With ChargeAfter, we have the peace of mind that our point-of-sale financing is powered by a proven platform and deep industry expertise, so we can focus on giving our customers a superb furniture buying experience.

Appliance financing helps your customers purchase the appliances they want without the immediate financial burden by enabling consumers to spread cost over time. Deliver higher financing approval rates with our waterfall financing embedded lending platform. It’s the only tool merchants need to manage POS financing from application to post-sale management.

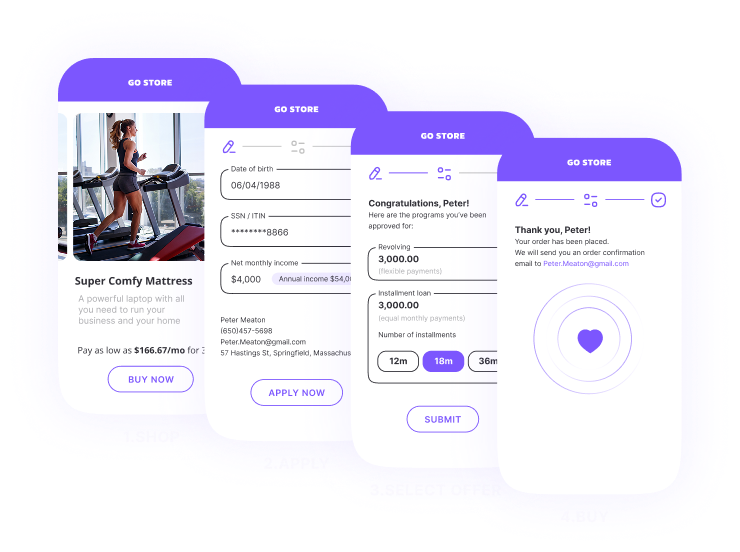

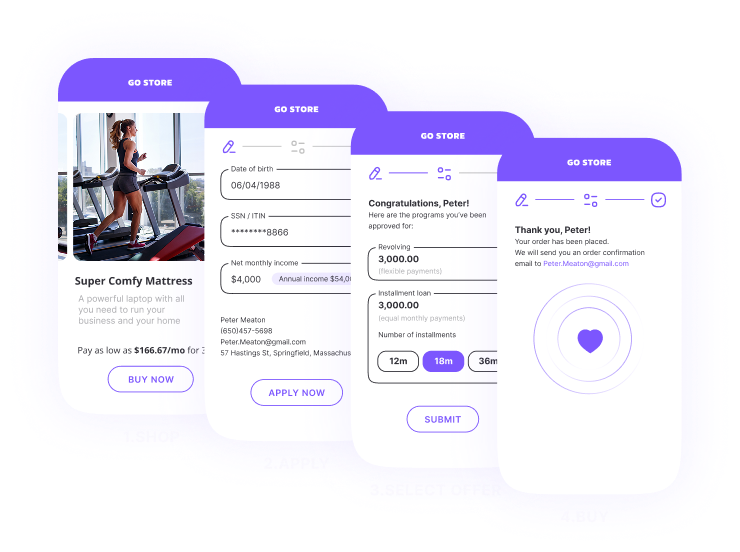

Sports and gym equipment can be a significant investment—for both individuals and commercial buyers. Offering flexible financing from multiple lenders at checkout increases conversion rates and increases customer satisfaction. ChargeAfter’s embedded lending platform makes it easy to offer personalized financing to every customer, right at the point of sale. With built-in post-sale management and analytics, you can streamline operations and keep customers coming back.

Say goodbye to painful integrations and declined financing

Sports and gym equipment is expensive. For many customers, buying gym equipment for in-home use is out of reach. Fitness businesses face large capital outlay and want to control cash flow through flexible financing. Gym equipment providers struggle to meet the financing needs of all of their customers. This impacts the bottom line, with high-intent customers not converting.

