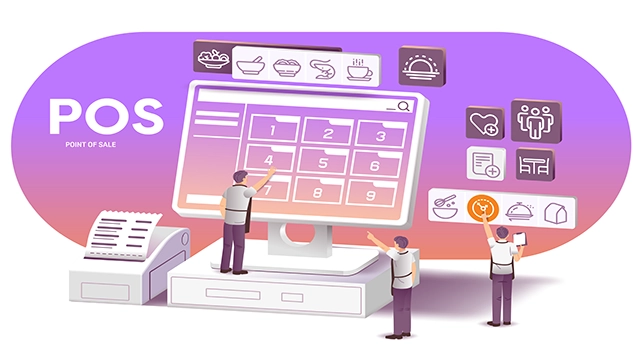

If you’re attending the conference and want to reform your point-of-sale financing, stop by booth 310 to discuss how our embedded lending platform can help you streamline your POS financing and boost approvals.

Category: Blog

The Power of Innovation: Rick Cunningham, Bread Financial

In this episode of our ‘POS Finance Innovators’ series, I had the privilege of sitting down with Rick Cunningham discuss how embedded lending is driving growth and delivering value.

In our latest episode of the POS Finance Innovators series, I had the pleasure of speaking with Rick Cunningham, Senior Vice President of Strategy at Bread Financial. Rick shared how embedded lending is driving growth for merchants and delivering value to consumers.

This conversation comes on the heels of our announcement earlier this year that Bread Financial joining the ChargeAfter embedded lending network, an exciting partnership that will empower more merchants and consumers with flexible financing options.

Here are some takeaways from our conversation.

Partnerships drive success

Rick emphasized that partnerships are at the heart of a successful point-of-sale financing approach. By working closely with merchant partners and working with embedded lending platforms like ChargeAfter, Bread Financial delivers tailored solutions that meet evolving customer needs and support merchant growth.

Customer-centric innovation

Rick talked about the importance of continuous innovation in POS financing. From frictionless APIs to risk management advances, every decision Bread Financial makes is centered on enhancing the customer journey. The company’s ability to blend the stability of a regulated bank with the agility of a fintech sets it apart in the market. They’re not just offering financing, they’re co-creating solutions that align with merchants’ needs and meet the expectations of today’s digital-first consumer.

The Role of AI in Customer Experiences

AI is playing an increasingly important role in retail. Rick highlighted that while consumers see the potential of AI to personalize experiences and offer better deals, merchants must use it thoughtfully to build trust and strengthen loyalty.

I hope you enjoyed this conversation! Make sure to follow us on LinkedIn or subscribe on YouTube to be notified when we release more videos.

About Jeffrey Tower

EVP Global Business Development and Strategy

Jeff has over 20 years of experience driving revenue through building global brand awareness, business development, marketing, and sales departments focused on consumer financing, fintech, and eCommerce.

Subscribe to us on YouTube Follow us on LinkedIn for more updates

Inside the Citi Retail Services Consumer Finance Strategy: My Conversation with Terry O’Neil

In this episode of our ‘POS Finance Innovators’ series, I had the privilege of sitting down with Terry O’Neil to explore the latest trends and innovations in consumer finance.

As Head of Connected Commerce for Retail Services and Head of Strategic Partnerships for U.S. Personal Banking at Citi Terry is at the forefront of this industry and shares from his vast knowledge which he has gained over two decades working in the payments space.

Terry shares his insights into customer expectations for financing and how they are impacting the Citi Retail Services approach from both a technology and customer-centric standpoint. In our conversation, we explored the latest trends, emerging expectations, and what lies ahead for merchants, consumers, and financial institutions.

Here are a few highlights from our discussion:

1. Customer Demand is Evolving

Consumers today expect optionality and flexibility alongside speed, transparency, convenience, and control. Terry talked about how customer demand is changing how banks and merchants deliver financing solutions. It’s no longer enough to offer customers payment plans; merchants must offer the right options at the right time, while maintaining a high bar for trust and data protection.

2. Merchants Need Tools That Empower Buyers

Terry talked about the importance of embedding the right tools throughout the buyer journey to meet customers’ needs. For example, customers require clarity about what different financing options mean for them and fast access to these options. Merchants therefore must provide calculators, pre-qualification options, and real-time approvals that help customers make informed decisions quickly. When merchants provide these tools, it doesn’t just improve conversion rates—it builds long-term customer loyalty.

