Boost your sales growth: The benefits of ecommerce financing

Consumer finance is not set to grow. It’s growing! As consumer behavior shifts towards online shopping, the benefits of eCommerce financing are becoming increasingly evident. By offering flexible payment options, ecommerce financing empowers customers to make purchases they might otherwise defer, significantly boosting conversion rates and reducing cart abandonment. For retailers, this means increased sales and the ability to reach a wider audience, including those needing access to traditional credit. Additionally, ecommerce financing can foster greater customer loyalty, encouraging repeat purchases through convenient and accessible payment plans. This trend aligns with the broader growth of POS financing, illustrating the critical role of flexible payment solutions in modern retail strategies.

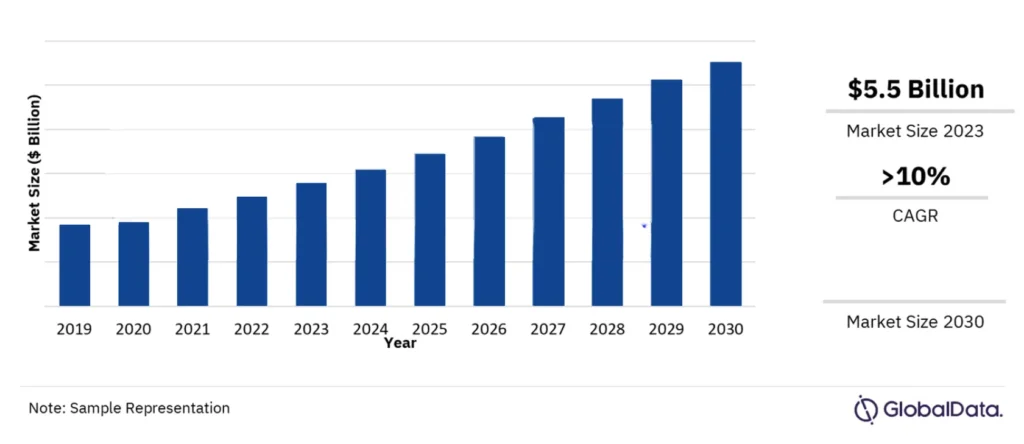

According to recent data from Globaldata, (POS) point-of-sale financing continues to grow significantly within the total unsecured lending balances in the United States. As of 2023, credit card balances amounted to around $1.08 trillion, reflecting a substantial increase from previous years. The POS software market was valued at approximately $5.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 10% through 2030. This growth is primarily driven by the rising adoption of contactless payment methods, which are favored for convenience, speed, and safety. The retail sector remains the leading end-user segment within this market, highlighting the expanding influence of POS financing.

POS software market outlook 2019-2030 ($ Billion)

Market size ($ Billion)

