The difference between buy now, pay later (BNPL) and consumer financing platforms

The buy now, pay later option has become a widely favored payment method within consumer financing, with over 50% of US consumers utilizing these services through various consumer finance platforms.

What is buy now, pay later (BNPL)?

Buy now, pay later (BNPL) is an innovative payment option that enables customers to acquire products and services without paying the total upfront. Instead, they can instantly finance their purchases and repay them through fixed, interest-free installments over a set period—for instance, a $100 purchase in four equal installments of $25.

Widely used by a diverse range of businesses, particularly e-commerce retailers, BNPL services help boost conversion rates, increase average order values, and attract new customers. Companies that have integrated BNPL services have experienced up to a 30% incremental rise in sales volume. This payment alternative grants customers the convenience of immediate financing for their purchases paid through predetermined installments.

As a merchant, you receive the complete payment for the item upfront, excluding any merchant fees, and are not responsible for handling the financing. Buy now, pay later providers undertake the responsibility of underwriting customers, managing installment plans, and collecting payments, allowing you to concentrate on expanding your business.

This guide provides an overview of buy now, pay later payment, and other financing options. It will educate you on their functionality and assist you in selecting a provider.

How do buy-now-pay-later services work?

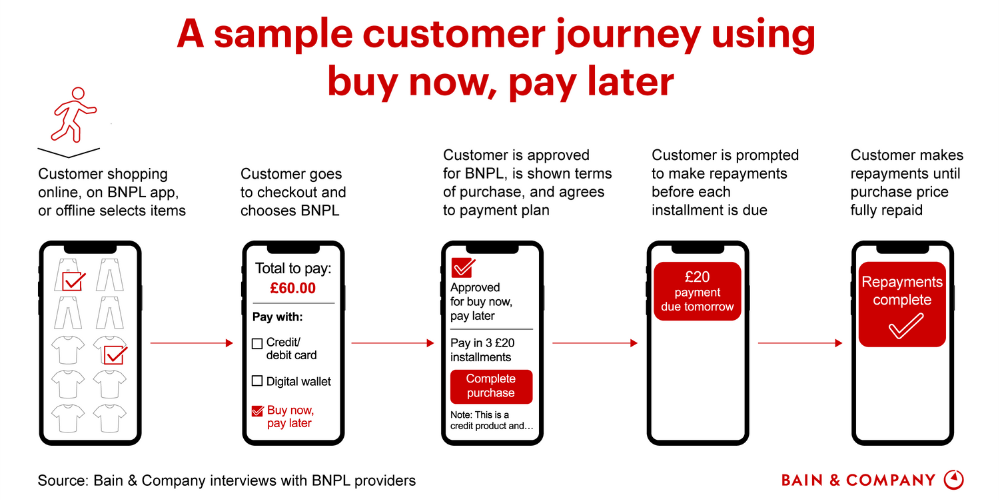

- Customers can use BNPL to purchase products or services online or in-store by selecting the BNPL option via an app.

- Once a plan is selected, approval from the BNPL platform is obtained, initiating the payment cycle. The first payment is deducted at checkout, while the remaining installments are typically interest-free. Extra costs may be incurred for late payments.

Businesses obtain the entire payment upfront (excluding any merchant fees) upon completing the transaction at checkout. Customers make their installments directly to the buy now, pay later provider, often without interest and with no extra fees, provided they pay on time.

Do buy-now-pay-later payment methods affect a customer’s FICO score (Credit Score)?

What Is FICO Score?

A FICO score is the number used to determine someone’s creditworthiness. Financial institutions and lenders use this as a guide to determine how much credit they can offer a borrower and at what interest rate. FICO scores can range from 300 to 850. The higher the number, the better. A FICO score is based on a few different factors:

When customers exercise caution by avoiding overspending and consistently making timely payments, the majority of buy now, pay later payment options should not substantially affect their credit scores.

How buy-now-pay-later services make money?

Different FinTechs monetize their BNPL platform in different ways. Generally, providers derive income from the merchant, customer, or both. The fees for merchants vary depending on the provider but typically encompass an initial setup fee and a fixed charge for each transaction. Customer fees usually involve late fees incurred due to missed payments.

What are the benefits of buy-now-pay-later services?

