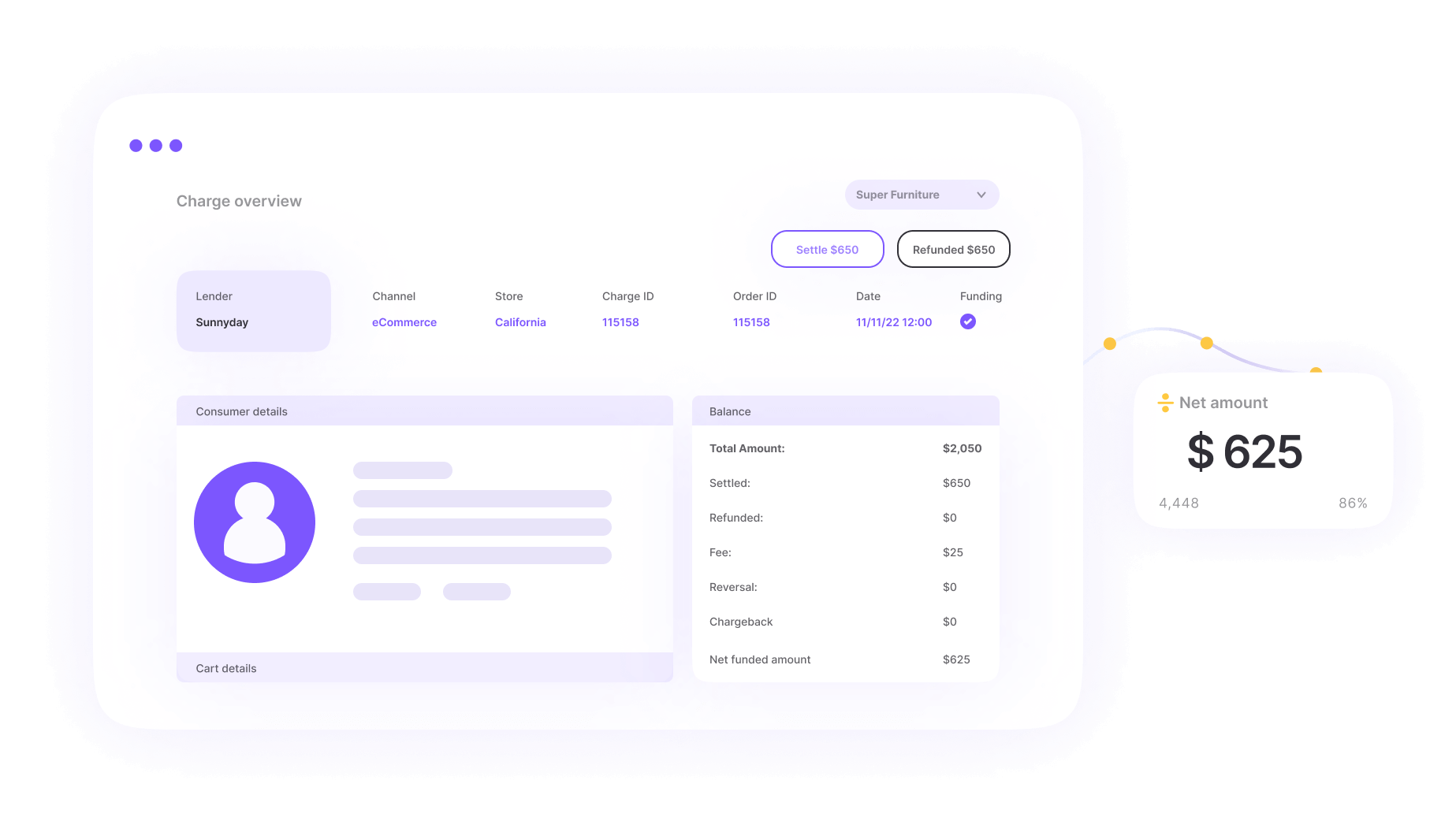

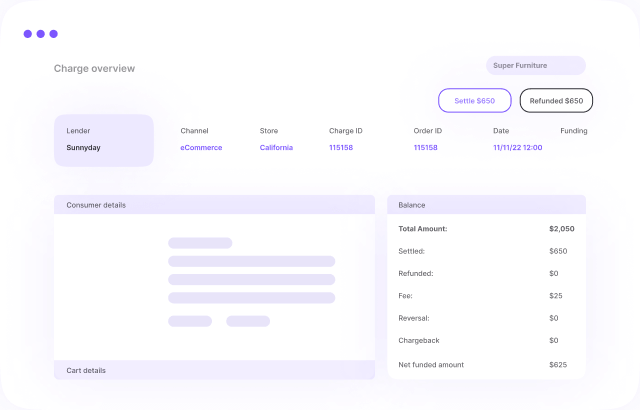

Leverage our all-in-one back office dashboard to view and manage all post-sale activities, including charges, settlements, refunds, and reconciliation. Review real-time updates on performance, volume, and order information, to identify opportunities to optimized your lending programs.