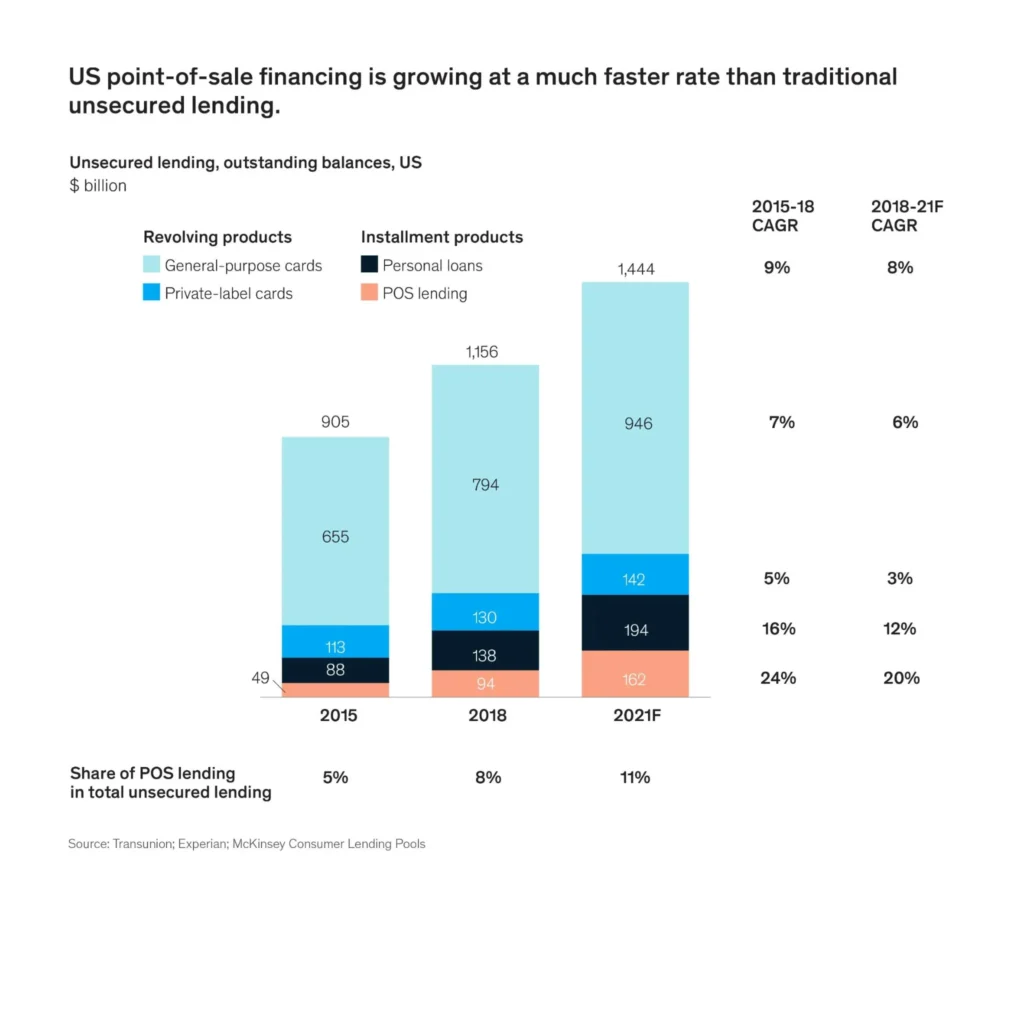

Similarly, according to McKinsey Consumer Lending Pools, the same trend is can be seen internationally with POS financing making up 11%

Prudence Research has also shown, how BNPL, a financial instrument for short term installment loans, falling within the POS Finance umbrella, has grown and how it is forecasted to grow dramatically in the coming years. For instance, the Buy Now Pay Later market size is forecasted to grow to a staggering 3.2 Trillion dollars by 2030.

Financing can expand the customer base for various purchases, including appliances, electronics, furniture, home improvement projects, and services like elective medical procedures and dental equipment and procedures. Offering financing options can boost sales for any seller, whether in a brick-and-mortar store, online, or through a call center, and cater to all consumer types.

Buying a product or service that costs between $1,000 and $10,000 is more complex than making a $50 purchase by swiping your credit card. Businesses need to make an effort to attract a broader range of consumers. Through embedded finance, consumer financing has expanded beyond buy now, pay later and adopted long-term installment payment, 0% APR, revolving lines of credit, and more, to offer consumers flexible payment options.

Industry analysis found how consumer financing increases merchant sales. For instance:

- According to The Inaugural Citizens Point of Sale Survey by Citizens Financial Group, the most notable finding is that 76% of consumers are more likely to make big-ticket sales when given the option of consumer financing, such as BNPL or other payment plan options. Of those surveyed, 66% want consumer finance alternatives to credit cards.The survey revealed that consumers would prefer non-credit-card consumer financing with fixed monthly plans, clear payment terms, and a clear understanding of how the amount will be paid off as the most important factors when considering a large purchase.

- Comparably, a study by Futurepay.com reports that 56% of shoppers are more inclined to purchase a high-priced item online if financing options are available. This percentage increases to 73% for frequent online shoppers. These statistics are very close to findings by the Citizens Financial Group.

- A recent FREE retailer insights survey by ChargeAfter indicates that from a retailer’s perspective, 85% of retailers expect year-on-year growth in consumer financing.

Higher value, more sales with ecommerce financing options

Merchants selling higher ticket items who offer consumer finance options achieve more sales than merchants without consumer financing options.