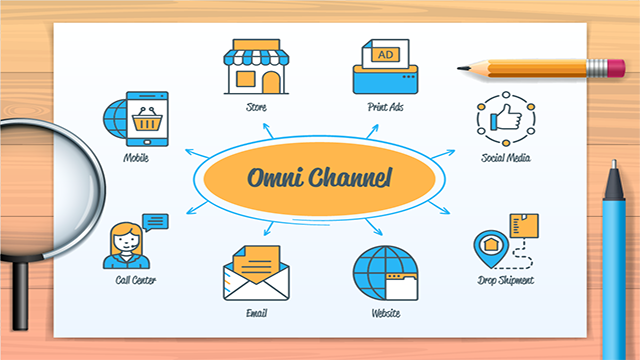

3. The Future Is Omni Commerce and Personal

Looking ahead, Terry sees omnichannel consistency as a must-have in point-of-sale (POS) financing. Whether the customer is shopping online, in-store, or elsewhere, the experience should be seamless and familiar. Personalization will also play a major role, with smarter systems delivering financing options tailored to each shopper’s needs. As embedded payments and lending continue to evolve, the winning formula will be one that combines smart tech, strong partnerships, and a relentless focus on the end user.

We hope you enjoy this interview and gain valuable insights. Stay tuned for more conversations with POS finance innovators!

About Jeffrey Tower

EVP Global Business Development and Strategy

Jeff has over 20 years of experience driving revenue through building global brand awareness, business development, marketing, and sales departments focused on consumer financing, fintech, and eCommerce.

Subscribe to us on YouTube Follow us on LinkedIn for more updates

What to Do When Your POS Financing Provider Exits the Market – ChargeAfter

Even the most trusted financing providers can change direction. The key for merchants is preparedness, with a built-in strategy for lender redundancy, control, and long-term stability.

Lenders can change direction for various reasons, from shifting business priorities to changing market conditions, or strategic exits from specific products or industries. Losing a lender provides an opportunity for merchants to rethink their financing model and adopt a more stable, scalable, and resilient approach. With the right technology, what starts as disruption can become a turning point toward a smarter financing strategy built for stability, control, and growth.

1. Why Replacing one POS Lender with another isn’t a Long-Term Solution

When you rely on individual lenders, any shift in strategy, whether a tightening of terms or a full market exit can leave your business exposed. It’s not just about losing a financing option, it’s the operational headache of finding a suitable replacement, negotiating new terms, managing compliance and integrations, and getting internal teams aligned fast enough to avoid gaps in service.

Swapping one provider for another might seem like a quick fix, but it repeats the same pattern of dependency and doesn’t solve the underlying problem: lack of control. Merchants need more than a replacement—they need a better solution. One that offers continuity, flexibility, and the ability to adapt as lender dynamics change.

2. How Waterfall Financing Transforms POS Lending

While many merchants already work with two or three lenders, these relationships are often siloed, requiring multiple applications and inconsistent customer experiences. This fragmented approach leads to operational inefficiencies, a fractured customer experience, and missed sales opportunities.

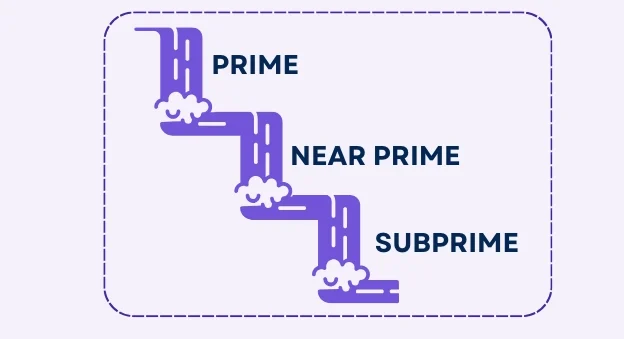

Waterfall financing solves this by using technology to unify the process. With a single application, customers are automatically routed through a sequence of lenders based on their credit profile. The result is a smoother experience, higher approval rates, and broader financing coverage.

3. How to expand your lender network without adding complexity

Traditionally, adding lenders to your POS financing program has meant more complexity: more integrations, more coordination, and more pressure on already stretched teams. That’s why many merchants have stayed limited to one or two providers, even when they know their customers could benefit from a broader range of options.