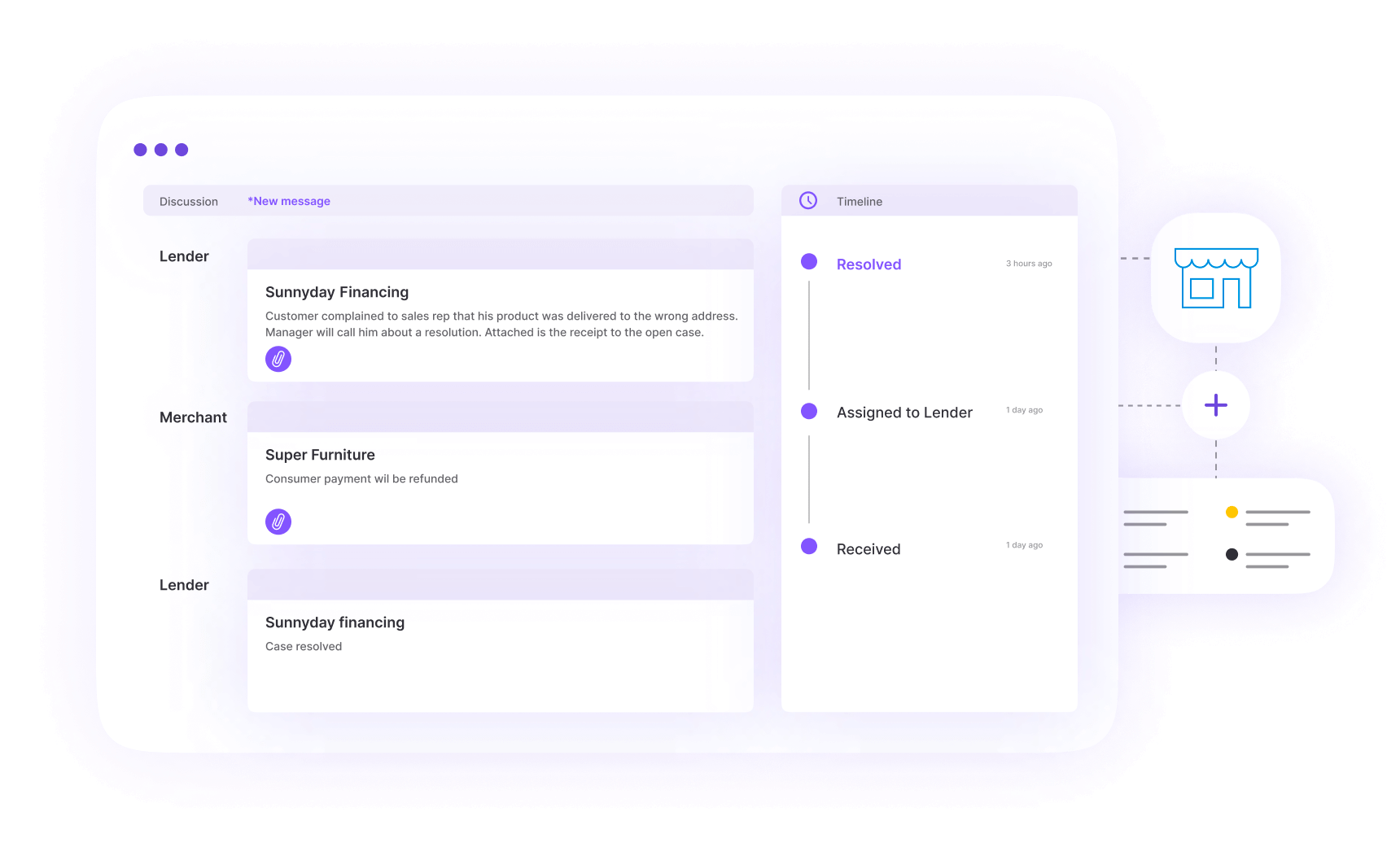

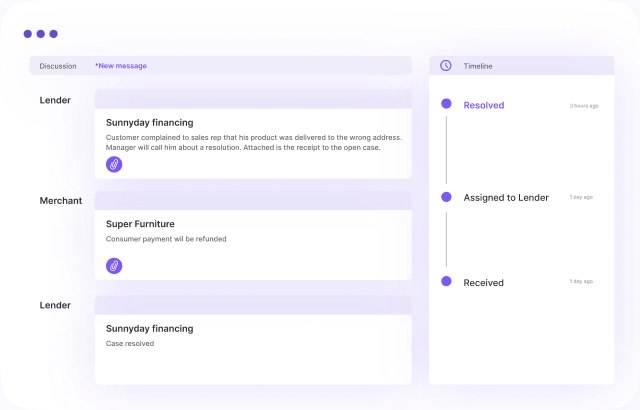

Resolve customer disputes efficiently from our resolution center. Merchants and lenders can communicate directly to manage disputes with advanced tools to track, process, and resolve cases.

Get a full view into all lending data in order optimize financing offerings, plan marketing and retargeting campaigns, enhance loyalty programs, and identify opportunities to increase your customers’ average order and lifetime value.