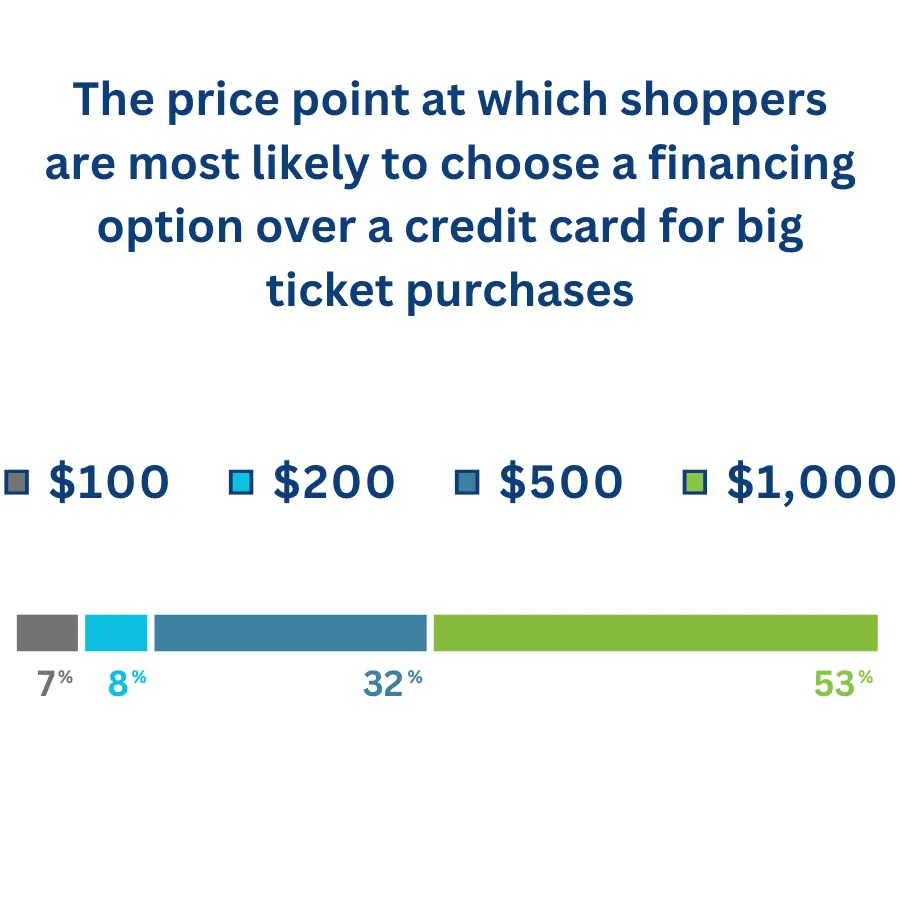

‘The Big Ticket: What’s stopping Shoppers’ (big-ticket survey) published its findings and according to them, financing alternatives stimulate high-value purchases. Over two-thirds of shoppers (68%) and 79% of daily shoppers would be more inclined to purchase a high-priced item if they could divide the cost into smaller payments. For high-priced items under $1,000, almost half of all shoppers (47%) prefer alternative financing over a credit card to complete the transaction. Even at a price as low as $200, 15% of shoppers were willing to switch away from a credit card.

Similarly, ChargeAfters’ Retailer survey released in 2023, from a retailers’ perspective, states that merchants recognize that financing options drive big-ticket purchases.