Waterfall financing not only improves the customer experience—the technology that enables it creates the foundation for easier, smarter lender management. With the right infrastructure, merchants can route applications intelligently across multiple lenders without building or maintaining separate integrations. The result: broader credit coverage and product choices with less operational strain.

4. How a Platform Approach Puts Merchants in Control of POS Financing

Beyond improving lender redundancy and the checkout experience, a platform-based model delivers additional powerful advantages for merchants before, during, and after the sale. With all lenders operating through a single interface, you gain real-time visibility into performance metrics, approval rates, and customer behavior across channels.

Managing post-sale activities such as disputes, reconciliation, and communication with lenders becomes significantly easier when everything flows through a single interface. No more jumping between portals, coordinating with multiple lender reps, or manually pulling reports.

More importantly, a platform gives you control. You can configure lending rules, manage promotions, add new products, or make changes in response to business needs, without depending on IT to rebuild workflows from scratch. It’s the kind of flexibility and stability that’s simply not possible when working with disconnected lenders in siloed systems.

5. The Business Impact of Smarter POS Financing Across the Board

Shifting to a platform-powered, waterfall-based financing model isn’t just about reducing risk—it’s about unlocking real business value. Merchants who adopt this approach consistently see higher approval rates and a smoother path to purchase for customers across the credit spectrum.

Internally, teams benefit from simplified operations, faster onboarding of lenders, and greater visibility across their entire financing program—from performance metrics to post-sale servicing. When financing works seamlessly, it stops being a source of stress and becomes a true driver of growth.

In moments of change, this model offers what single-lender setups can’t: stability, flexibility, and the confidence to move forward without disruption.

Building a smarter financing strategy starts with ChargeAfter

In my work with merchants and lenders every day, I see the difference that ChargeAfter’s platform can make, especially when a lender exits or tightens its terms. It’s not just about finding a replacement: it’s about building a financing program that’s resilient, flexible, and designed for growth.

If you’re facing changes in your financing setup or rethinking your long-term strategy, I invite you to connect with the ChargeAfter team to see how we can help you move forward with confidence.

Ready to future-proof your POS financing?

About Kevin Lawrence

VP Global Lender Relations – Kevin has worked in the banking and finance industry for over a decade. He has worked closely with some of North America’s largest banks, financial institutions, and retailers. Kevin is an expert in embedded consumer financing and B2B financing. He has a deep understanding of current trends and where the industry is heading.

The Loyalty-Building Power of Waterfall Financing

Explore how merchants selling big-ticket items harness the power of waterfall financing to reach a wider customer base, maximize approvals, and simplify the purchasing journey.

Building brand loyalty requires more than offering exceptional products or services. Today’s shoppers expect seamless experiences, including access to best-fit financing choices within their purchasing journey from luxury boutiques to eCommerce websites. To meet customers’ demands across the credit spectrum, leading luxury brands are implementing a waterfall finance model that cascades applications through multiple lenders, which has become an essential strategy in 2025.

Which industries benefit from waterfall financing?

Waterfall financing is particularly impactful in industries selling high-ticket items, where affordability can be a barrier to purchase. For example:

- High-end jewelry

- Luxury goods by top brands such as bags, shoes, and accessories

- Home goods

Unlike small everyday purchases, big-ticket items often require financing because the upfront cost is too high for many consumers to pay out of pocket. Traditional financing options may reject applicants with lower credit scores, leaving them without alternatives. Waterfall financing solves this by sequentially matching customers with lenders, ensuring more approvals and higher purchase conversions. Additionally, these large purchases often involve longer decision-making cycles, and flexible financing can be the deciding factor in whether a customer completes the transaction.

This model is also transforming B2B transactions. Small and medium-sized businesses (SMBs) often struggle to secure traditional financing for equipment, supplies, or technology upgrades. With embedded waterfall financing, merchants can offer tailored solutions that allow SMBs to scale their operations without cash flow constraints.

Serve more customers, build stronger relationships

Expanding your customer base starts with inclusivity. Waterfall financing empowers luxury and jewelry retail businesses to serve a diverse range of customers by cascading applications through a network of lenders, accommodating credit profiles from prime to no-credit-required.

