3 Ways Retailers Combat The Changes In Demand For Consumer Financing

Digital technology has disrupted the way retailers construct their marketing strategies and how customers shop, which is why the world of retail is very different today than it was just five years ago. Consumers now use their smartphones to see product reviews and compare prices. In other words, making informed decisions is much simpler for consumers. The same is true for the financial component. The form of retail financing the buyer chooses has changed due to advances in consumer financing over the past few years.

For example, the usage of point-of-sale (POS) financing increased drastically after the pandemic hit, and the trend is still going strong as BNPL and other POS financing options have become a habit for consumers. Recent data shows that BNPL is evolving beyond a mere payment option, According to McKinsey & Company, about 17% of Afterpay users initiated one or more transactions directly through the app in February 2021. This shift illustrates the evolving role of retail financing in the consumer shopping experience. As shopping patterns change, brands can develop and apply next-generation tactics to enhance the customer experience with different consumer financing options in the upcoming years.

Why is consumer financing necessary?

Retailers need help selecting the best retail financing options due to the wide range of choices available.

So why is retail financing so necessary?

To increase sales – you can offer customers lower interest rates, promotions, or discounts on your products. However, it’s becoming more attractive to consumers to pay full price if they have the option to finance their purchase and split the payment. Using lending services has become a part of our merchant offering and consumers’ lives.

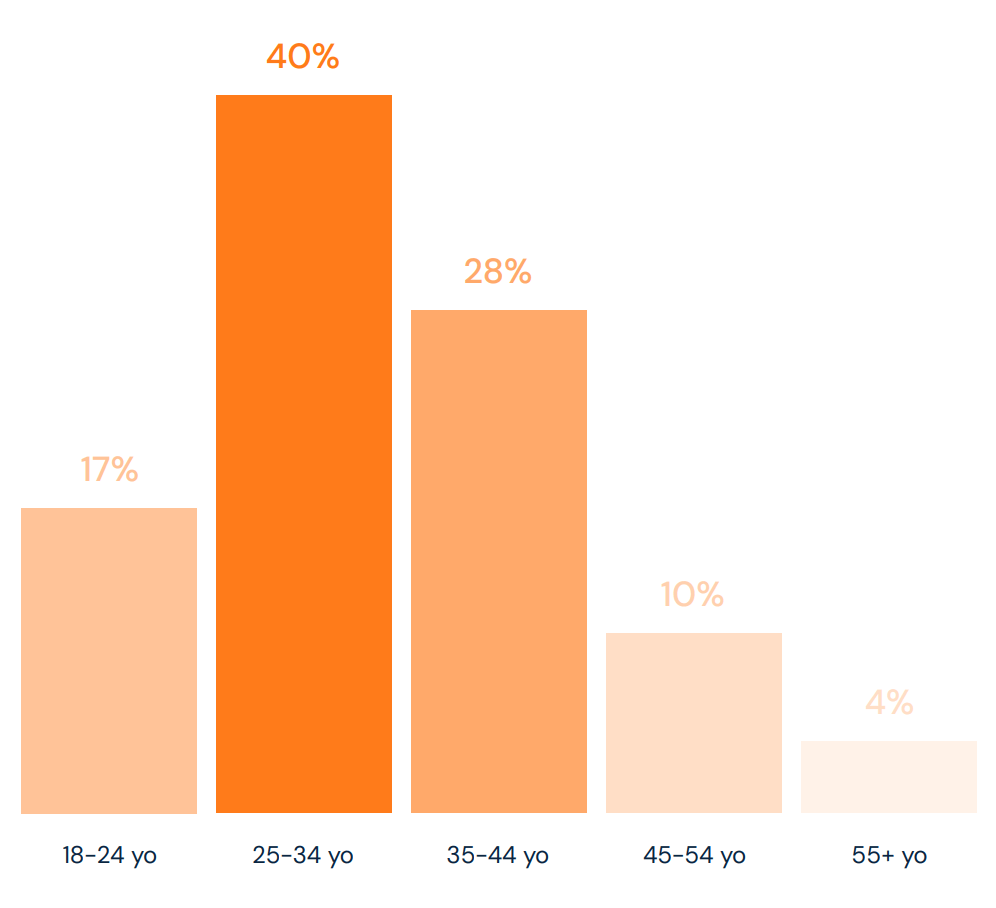

In addition, customers can split payments over time without incurring any costs, thanks to current financing solutions. Because of this, BNPL lending and POS financing are among the most popular types of retail financing available today. According to data from Fit Small Business, 56% of millennials and 40% of consumers aged 25-34 have used BNPL services, making them the most significant demographic for BNPL. This trend is particularly pronounced among consumers earning between $20,000 and $50,000 annually, with 21% of this income bracket using BNPL last year.

Because of this, retail financing options are now available as an integral part of the shopping experience for products and services like furniture, home improvement, vacation, auto parts, education, and many more.