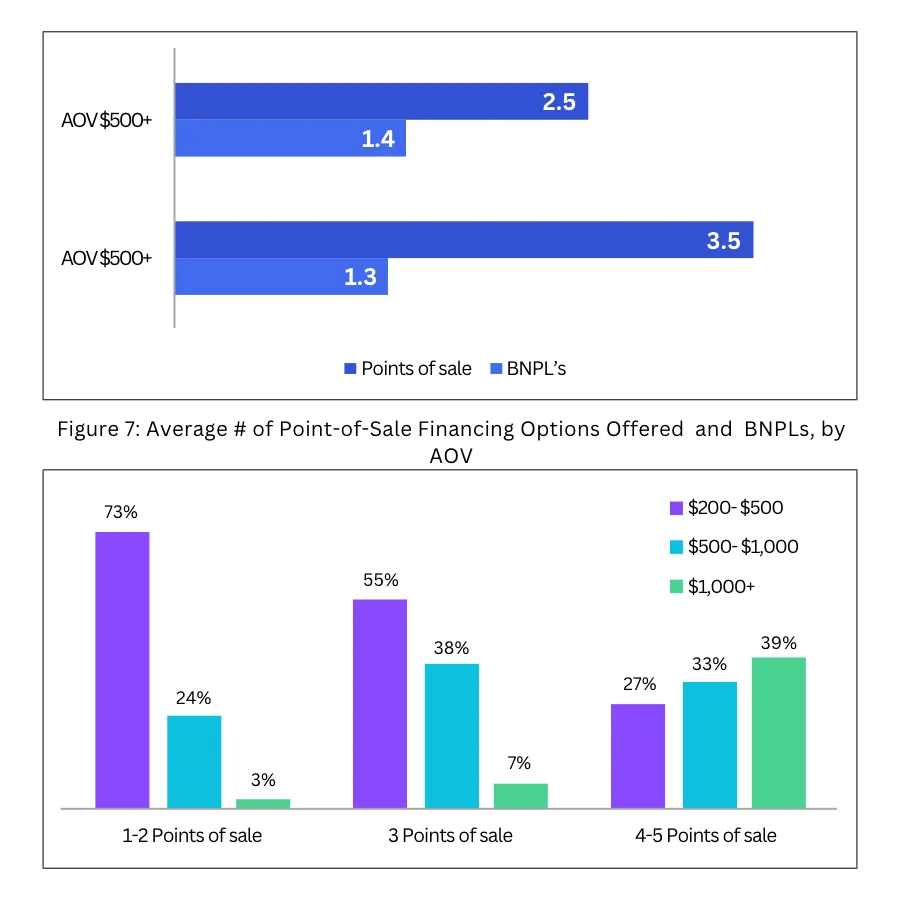

The number of BNPLs merchants offered to customers is not affected by the retailers Average Order Value (AOV). However, other POS financing options vary significantly depending on the AOV of the business. When the AOV is less than $500, companies typically offer 2.5 different POS financing options. However, when the retailer AOV exceeds $500, this number increases to 3.5 different POS financing options. As their AOV increases, merchants seek to diversify their payment options to meet customer demands. There is no one-size-fits-all solution regarding financing options, particularly with a substantial AOV. Offering a limited BNPL of pay in four or six installments is insufficient as customers require more flexibility and choice.

Financing options by average order value (AOV)

Fintech companies at the forefront of consumer finance innovation offer embedded financing & lending technologies making it easier for merchants to integrate omnichannel consumer financing solutions.

Embedded finance solutions that integrate easily, such as ChargeAfters’ multi-lender platform, allows merchants to offer their customers quick, convenient, and personalized financing options. Customers connect to a wide choice of financial products and lenders in a single application, resulting in an 85% approval rate. Merchants increase sales by offering consumer financing and installment payments on sales where the same customers would typically walk away from the sale.

Reduce cart abandonment with consumer finance

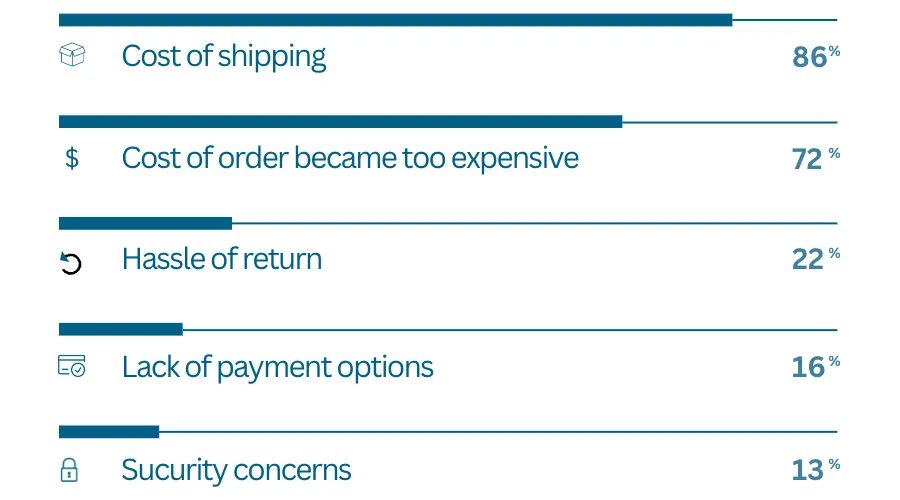

The Big Ticket: What’s stopping Shoppers survey found that 66% of shoppers abandon their carts after adding an item to their shopping cart. 72% of this abandonment was due to the items being too expensive, and 16% because there were no payment options.