For example, a customer declined by both prime and near-prime providers might qualify for a lease-to-own option, turning a potential lost sale into a completed transaction. By integrating a full waterfall finance cascade with prime, near-prime, and subprime options instantly available, Raymour & Flanigan achieves over 94% in-store approval rates and over 80% approvals overall. Click here to download the case study.

By ensuring all credit tiers are catered to, merchants demonstrate flexibility and commitment to their customers’ needs, fostering brand loyalty.

For example:

- Prime customers purchasing an engagement ring can quickly and easily secure a 0% installment loan.

- A near-prime shopper declined for a 0% loan, can be instantly approved for a low-interest plan.

- A shopper with low or no credit can be quickly referred to a tertiary option within the same application process.

All leave satisfied, increasing the likelihood of positive reviews and repeat business.

Flexible terms build trust and confidence

Customers value financing solutions tailored to their unique financial situations. Waterfall financing ensures each customer is matched with the most suitable lender, maximizing approval rates and guaranteeing terms that fit their needs. However, our recent survey highlights significant gaps in the market:

- 67% of merchants provide near-prime lending options

- Only 26% offer prime financing solutions.

- A mere 6% cater to the entire credit spectrum.

This imbalance leaves a significant segment of customers underserved. Prime shoppers will be tempted to take their business elsewhere if they think they can get better terms. Subprime shoppers without an option at all will also be likely to abandon their carts. These scenarios represent a missed opportunity to build loyalty.

By prioritizing transparency, affordability, and flexibility across all credit tiers, merchants can achieve approval rates as high as 85%, driving sales and customer loyalty.

How waterfall finance simplifies the customer journey

A seamless financing process is critical to delivering a positive customer experience, and waterfall financing makes this possible. By integrating an embedded lending platform, businesses can provide customers with a consistent, frictionless experience across all touchpoints—whether they’re shopping online, in-store, through a call center, or even at home through a contractor.

Waterfall financing matches customers with the best financing option for their credit profile without requiring them to apply multiple times. Customers appreciate the efficiency of receiving tailored options quickly and without hassle, increasing the likelihood of completed purchases.

By eliminating complexity and creating a user-friendly experience, businesses build trust, enhance satisfaction, and strengthen their competitive edge.

Conclusion: Putting Customers First with Waterfall Financing

Waterfall financing is more than a payment solution—it’s a strategic tool for building trust, fostering loyalty, and driving long-term growth. By providing tailored, flexible, and inclusive financing options, merchants selling big-ticket items can meet the diverse needs of their customers and remain competitive.

If your business is ready to enhance the customer journey and achieve higher approval rates, now is the time to explore the transformative power of waterfall financing.

About Nufar Bareket

Global Head of Partnerships

Nufar has over 15 years of experience in global business development with Fortune 500 companies in the Retail and Financial Services spaces.

Meet with Us at Payments MAGnified: Booth 314

Heading to Payments MAGnified? Let’s connect at booth 314! Book a meeting now

February 10–13, 2025, Gaylord National Resort in National Harbor, MD.

Is point-of-sale financing a strategic priority in 2025? If so, you’re in good company—78% of merchants highlighted it as a key focus in our latest survey. Our team will be on hand at Payments MAGnified to discuss how we can help you streamline the omnichannel journey, boosting approvals, and delivering an outstanding customer experience.

Discover why our embedded lending platform is the platform of choice for leading merchants. Your customers benefit from greater personalization and choice, while your team enjoys a simple integration and end-to-end control of the lending journey on a single platform.

See you at Booth 314. Book time with us now!

Meet the ChargeAfter Team

Connect with our team now on LinkedIn:

- Meidad Sharon – CEO & Founder

- Gil Segev – EVP Global Strategic Resources

- Kevin Lawrence – VP of Global Lender Relations

- Jim Magnuson – Director of Sales

See you there!

2025 Consumer Device Upgrades: Retailer Insights

As we step into 2025, a noticeable trend is on the horizon: the wave of personal device upgrades. The devices that served us during the pandemic—a period marked by rapid digital adaptation—are now showing their age. Whether it’s personal computers, monitors, phones, or other gadgets, many of the tools we relied upon to navigate remote work, virtual learning, and staying connected have reached the end of their optimal lifecycle.

In this article, we’ll explore the key trends shaping consumer demand for personal device upgrades in 2025 and highlight how retailers can empower shoppers to upgrade to make the purchases they desire.