Seamless checkout experiences are crucial for any business, especially when targeting e-commerce expansion. Customers anticipate smooth, personalized payment experiences that allow them the freedom to select their preferred payment method. Buy now, pay later payment options provide adaptability and ease to your customers, minimize fraud, and enhance conversion rates and average order values.

As the cost of living increases, customer demands for BNPL solutions will likely grow, making it a superior short-term installment payment option even for credit card holders.

Get paid upfront and receive protection from repayment risk and fraud:

The merchant obtains the entire transaction amount upfront, without delay—regardless of the customer’s success in paying their installments. Consequently, buy now, pay later providers/lender-network assume all customer risks, protecting your business from fraud. In cases where a customer files a fraud-related dispute, the buy now, pay later provider bears the risk and any related expenses.

Extend customer reach:

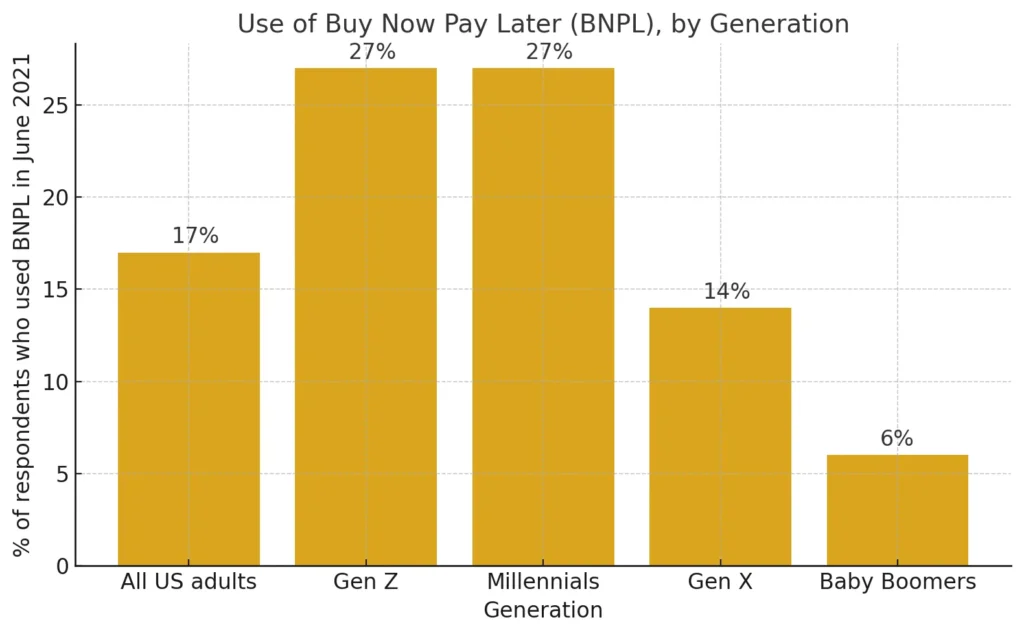

Providing diverse payment methods enables you to establish a relevant and recognizable payment experience, attracting more customers. Buy now, pay later options appeal to younger consumers who frequently lack credit cards: 27% of millennials and Generation Z shoppers utilized buy now, pay later services in 2021. Additionally, buy now, pay later services to possess well-established marketing channels, including shop directories and email marketing, which may present further opportunities for reaching new customers.

* Marketingcharts.com – August 2021 | Data Source: Morning Consult

Enhanced customer experience:

Buy now, pay later payment solutions provide customers with a quicker, more accessible means of obtaining financing. Customers undergo a soft credit check (as opposed to a hard review associated with other financing methods), and there are no separate applications, application fees, or added processing time. Most providers feature easy-to-understand repayment plans and terms. Additionally, returning customers can enjoy a seamless checkout process, finalizing their payments in just a few clicks.

Increased sales conversion

Customers are more inclined to complete a purchase if they can pay over time. Buy now, pay later services help alleviate the sticker shock—making four interest-free payments of $50 appears less daunting than a single $200 credit card transaction with accumulating interest.

Increase the value of sales

Buy now, pay later services eliminate the obstacle to making more substantial purchases by enabling customers to split the payment over time, accommodating their budget. For businesses offering lower-priced products, customers might be more inclined to buy extra items when they discover the option to spread the total cost over in installments.