Rising popularity of omnichannel consumer lending

Consumer financing has become more popular overall during the past ten years. More consumers frequently use retail financing services to obtain the funds required for shopping or unexpected expenses. According to the statistics, consumers favor point-of-sale financing solutions. Retail financing choices give consumers freedom, making it much easier for them to manage their finances if used appropriately. Recent insights from McKinsey & Company highlight that POS financing providers are now not just payment partners but also integral to commerce enablement and co-marketing, particularly in omnichannel strategies.

Retailers today must ensure that their financing options are seamlessly integrated across both online and offline channels. Consumers expect a smooth transition between their digital shopping experiences and in-store visits, making it essential to provide a consistent financing experience. However, many retailers need help achieving this uniformity, which can lead to customer dissatisfaction or even lost sales. Retailers can effectively bridge this gap by adopting strategies such as integrated POS systems and maintaining consistent credit terms. Leading retailers who have embraced these strategies deliver the same convenience and flexibility, regardless of whether customers shop online or in-store. This approach enhances customer satisfaction, strengthens loyalty, and encourages repeat business. However, online retail financing is one of many instruments that can help buyers have a positive purchasing experience. Customers who prefer local shopping or need a nearly complex product to select or purchase online require retailers to adjust to their needs.

For instance, if a customer wants to purchase a new mattress or any other type of furniture, they may want to physically inspect it to ensure they are making the appropriate decision. Therefore, when a customer went to a store after seeing the retailers’ online pleasant retail financing options, they had to have the same financing experience. For situations like that, retailers offer in-store retail financing. To provide the buyer with the same comfortable shopping experience, several furniture stores, including Raymour & Flanigan, are now leveraging POS financing and BNPL lending features via an omnichannel multi-lender platform.

Point-of-Sale financing

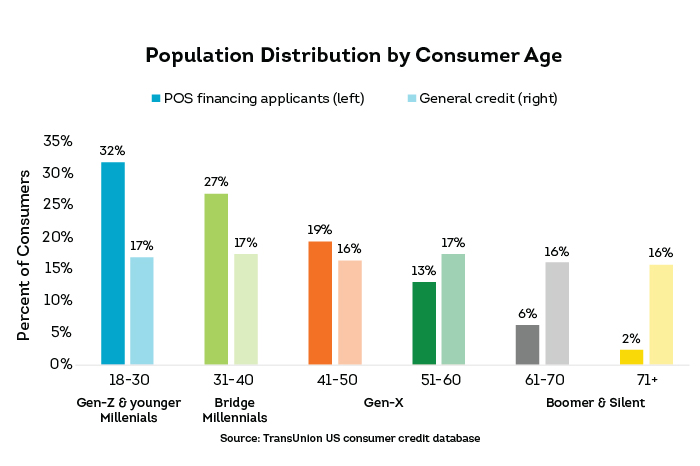

POS financing has evolved into one of the critical tools for consumers, making it seamless to access flexible lending options. Younger generations are particularly inclined towards these methods, with BNPL being a significant driver. Technological advancements and deeper integration into the shopping experience have marked the rise of POS financing services. According to McKinsey & Company, POS financing providers now leverage advanced technological capabilities, such as sophisticated fraud detection models and deep integrations into shopping carts, to enhance consumer service and mitigate risks. These advancements are crucial for maintaining the effectiveness of retail financing solutions in a competitive market.

The fact that customers receive the quickest and coziest method of financing is one of the reasons the service has become so well-liked. It usually only takes a few seconds to apply and receive the funds you require when reputable third parties are involved. It also allows customers to receive the best financing options: Installments, Revolving loans, BNPL, or LTO (lease-to-own), among the most popular examples of financing.

Potential problems for retailers

Retailers will probably have to contend with a continued challenging growth environment and higher expenses while offering solutions for their customers who are operating with cash constraints.

3 Strategies for retailers to tackle consumer financing demand

1. Be on every channel

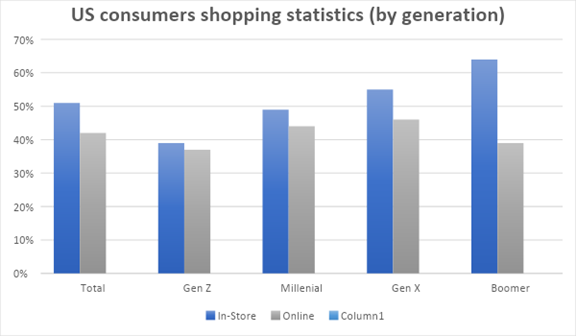

According to TIDIO statistics, customers utilize POS financing and BNPL differently in-store and online. All customers do not prefer online services. Some customers prefer to purchase goods and services from brick-and-mortar establishments.

This demonstrates the need for consumer financing solutions like POS financing or BNPL lending across all channels. Whether it will be for customers who choose to shop in person at the neighborhood store or for online users on websites or mobile applications, retailers need to ensure they are present on every channel to meet the diverse needs of their customers. Retail financing must be integrated into digital and physical platforms to provide a seamless experience that meets consumers wherever they shop.