A Pandemic Boom Turning into an Upgrade Opportunity

Between 2020 and 2021, consumer demand for personal devices skyrocketed. With work-from-home setups, virtual meetings, and online schooling becoming the norm, millions invested in technology to stay connected and productive during the pandemic. Fast forward to 2025, and many of those devices are now outdated, less efficient, and struggling to keep pace with today’s software and connectivity demands.

Most device manufacturers often design hardware with a lifespan of three to five years, particularly for phones and laptops. As the devices purchased during the pandemic approach or exceed that threshold, consumers are faced with a choice: repair their aging devices, continue to tolerate diminishing performance, or upgrade to newer, faster, and more capable models.

Why 2025 Could Spark Device Upgrades

1. Evolving Tech Standards

Rapid advancements in technology are leaving older devices behind. The rollout of 5G, improved Wi-Fi 6E standards, and more power-efficient processors, brings significant gains in speed, reliability, and performance. Upgrading to these newer models isn’t just about keeping up—it’s about unlocking smoother, faster, and more reliable technology.

2. Increasing Work and Play Demands

In the post-pandemic era, the boundary between work and personal devices has continued to blur. Hybrid work has become the norm, and the average consumer now demands optimal performance from their laptops, tablets, and smartphones to meet the dual needs of professional productivity and personal entertainment.

3. Affordability Will Shape Consumer Choices

With rising costs in many sectors, affordability will be a key driver of purchase decisions in 2025. Retailers that offer competitive prices and flexible payment options will have a distinct advantage. Retailers that provide point-of-sale (POS) financing solutions, such as 0% or deferred interest programs and that address the full credit spectrum of prime, near-prime, no-credit-required, buy-now-pay-later (BNPL) and B2B programs, are uniquely positioned for significant wins. These solutions allow consumers to spread the cost of new devices over manageable payments, making upgrades more accessible without the burden of upfront expenses.

4. Sustainability and Trade-In Incentives

Eco-conscious consumers are increasingly looking to trade in old devices in return for credit toward new purchases. Manufacturers and retailers offering robust trade-in programs, ensuring old gadgets are recycled responsibly while making upgrades more affordable are gaining favor with sustainability-minded consumers .

5. Rising Consumer Expectations

The rise of AI, augmented reality, and other cutting-edge innovations are becoming more mainstream, but they require hardware capable of running them effectively. Devices bought in 2020 often lack the processing power or graphics capabilities to fully leverage these advancements, creating a clear upgrade imperative.

6. The Buzz Around New Product Launches

The tech world is buzzing with rumors of exciting product launches in 2025. From new foldable laptop designs and next-generation monitors to AI-integrated smartphones, this year is poised to showcase innovations that make upgrading irresistible, even for those whose devices are relatively new. .

Key Devices on the Upgrade List

• Laptops and Desktops: Aging processors, reduced battery life, and limited support for modern software are driving the need for replacements. Upgrades like faster SSDs, advanced GPUs, and improved battery performance are in high demand.

• Monitors: High refresh rates, 4K resolution, and ultrawide displays are becoming the standard for work and gaming, making older monitors feel inadequate.

• Smartphones: Foldable designs, improved camera technology, and AI-powered features are making 2025 an exciting year for smartphone enthusiasts.

• Peripherals: Keyboards, mice, webcams, and docking stations have seen wear and tear over time, pushing consumers to refresh their setups for ergonomics and better functionality.

Retailers and Manufacturers: Positioned for Success

Retailers that adopt affordability-focused strategies, such as competitive pricing, trade-in programs, and point-of-sale financing solutions, are well-positioned to thrive in 2025. By partnering with an embedded lending platform like ChargeAfter, retailers gain access to all POS financing categories and programs—including consumer-focused and B2B solutions—through a single integration.

This streamlined approach enables retailers to offer a variety of financing options, such as buy-now-pay-later plans, installment loans, revolving lines of credit, and leasing options. These solutions make it easier for customers and B2B purchasers alike to upgrade their devices without the burden of significant upfront costs, making high-ticket purchases more accessible . These solutions not only enhance the customer experience by providing flexible payment terms but also capture consumers who might otherwise delay upgrading due to upfront costs.

