3 Benefits of Integrating Waterfall Financing

In 2024, sales channel strategies need to be diverse and optimized to suit the purchasing behaviors of the modern shopper. In this article, we explore sales channel strategies in more detail and share 3 benefits of a sales channel strategy that integrates waterfall consumer financing.

What is waterfall financing?

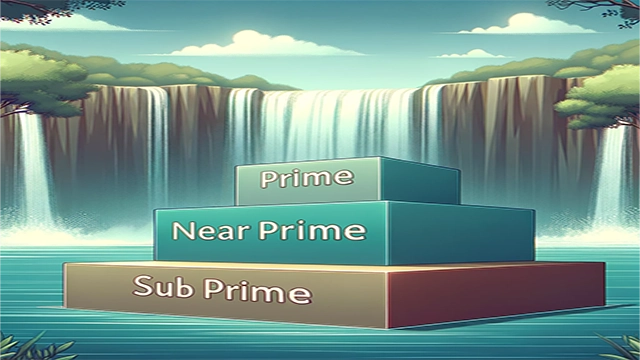

Waterfall financing, from a consumer financing perspective, is a method of consumer lending at the point of sale whereby a shopper loan or credit application passes through a series of lender tiers prioritized for receiving the best loan interest and terms to lower-tiered lenders offering the next best loan offer.

Here’s how it typically works:

- First Tier Criteria: Initially, an application is evaluated against the strictest criteria. These criteria include a high credit score, low debt-to-income ratio, or other financial stability and creditworthiness indicators. Most applicants who meet these criteria are considered low-risk borrowers.

- Subsequent Tiers: Applications not meeting the first tier’s stringent requirements are passed down to the next tier. Each successive tier has slightly more relaxed standards than the one before it. For instance, the second tier might accept lower credit scores or higher debt-to-income ratios.

- Approval or Decline: This process continues until either the application is approved under one of the tiers’ criteria or fails to meet all tiers’ standards and is ultimately declined.

What is a sales channel strategy?

A sales channel strategy refers to the marketing tactics used across several sales channels. In the modern eCommerce landscape, a single sales channel is simply not enough. Online stores should utilize a variety of channels, from social media platforms to Google Shopping and beyond, to attract new customers and retain existing shoppers. A sales channel strategy considers how best to engage consumers through online marketplaces, modern marketplaces, wholesale selling, retail selling, and paid advertising. Using a combination of platforms within these avenues will lead to greater sales channel success.

Waterfall financing from ChargeAfter will also support your sales channel strategy by empowering your customers’ purchases. By partnering with ChargeAfter, you can offer your customers access to a wide network of lenders capable of facilitating their shopping needs across your entire sales channel strategy. Let’s take a closer look at the benefits of a sales channel strategy that integrates waterfall consumer financing.

Benefits of waterfall financing

Benefits for shoppers

Waterfall financing makes shopping more accessible than ever. Merchants that use waterfall financing give their shoppers access to lenders who can finance their shopping decisions. Customers can receive this financing without having to undergo credit checks, making consumer financing a feasible choice for shoppers unwilling to turn to their financial institution for support. This, coupled with favorable repayment plans makes for an efficient shopping experience that appeals to new and existing customers.

- Increased access to credit: Waterfall financing allows individuals who might not meet the strictest lending criteria to access credit still. This benefits those with lower credit scores or less conventional credit histories.

- Opportunities to build or repair credit: For borrowers looking to build or repair their credit, gaining access to credit through less stringent tiers can provide this opportunity as long as they manage their debt responsibly.

- Tailored financial products: Since waterfall financing involves different tiers with varying criteria, consumers might find products more tailored to their financial situation rather than a one-size-fits-all approach.

Benefits for lenders

- Market expansion: This approach allows lenders to serve a broader range of customers. They can cater to prime borrowers in the upper tiers while offering products to near-prime or subprime borrowers in lower tiers, thus expanding their market reach.

- Improved loan performance: Using more detailed criteria to assess borrowers, lenders can better predict loan performance and reduce default rates. Each tier can be optimized based on the risk profile and past performance of borrowers in that category.

- Flexibility and responsiveness: Waterfall financing provides a framework for lenders to quickly adjust their lending criteria in response to changing market conditions, regulatory environments, or shifts in their risk appetite.

- Data-driven decisions: This approach often relies on comprehensive data analysis, allowing lenders to make more informed and precise decisions based on various variables beyond just credit scores.

Industry benefits:

- Financial inclusion: By providing credit opportunities to those whom traditional criteria might exclude, waterfall financing contributes to financial inclusion efforts.

- Innovation in lending: This approach encourages innovation in the lending industry as lenders develop more sophisticated models to assess borrower risk across different tiers.

In summary, waterfall financing offers a more nuanced and flexible approach to lending that can benefit a wide range of consumers, especially those who might be underserved by traditional models, while also allowing lenders to manage risk and expand their customer base.

Originally published: 12 Jan 2022

Updated: 24 Jan 2024