2. Offer simple and clear financing

According to the findings of Citizens Point of Sale Survey, 76% of American consumers are more inclined to make a retail sale if a payment plan is supported by an easy and smooth point of sale experience. The survey found that 62% of respondents would like fixed monthly contracts with unambiguous payment terms, and a good understanding of how the sum will be paid off as the most crucial elements. Additionally, 66% of customers believe they already have sufficient credit cards and would rather avoid adding an additional credit card merely to make a large purchase. This suggests that customers seek a different option than applying for a new credit card to make a sizable purchase at a store. Retail brands can modernize their payment solutions by moving away from the store credit approach and adding simple financing options to their customers.

3. Offer white-labeled consumer financing

Consumers are flocking to private-brand products in the current market to combat inflation. Retailers should periodically reevaluate their category strategies to take advantage of this. Successful stores will strike a balance between fast-changing consumer tastes and pressures from individual inflation rates. This would require reconsidering their balance of national and private brands.

Consumers planning a significant purchase view trust in the organization providing the financing as one of the main reasons they prefer branded lending platforms over independent FinTech firms. This demonstrates how retailer brands can profit from branded white-label financing solutions to attract more customers.

Additionally, financing platforms like ChargeAfter provide customizable white-label financing options. This allows the merchant to change the financing software however they see fit while giving customers the financing options they need and demand. By offering white-labeled retail financing, retailers can build stronger brand loyalty while providing trusted and customized financial solutions to their customers.

How to choose the best consumer financing company for your store

Ready to provide your clients with immediate financing? Great! But which should you pick? It’s difficult to single out the top consumer financing providers because so many fintech firms provide BNPL products. Having said that, there are some qualities to consider while selecting a BNPL and consumer financing providers:

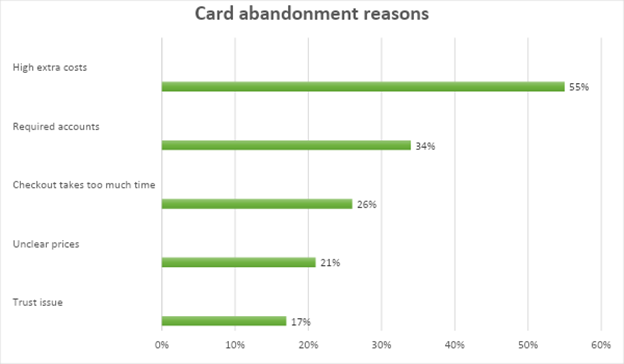

- Positive customer experience: Businesses need to deliver satisfying user experiences. For instance, ensuring a smooth checkout experience would help prevent cart abandonment. Since over 80% of shoppers leave their carts empty before making a purchase, financing and BNPL ought to have superb integration into your customer journey. User-friendly features, and no interruptions during checkout help decrease cart abandonment.

- Perfect payment plans: By offering various payment options, retailers open up their products to more people, which can increase sales and brand loyalty. Customers and business owners alike can benefit from high flexibility. Thanks to financing platforms, any retailer can act as a lender. A financing platform gives shoppers the freedom to choose their financing conditions based on sophisticated risk assessment models. Customers will be able to select from a variety of payment plans without having to worry about not being approved.

- Reduced risks: Flexibility and scalability are features reputable consumer finance businesses can provide. You may increase sales, draw in new clients, and maintain existing ones by making it simple for people to finance the goods and services, but risk management should always be considered. Make sure to work with providers with low MDR (Merchant Discount Rate) and can provide the best interest rate for your customers. In addition, make sure the PoS financing solution of your choice has cutting-edge management including managing reconciliation, chargebacks and dispute resolution. Working with multiple lender increases redundancy as well as enabling personalization and choice.

- Helps you control Data: Lastly, reputable BNPL and POS financing solutions should assist retailers in regaining control over consumer data and streamlining payments. This would enable retailers to understand better what customers want, need, and like. Advanced financing solutions permit retailers to give clients financing options, safeguard user information, and build long-lasting relationships with customers.

Summary

Retail financing is evolving and brands must stay on top of emerging trends to ensure they offer the services that customers want. The best way to do this is through a platform-first approach. As highlighted by recent data from McKinsey & Company, POS financing providers are integrating more profoundly into the shopping experience and expanding their service offerings to include traditional banking products. Retailers and retail financing platforms must work closely together to ensure they provide seamless, flexible, and secure financing options that meet the needs of today’s consumers.

Retail financing solutions have become critical to modern retail strategies. Retailers who successfully implement these advanced financing strategies— through an omnichannel approach, white-labeled, and improved risk management—will likely find themselves better positioned to capture consumer loyalty and drive long-term growth, even in a competitive market. Therefore, it is not just about offering financing options but about integrating retail financing into the broader retail strategy to enhance the overall customer experience and meet evolving consumer expectations.

About ChargeAfter

ChargeAfter is a leading multi-lender platform for Consumer Financing. It connects businesses with the most reliable lenders, enabling them to offer customers the greatest financing solutions. With the best system of Waterfall Financing, ChargeAfter guarantees lending to every shopper, by matching the most relevant lender to every client. Using the unique consumer financing technology, ChargeAfter provides consumers with the best shopping experience. MUFG, VISA, Bradesco, BBVA, Synchrony, CITI Banks are among the investors of ChargeAfter.