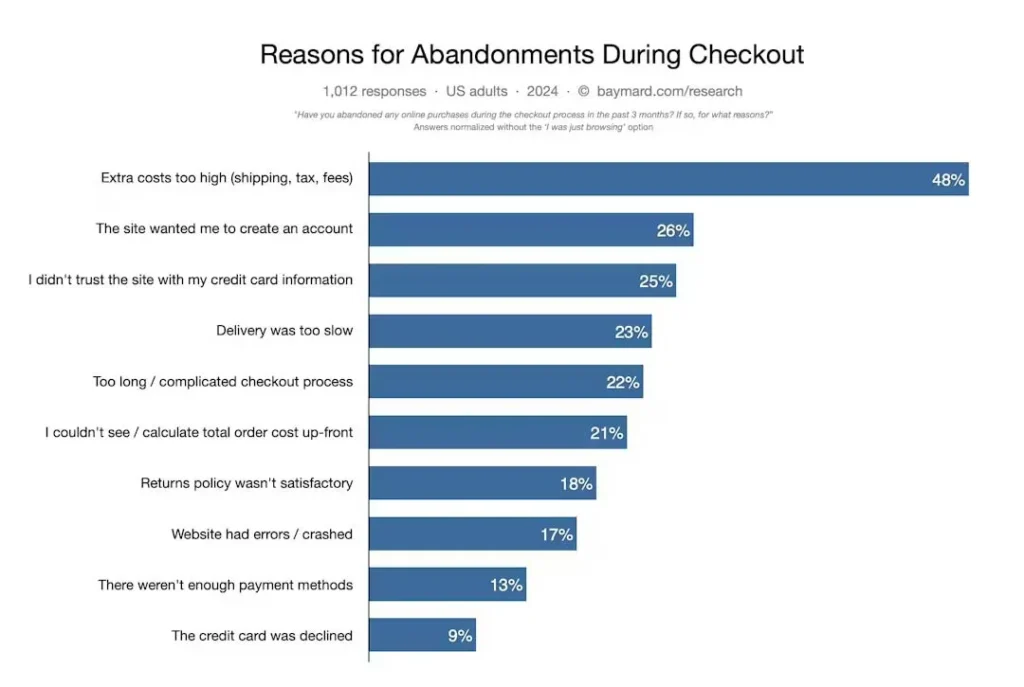

Another Research conducted by beymard.com in 2022 shows that site trust (18%), complicated checkout process (17%), inability to calculate total order cost upfront (16%), not enough payment options (9%) and. Credit card declines (4%) are the main reasons for abandonment. These statistics can be significantly improved with the correct embedded finance technology.

According to recent research conducted by Baymard Institute in 2024, the main reasons for cart abandonment include high extra costs (48%), the site requiring account creation (24%), slow delivery (22%), lack of trust in the site’s security (18%), complicated checkout processes (17%), inability to see total order costs upfront (16%), and insufficient payment options (9%). Credit card declines account for 4% of abandonments. These issues can be significantly reduced with the correct embedded finance technology.

With an embedded lending platform like that of ChargeAfter, merchants can increase sales by decreasing cart abandonment.

Conclusion: Boost sales with ecommerce financing

Reducing cart abandonment is one of the most significant benefits of offering consumer financing and installment payments in e-commerce stores. Many customers abandon their carts because they need help to afford the full price of an item at the time of purchase. However, by offering financing options, merchants can make sales more affordable and accessible, reducing the likelihood of cart abandonment and increasing the chances of a sale.

In addition to reducing cart abandonment, offering financing options can increase customer loyalty and repeat business. Customers who take advantage of financing options are more likely to return to the same merchant for future purchases, as they have established a relationship and trust with the merchant through the financing process.

Offering ecommerce financing options can help merchants reach a wider audience of potential customers. Many consumers who may not have been able to afford high-ticket items in the past may now be able to do so with financing options, opening up a whole new market for the merchant.

Finally, offering financing options can help merchants stand out from the competition and differentiate themselves in the crowded e-commerce marketplace. By providing financing options, merchants can provide a more comprehensive and customer-centric shopping experience that distinguishes them from other retailers.