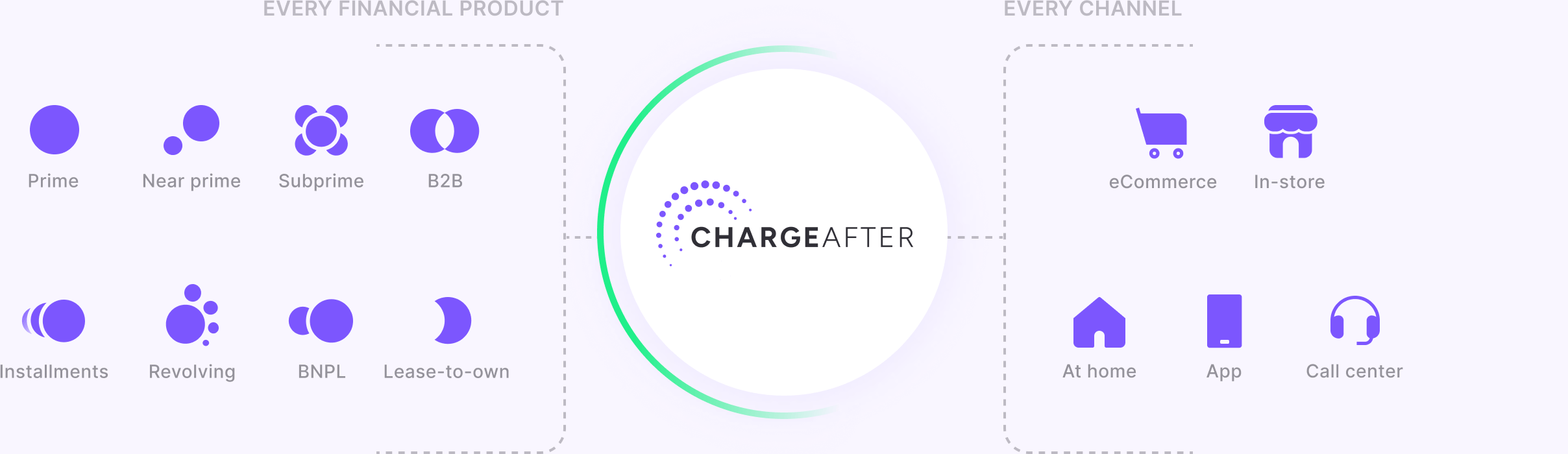

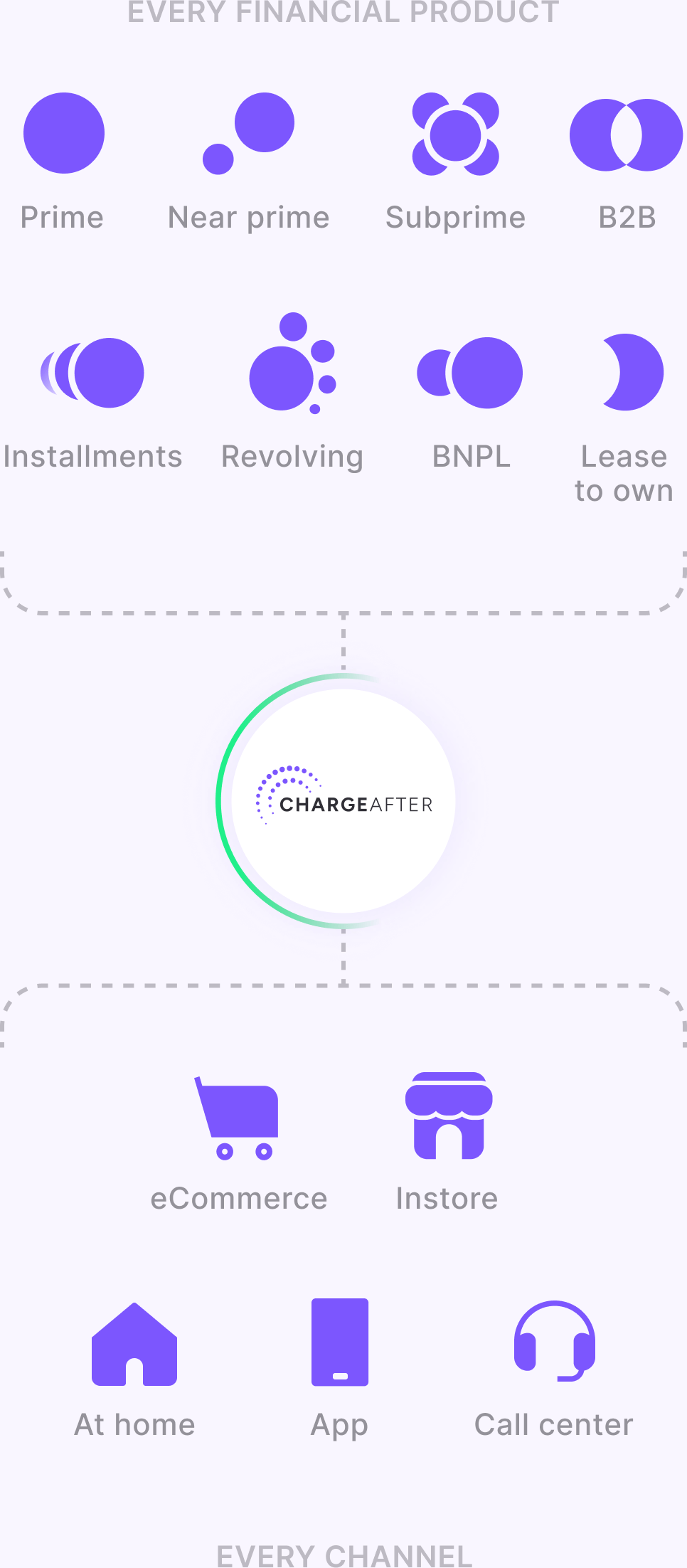

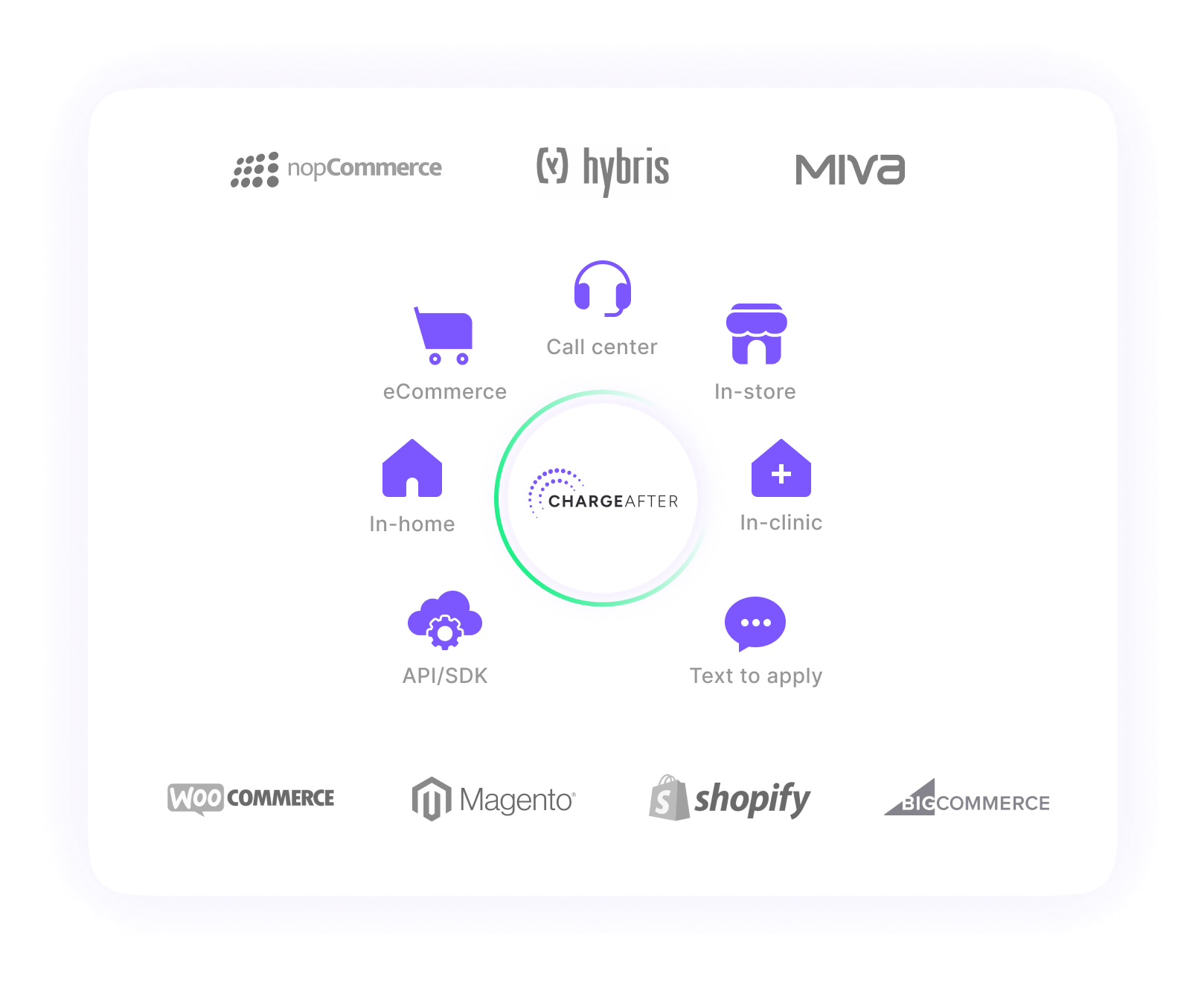

ChargeAfter’s embedded lending platform empowers gym equipment financing for all buyers – B2B and B2C. Our network of lenders provides embedded financing choices for customers with diverse needs, increasing approval rates leading to more sales and brand loyalty. The platform is fully omnichannel can be embedded into all points of sale and has advanced post-sale capabilities and analytics.

