Leading retailers recognize the strategic importance of point-of-sale (POS) financing to attract interest-weary shoppers, especially during this period of uncertain economic conditions. When implemented correctly, POS financing becomes an essential tool to boost conversion and customer satisfaction.

In May, the Federal Reserve reported that consumers are preparing for continued inflation, yet they remain undeterred from shopping. The April Survey of Consumer Expectations shows that spending is projected to grow by 5.2% over the next year. This underscores the importance of providing flexible and appealing financing options at the point of sale.

The Strategic Importance of POS Financing

A well-executed POS financing offer meets the customer at their moment of need, offering a fast and seamless experience. ChargeAfter data shows that merchants who adopt a multi-lender waterfall financing model with solutions for prime, near-prime, and subprime shoppers, can achieve up to 85% approval rates. This model ensures that a wide range of customers can access financing options that suit their credit profiles, expanding the potential customer base and increasing conversion rates.

Moreover, recent data gathered by ChargeAfter reveals that only 2% of retailers achieve at least 80% approval rates, highlighting the competitive advantage of implementing a robust POS financing strategy.

Multi-Lender Waterfall Model: A Path to Higher Approval Rates

To effectively meet the needs of their entire customer base, retailers must integrate multiple lenders covering the full credit spectrum into the points of sale. This multi-lender approach provides personalization and choice through various financing products such as private label credit cards (PLCC), revolving credit, installments, lease-to-own, buy now, pay later (BNPL), and B2B financing.

However, merely offering access to multiple lenders is insufficient. A well-executed POS financing offer must meet customers at their moment of need, whether they are shopping in-store, online, through call centers, or even in-home. It should provide a fast and seamless experience in real-time and deliver choice and personalization.

Integrate Multiple Lenders with an Embedded Lending Platform

To seamlessly integrate multiple lenders into omnichannel points of sale with a single application, an embedded lending platform is essential. As well as delivering customers with instant access to the best-fit financing options, it provides numerous benefits for retailers. These benefits include fast and easy integration, comprehensive post-sale management, lender redundancy, visibility and control, and financing data in a single integrated solution. ChargeAfter is the platform of choice for America’s top retailers. In a single technical integration, ChargeAfter not only makes it easy to unlock a network of lenders but also removes the burden of managing multiple lenders, including taking care of sensitive PII, terms and conditions, disclosures, etc.

Effective Marketing Strategies to Promote Financing Options

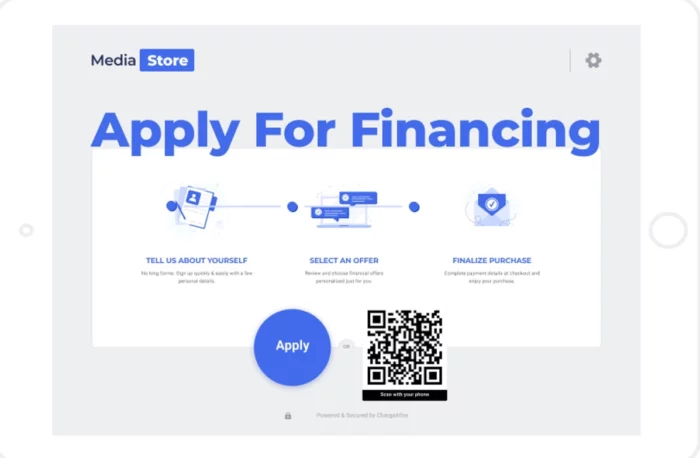

Of course, retailers need to communicate to buyers that financing is available within the shopping journey. One way to do this is through marketing campaigns. Another effective way is to communicate with shoppers throughout their purchasing journey. For example, retailers can add promotional widgets on their eCommerce websites, embed financing into the checkout process, and invite customers to apply for pre-qualification, which can also be used in-store. In-store signage with QR codes enables customers to apply for financing on their mobile devices, facilitating purchasing decisions.

Signage regarding POS financing availability at self-checkout and traditional checkout ensures shoppers can confidently continue their journey, knowing that POS financing can help them buy the desired goods. In the context of persistent inflation and evolving consumer spending habits, retailers must adopt diverse financing options to attract and retain customers.

The Competitive Advantage of Embracing Innovative POS Financing Solutions

Retailers who embrace innovative POS financing solutions will be well-positioned to drive sales, boost customer satisfaction, and maintain a competitive edge in the market. By adopting a multi-lender waterfall model through a platform, retailers can offer a seamless and personalized financing experience that meets the diverse needs of their customers. Effective marketing strategies further enhance the visibility and appeal of these financing options, ensuring that customers are well-informed and confident in their purchasing decisions. ChargeAfter is the platform of choice for America’s top retailers.

Mark Denman

EVP Merchant Sales & Success

About Mark Denman

Mark has worked in the near-prime and tertiary lending space for 30 years. As EVP of Merchants Sales & Success at ChargeAfter, he is responsible for ensuring merchants and lenders get the best care possible.