By leveraging ChargeAfter’s comprehensive platform, retailers can boost sales, improve customer satisfaction, and foster long-term loyalty, all while meeting the diverse needs of modern shoppers.

Conclusion

2025 is shaping up to be a pivotal year for rethinking the technology we use every day. Whether driven by necessity, innovation, or affordability, this year could spark a significant upgrade cycle. As consumers weigh their options, one thing is certain: the devices we choose today will define how we work, play, and connect in the years ahead.

For retailers and manufacturers, this presents a golden opportunity to align their offerings with consumer needs, by prioritizing affordability, accessibility, and cutting-edge innovation.

So, will 2025 be the year you decide to upgrade? It just might be the perfect time to swap out those pandemic-era devices and step into a new era of performance and connectivity.

About Kevin Lawrence

VP Global Lender Relations – Kevin has worked in the banking and finance industry for over a decade. He has worked closely with some of North America’s largest banks, financial institutions, and retailers. Kevin is an expert in embedded consumer financing and B2B financing. He has a deep understanding of current trends and where the industry is heading.

5 Common Point-of-Sale Financing Mistakes For Retailers to Avoid in 2025

Point-of-sale (POS) financing has become a strategic priority for retailers looking to boost customer satisfaction and increase sales. However, there are common mistakes that can hinder success. In this article we explore how to avoid these pitfalls and maximize the benefits of POS financing.

Shoppers today demand choice, personalization, and convenience in every aspect of their retail experience—yet many merchants fall short when it comes to point-of-sale (POS) financing. A recent survey by ChargeAfter highlighted that despite the integral role that POS financing plays in generating sales revenue, only 1% of merchants agree that they meet the needs of all of their customers. Recognizing the strategic importance of POS financing, 78% of merchants say that point-of-sale financing is a strategic priority for 2025.

The current state of POS financing presents an exciting opportunity for retailers to differentiate themselves. By addressing common pitfalls and implementing smarter, more customer-centric financing strategies, merchants can not only boost approval rates and sales but also build stronger, long-term customer loyalty.

Let’s explore the 5 most common mistakes retailers make with POS financing and how to avoid them.

The 5 Most Common POS Financing Mistakes Retailers Make

- Working with a single lender

- Ignoring the omnichannel experience

- Providing a fragmented customer experience

- Overlooking the value of financing data to build customer loyalty

- Adding additional lenders without using a platform

Mistake 1: Working With A Single Lender

To cater to their diverse customer base and offer the most favorable lending options, retailers must collaborate with multiple lenders catering to various credit profiles. Lenders typically specialize in specific customer segments, such as prime, near-prime, or subprime, and specific loan products like buy now pay later (BNPL), 0% APR, short/long-term installments, lease-to-own, etc. Additionally, geographical coverage is another aspect, as lenders typically only serve one region.

When a retailer relies solely on a single lender, it poses challenges. For instance, if a shopper is declined for a loan at the checkout stage, they have limited alternatives and are likely to abandon their shopping cart. This results in a lost sale and customer, as they might be deterred from future purchases. Moreover, if the lender with whom the retailer exclusively works changes their terms or ceases operations, they find themselves in a difficult situation without alternative lending options.

Research by Snap Finance published in Yahoo finance in March 2024 reveals that almost 50% of consumers with credit challenges will avoid purchasing from stores that do not supply them with financing options.

Mistake 2: Ignoring the Omnichannel Experience

It’s often said that one should never put all their eggs in one basket, and this is especially true when it comes to the sales experience. Customers are, in the end, individuals with different preferences when making purchases. It is important to offer a consistent experience regardless of how the consumer engages with your business.

Whether your customers are using an app, website, or physical store, they should enjoy a consistent experience, including when it comes to point-of-sale financing, regardless of how they choose to access your services. Shoppers who rely on financing to make a big-ticket purchase, for example buying furniture, will likely prefer to apply for financing online from home before heading to the store with their pre-approval to complete their purchase. This translates into other purchases that customers know they can’t access without financing and where they want to avoid the embarrassment of in-store declines.

To provide a seamless omnichannel experience, it is equally essential to strategically offer point-of-sale financing options across various customer interaction points, not merely at checkout. In-store, this can include QR codes that are displayed throughout the store where customers can apply in advance on their mobile devices, as well as at self-checkout, or at traditional checkouts.