Get up and running quickly with rapid integrations and accelerate time-to-market with a swift onboarding process that connects multiple lenders to every point of sale through our APIs, SDKs, and ecommerce extensions.

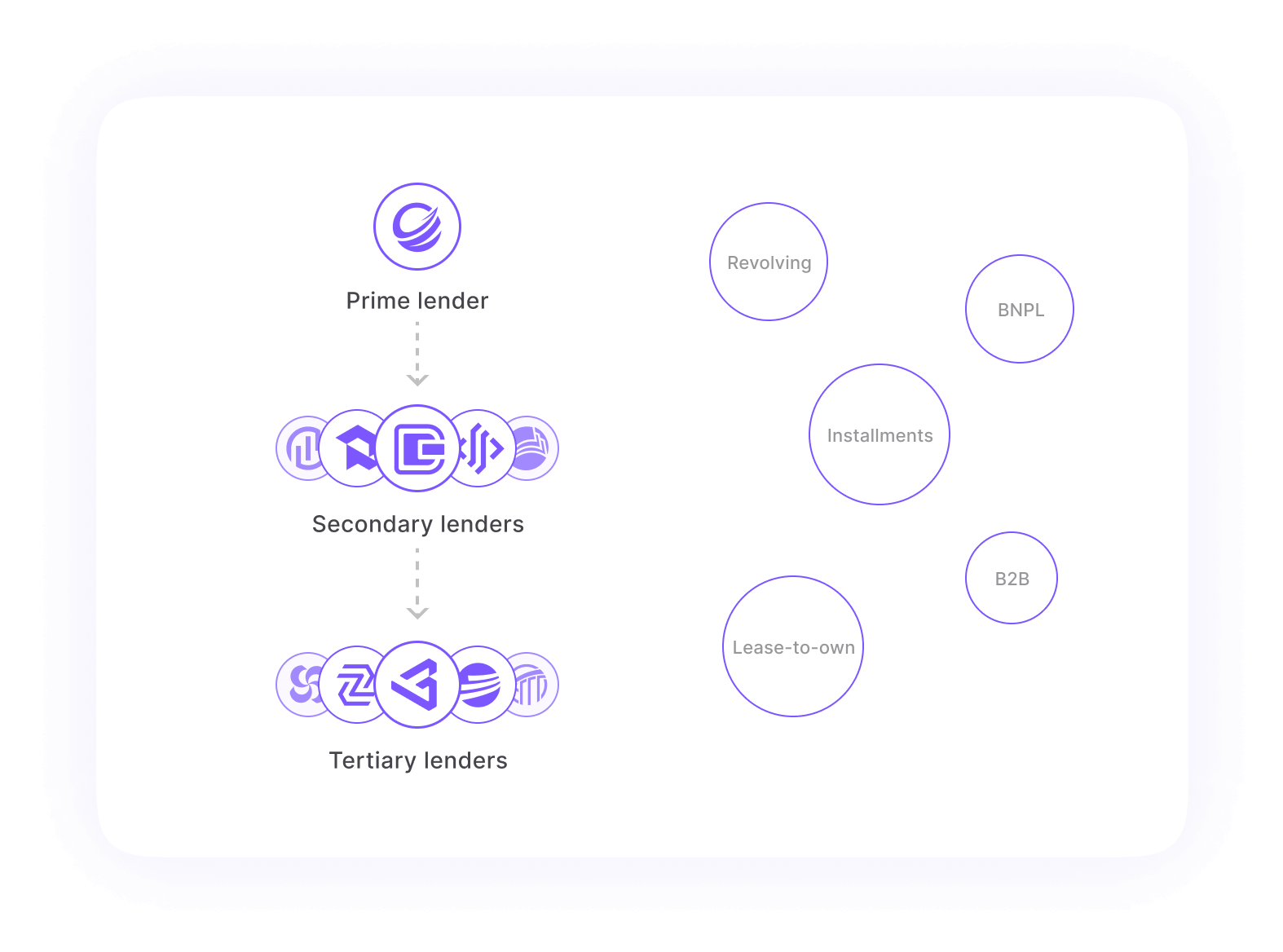

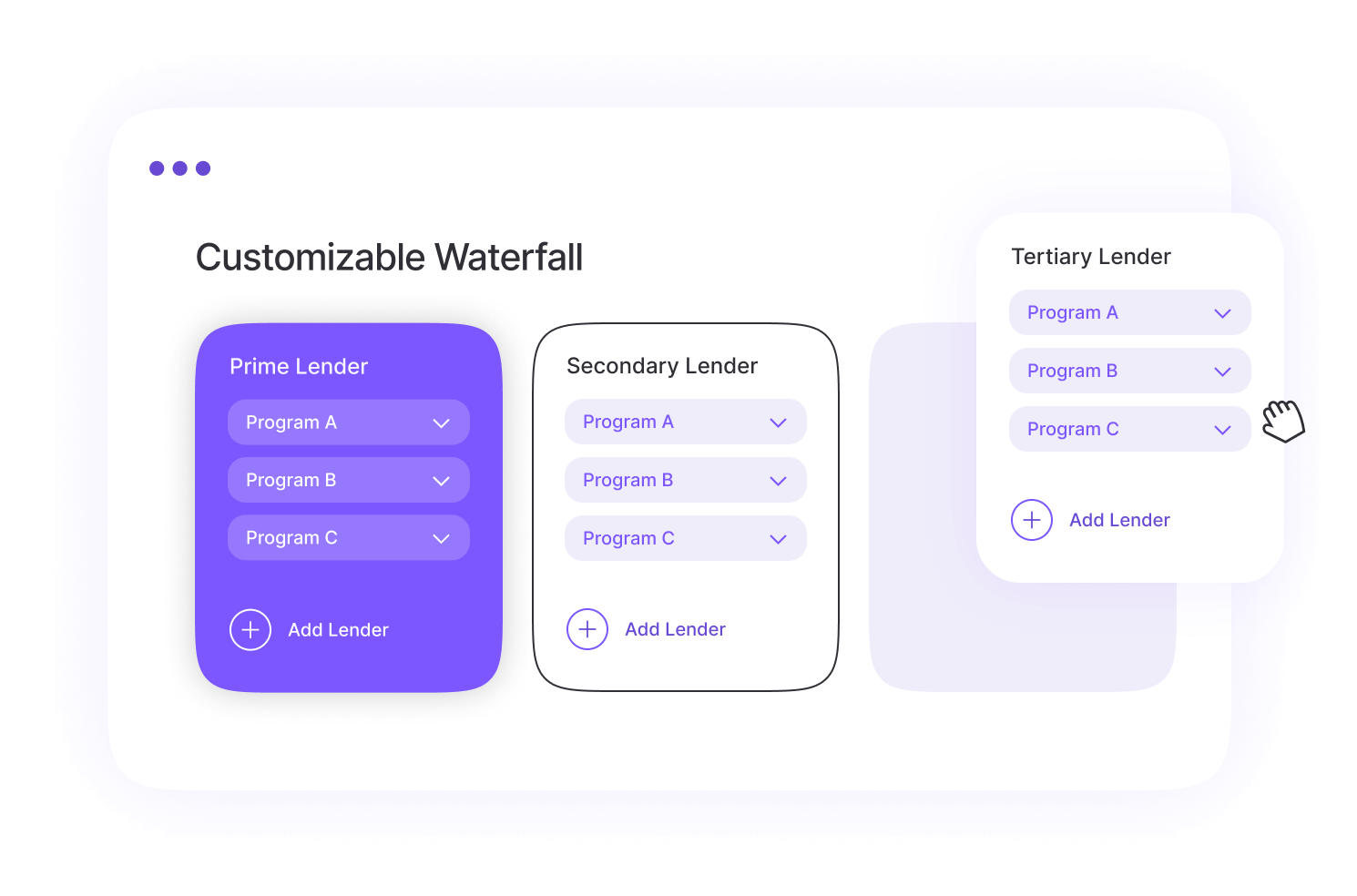

Configure your waterfall financing cascade with primary, secondary, and tertiary lenders of your choice. Build a lending offering that covers multiple segments, products, and geographic locations, all tailored for your brand.

Business users can easily customize the platform to adapt for any needed changes. For example, they can switch lenders, update policies, and connect to new lending products, empowering them with greater flexibility and control.

Effortlessly connect with lenders in multiple countries through our embedded lending network. Our platform makes it simple and straightforward to add, remove, and manage financial products.

Join merchants across the globe reporting approvals of over 80%.

We are fully secure and protected, giving you peace of mind.

Build your customer base with more approvals - they’ll remember you for it.

Optimize your financing

offers with powerful consumer

financing analytics.

Our embedded lending network accommodates any customer, regardless of their credit history or score.

Integrate any lender and consumer finance product into your embedded lending offer.