Customer lifetime value refers to the total amount of money spent by a consumer with your eCommerce store across the entire collection of their orders. It boils down to the potential value of revenue to be made from a specific customer. Several things affect customer lifetime value, namely one’s ability to retain customers, so it is vital that you consider strategies to increase customer lifetime value and prolong your revenue generation with each customer. In this article, we discuss the most powerful ways to increase customer lifetime value specifically in reference to automating key areas of your marketing operations. We discuss automating consumer financing, email marketing, and more.

Automating Consumer Financing

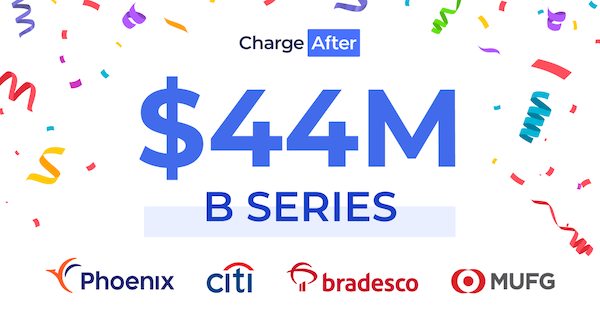

Automating consumer financing is one of the most powerful ways to improve customer lifetime value in the modern world of eCommerce. Consumer financing services, like BNPL, are seeing an increase in interest among the modern shopper, and adopting these can help businesses leverage the potential revenue generation amongst these buyers. Automating consumer financing involves partnering with the best consumer financing platforms on the market. ChargeAfter is one of these service providers that can facilitate the effective and efficient delivery of online financing to each and every one of your customers. Instead of having to source financial aid from third parties, they can receive financial support at the push of a button and do not have to go through credit checks. Therefore, they can shop quicker than ever before on your online store and are more likely to do so in the future – increasing their total customer lifetime value.

Automating Email Marketing

Email marketing is an incredibly important marketing funnel that you should automate to save time and capitalize on the revenue potential of maximizing your email marketing strategy. With an extensive list of shoppers’ email addresses, you can quickly deliver personalized marketing material to them directly into their inboxes that they will be viewing throughout the workday. Automating these email processes can streamline their consumer experience as well as save your marketing team time, ensuring that you make smarter investments into your initiatives. Furthermore, email marketing enables businesses to reward their loyal customers and subsequently improve customer retention rates. The addition of consumer financing may also appeal to shoppers that arrive at your landing pages from email marketing campaigns, further increasing your customer lifetime values.

Automate Social Media Marketing

It is possible to automate various aspects of your social media marketing to improve customer lifetime values. For starters, you can preschedule all of your social media content publications at the beginning of the month, freeing up time to focus on customer service over the course of the month. Secondly, you can automate social media chatbots to facilitate seamless conversations with your consumers. The ability to contact your store at all hours of the day encourages shoppers to be more invested in your platform and can also facilitate relationships with customers shopping from different time zones. You can also run automated social media marketing campaigns through platforms like Buffer and Hootsuite. Having access to this automation can greatly increase customer lifetime values as you are able to send personalized messages to new and returning customers at the right times and with the right promotional context.

From consumer financing to email marketing and social media marketing, automation is one of the most efficient and effective strategies for increasing customer lifetime value as it saves you time to focus on customer service, enables personalized messaging, and facilitates beneficial long-term customer relationships through all-hours communication strategies.

Want to learn more? Reach out to us here.