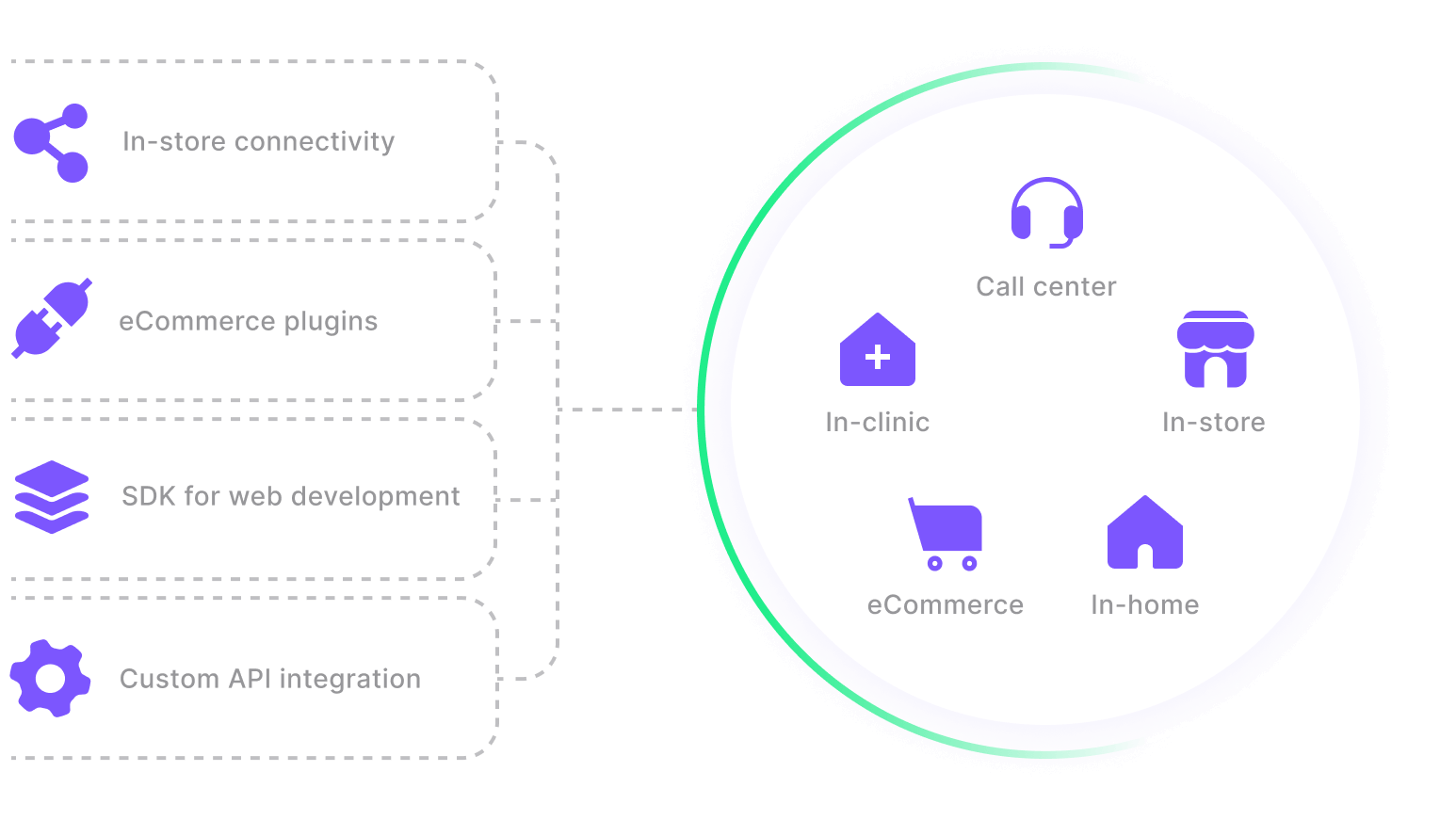

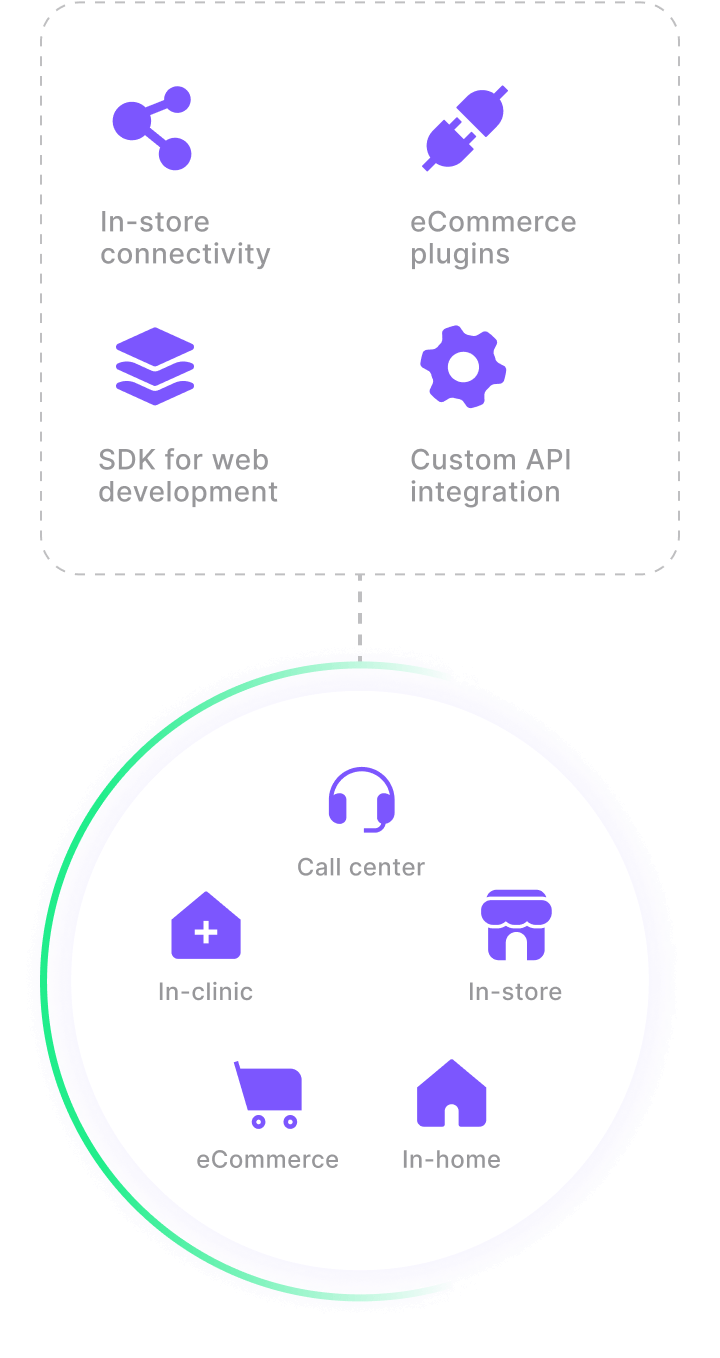

Easy plug & play integrations for every point of sale

One click integration to leading eCommerce platforms

API and SDK integration kit to built your own eCommerce checkout experience

Custom integration to in-store POS or our ready made sales app

It’s embed time

Book a demoPOS financing built for enterprises

For merchants

With a single POS financing application, your customers are matched with multiple lenders and personalized financing choices at every point of sale.

For financial institutions

Leverage our white-label financing platform to create, manage, and distribute any consumer financing product at scale within one streamlined experience.

Resources

The Retailers Guide to Consumer Financing 2024