Mistake 3: Providing a fragmented customer experience

While an omnichannel financing experience is critical, it isn’t the only barrier to a fragmented customer journey. When retailers fail to establish a streamlined process for loan applications and approvals, especially when integrating more than one lender into their offer, the result is a frustrating experience for customers.

Consider a shopper applying for a loan at the point of sale, which gets declined. If the retailer offers more than one lending option, the customer who wants to continue looking for a loan has to start the application process all over again with a different lender. This repetition not only adds unnecessary inconvenience and time consumption for the customer but also creates a sense of frustration and confusion.

This poor experience leads to customer dissatisfaction, a loss of trust in the retailer, and potential purchase abandonment. Retailers should prioritize integrating their financing options into a single platform to establish a cohesive process that ensures a seamless customer experience, minimizing the need for multiple loan applications and reducing the likelihood of customer frustration and disengagement.

Jerome’s Furniture, a discount furniture chain store in Southern California, achieved a 67% increase in consumer financing adoption with high approval rates by embracing consumer financing as part of the customer journey with ChargesAfter’s embedded lending platform.

Mistake 4: Overlooking the value of financing data to build customer loyalty

Data about customer financing is an invaluable asset that can help retailers make informed decisions across various aspects of their operations. By harnessing insights derived from customer financing data, retailers can enhance their marketing strategies, identify upselling opportunities, and optimize their lenders.

Customer financing data provides a comprehensive understanding of customer purchasing behavior and preferences. By analyzing this data, retailers gain insights into which products are most commonly financed, the preferred financing options, and the specific factors influencing customers’ decisions. With this knowledge, retailers can tailor their marketing strategies to target the right audience, showcase relevant products, and optimize promotional campaigns to resonate with customers’ financing preferences.

Access to individual shoppers financing data is a powerful way for retailers to build personalized customer relationships and highlights upselling opportunities. By analyzing shoppers purchasing patterns and financing histories, retailers can identify customers who have previously financed products and can invest in higher-priced items. With this information, retailers can personalize their sales approach, offer attractive financing options, and guide customers toward upgrading their purchases. This boosts revenue and enhances customer satisfaction by providing tailored recommendations based on their financial capabilities.

Moreover, retailers can leverage financing data to collaborate with lenders and optimize partnerships that provide their customers with the most successful financing options.

Mistake 5: Adding additional Lenders without using a platform

Adding additional lenders without using a point-of-sale (POS) platform contributes to a poor customer experience and makes managing post-sale processes such as refunds, reconciliations, and disputes exceptionally complicated. Without a centralized system, each lender operates independently, making it difficult to streamline and coordinate these critical activities.

Without an embedded lending platform, managing post-sales transactions becomes a cumbersome process. Each lender may have different refund policies, procedures, and timelines, making it hard to ensure consistent and efficient processing. Reconciling transactions across multiple lenders becomes equally complex, as there is no centralized mechanism to track and match payments, leading to potential errors and discrepancies.

Handling disputes becomes a more arduous task as well. Without a unified platform, resolving issues requires interacting with each lender separately, prolonging the resolution process and causing frustration for customers and retailers. The lack of streamlined communication channels and standardized dispute-resolution procedures can result in inconsistent outcomes and an unsatisfactory customer experience.

Additionally, compliance becomes more complicated without a platform. Each lender may have its own regulatory requirements, and managing and ensuring adherence to these varied compliance standards can be daunting. This increases the risk of non-compliance and potential legal issues for lenders and merchants.

Conclusion – A platform-first solution

Retailers are increasingly partnering with ChargeAfter to simplify their financing operations and eliminate the common pitfalls of point-of-sale financing. By embedding multiple lenders into a single, easy-to-manage platform, ChargeAfter enables merchants to deliver a seamless and efficient financing waterfall experience for their customers. With this approach retailers can achieve approval rates of up to 85%, meeting the needs of shoppers across the credit spectrum.

Beyond customer benefits, the platform simplifies post-sale processes by consolidating lender relationships, streamlining workflows, and reducing administrative burdens.

About Kevin Lawrence

VP Global Lender Relations – Kevin has worked in the banking and finance industry for over a decade. He has worked closely with some of North America’s largest banks, financial institutions, and retailers. Kevin is an expert in embedded consumer financing and B2B financing. He has a deep understanding of current trends and where the industry is heading.