Consumer Buying Trends Survey – The Importance Of Consumer Finance

Furniture industry research specialist Dana French conducted the Consumer Insights Now research, which was released in September and was co-sponsored by ChargeAfter. The consumer finance study highlights customer behaviors across age groups (18-74). The primary goal of the research was to identify customer preferences and trends which would provide furniture sellers with useful information.

The survey provides data on how buyers often use consumer financing in a variety of ways. The research’s results include the kinds of goods they want to purchase, how they intend to finance such purchases, and how the furniture fits into their overall shopping list.

The research gives furniture retailers all the information they need to know about customer trends right now. For both new and established retailers looking to offer the precise services that customers want, the data may be of tremendous assistance. Especially when the study displays a variety of consumer behavior statistics.

The study emphasizes once more how essential consumer financing has become to our daily lives and how it affects every significant purchase made by a customer. Numerous survey results show that younger customers are more inclined to utilize consumer financing in their everyday life which is evidence that retail finance has become popular in recent years.

The survey’s findings could help retailers understand the value of customer financing in the furniture industry. It may be a signal for them to introduce additional buy-now, pay-later (BNPL) loans or POS financing alternatives.

The results of the survey also revealed which age group is the most significant group of consumers and which of them must be the primary category of potential customers. As a result, the data may be used by retailers to create a precise marketing strategy for upcoming sales and ensure that customers will have access to the financing choices they require. When properly applied, research may boost sales and conversion rates for shops.

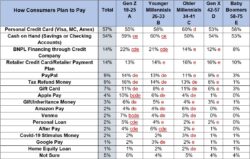

How Consumers Plan To Pay

According to the chart above, different age groups have different plans for how they will make their payments, or use consumer finance solutions. Although the numbers for customers who use credit cards and those who prefer to pay with cash are practically identical, we can see that younger groups are slightly biased towards cash payments. Due to their familiarity with traditional banking services and installment payments, older generations are more inclined to utilize credit cards for payment.

In contrast, younger Millennials and Gen Z tend to choose Buy Now Pay Later services from financing platforms when it comes down to consumer financing options available to them.. There are two potential causes for this. Namely, younger consumers may like BNPL since it offers superior services and the benefit, occasionally, of no interest charges, or are often unable to qualify for credit cards because they do not yet have a solid credit score. Similar considerations apply to cash payments, which are often made from savings accounts and are more frequently made by older generations.

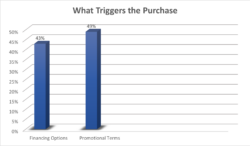

Are Consumer Financing Options And Promotional Terms Important To Consumers?

Promotional terms are significant to 49% of customers overall for home goods, whereas financing options are important to 43% of customers when we compare how financing choices and promotions trigger the purchase for the consumers. The younger generations of Gen Z are the only age group, as shown in the table above, that is more likely to make a purchase when the shop offers financing choices at the point of sale. However, this is not true for other age groups. Only 27% of Baby Boomers believe that financing alternatives at the store are the reason to make a purchase, according to the lowest numbers for consumer finance.

Though the comparison is close across practically all age groups, younger generations are more influenced by both possibilities and are more likely to purchase as a result. As we can see, promotional conditions are an excellent instrument for boosting sales and luring customers. Conversely, the businesses that choose to use both of the proposed solutions will succeed the most and draw in the most number of customers.

As shown, the Consumer Insights Now consumer finance survey provides the exact data and facts furniture retailers require to develop effective new tactics and know which consumer financing solutions to use.

References:

Consumer Insights Now research, Home News Now (September 11, 2022) Consumer Insights Now: Research highlights consumer buying behavior in the second half