Black Friday is an opportunity for eCommerce brands big and small to leverage the influx of consumers shopping for the biggest and best deals online. The annual shopping phenomenon remains the highlight of the consumer shopping calendar, and online store owners should consider optimizing their platforms for the inevitable increase in customer activity during the Black Friday weekend. Fortunately, there is still enough time to do so, and buy now pay later solutions from ChargeAfter can help your business prepare for a profitable Black Friday weekend. Here’s how.

What is Buy Now Pay Later?

As an eCommerce business owner, it is important to stay on-trend and up to date with the latest online platform integrations that can improve sales. Buy now pay later solutions are a relatively modern website integration that offers customers access to comprehensive consumer financing at the push of a button. These platforms, which deliver tailored loan solutions, are effective checkout plugins that help customers shop quickly, easily, and affordably without having to leave your website.

How do they work? Well, ChargeAfter is one of the leading buy now pay later platforms as its plugin gives online shoppers access to a wide network of lenders capable of facilitating their personal financing requirements. With ChargeAfter, eCommerce business owners no longer need to source lenders or expect consumers to seek financing from third-party providers. As an owner, you can sit back while your customers utilize the ChargeAfter buy now pay later platform on your website and receive financing within minutes from a willing and reliable lender in our extensive portfolio.

How Will Buy Now Pay Later Benefit Black Friday?

Black Friday is closer than consumers think, and it is important to facilitate a seamless online shopping journey during this annual height of online retail. Fortunately, you can start putting in place the necessary strategies to capitalize on the trending shopping period soon rather than later. And, buy now pay later should be the first integration to consider. Here’s why:

Black Friday Sales are Made Easier

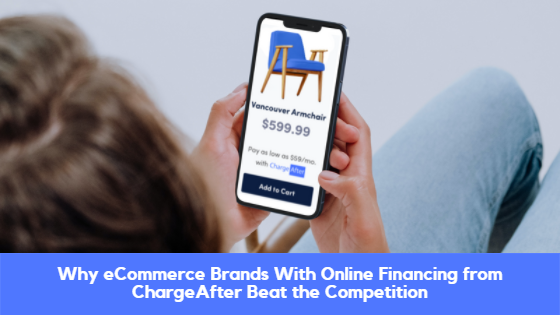

Ease of use in the consumer journey is critical in the modern world of eCommerce, and buy now pay later facilitates a seamless checkout experience for all your shoppers. They can access funds to make purchases at the push of a button, and without having to seek assistance from financial service providers. As a result, they can grab the hottest Black Friday deals from your shop in an instant. The simple steps of ChargeAfter’s buy now pay later Black Friday solution also keep the customers on your website so that they can continue shopping with ease.

Black Friday Sales for More Consumers

Buy now pay later from ChargeAfter gives more consumers access to the deals on your eCommerce platform. This is because the consumer financing solution requires no credit checks and the repayment plans include low interest services. With consumer financing for merchants from ChargeAfter, customers that were at a previous disadvantage because of financing red tape are now capable of purchasing their favorite products during the Black Friday sales affordably and with little stress involved.

Black Friday Sales are Bigger than Ever

An added benefit of low interest repayments is that customers can purchase bigger items during your Black Friday sales than ever before. As they will not have to pay extensive loan rates, they will be more willing to shop your biggest and best sales, raising the average order values that you experience during the day and over the weekend.

With buy now pay later Black Friday solutions from ChargeAfter, eCommerce stores can leverage the massive consumer day and make more sales thanks to an easy checkout experience, consumer financing with no credit checks, and easily repayable payment plans.

Want to learn more? Reach out to us here.