Problems with providing Buy-Now-Pay-Later

Buy now, pay later (BNPL) is a popular option for consumers who want to purchase without paying the total amount upfront. However, it has many limitations. It is only suitable for specific credit types. BNPL may be an option for those with good credit and a stable income, but it will decline those with lower credit scores, resulting in low approval rates.

Most BNPL loans range from $50 to $1000. For larger purchases, there is a need for other financing options.

Additionally, existing BNPL providers have a one-size-fits-all approach and don’t offer personalized lending. In today’s world – different people need different consumer financing options, and different consumers have unique financial situations; a customized approach can help them access suitable credit for their needs and budget. Without personalized lending options, consumers may be presented with unstable lending options, resulting in an inability to repay, high-interest charges, and potentially damaging their credit score.

The lack of personalized lending options in existing BNPL providers can also be bad for merchants. When consumers are given a one-size-fits-all financing option, it can lead to a higher rate of default and late payments.

Consumer financing Platforms

While both consumer financing platforms and “buy now, pay later” (BNPL) solutions provide consumers with access to credit, there are some advantages that consumer financing platforms have over BNPL solutions. First, consumer financing platforms often offer more flexible repayment terms, allowing borrowers to choose a repayment period that suits their budget and financial situation. In contrast, BNPL platforms typically require repayment within a short timeframe, which can be challenging for some borrowers. Additionally, consumer financing platforms may offer lower interest rates and fees than BNPL platforms, saving borrowers money in the long run. Finally, consumer financing platforms may offer a broader range of loan options and loan amounts, making them a better choice for consumers who need more substantial financing for significant purchases. The main reason consumer financing platforms are more flexible and carry these benefits is that they connect to multiple lenders and are not the lender itself. Overall, while BNPL platforms can be convenient for smaller purchases, consumer financing platforms are often better for consumers looking for more effective and flexible financing options.

Buy Now, Pay Later provider comparison.

Choosing the right buy now, pay later provider depends on the types of products you sell, their prices, and your customer base. When evaluating providers, consider the following:

Repayment terms: Buy now, pay later providers offer varying installment loan plans and term lengths, ranging from several weeks to multiple years. If your business has a high average order value, seek lenders that provide repayment over an extended period (like monthly installments over six months). Conversely, merchants with lower average order values may opt for fewer installments over a shorter duration, such as four installments over six weeks.

Credit limits: Each customer will have a unique spending limit based on their usage, credit, and repayment history. However, some buy now, pay later providers impose minimum and maximum credit limits. Assess your average order value and choose a provider that offers sufficient credit for customers to complete a purchase.

Customer location: Determine the markets in which you would like to provide buy now, pay later services, taking into account your customers’ locations. Often, this may involve offering multiple buy now, pay later providers to maximize your geographic coverage. With ChargeAfter’s multi-lender platform, this is unnecessary because the ChargeAfter platform connects you to the relevant lenders and services in one platform.

Affirm

Affirm BNPL range from 4 interest-free bi-weekly payments to extended installments for eligible customers of up to 36 months. The usual 0% APR loans range from 3,6, to 12 months.

Afterpay

Afterpay, known as Clearpay in the UK and the EU, enables customers to split payments into four interest-free bi-weekly installments or three interest-free monthly installments. With 20 million active users, it operates in Australia, Canada, France, New Zealand, Spain, the UK, and the US.

Klarna

Klarna Pay in Installments lets customers spread the cost of an online purchase over three or four interest-free payments. Klarna Pay Later in 30 days allows customers to complete a transaction and pay the total amount later, with no extra cost. Klarna Financing provides up to 36 months of credit for approved customers.

ChargeAfter

Multi-lender consumer financing

Offering the power of choice, ChargeAfter provides a single application for personalized point-of-sale financing, guaranteeing approval and acceptance rates for any consumer financing option. ChargeAfter’s multi-lender platform caters to all credit types and currencies and connects consumers with suitable lenders for all e-commerce and in-store financing needs.

Consumer finance, not only BNPL

Unlike other platforms, ChargeAfter allows for various types of consumer finance:

- Straight Revolve: A type of credit that a borrower can continue to draw from and repay.

source: wallstreetprep.com

- Deferred Interest (6/12/18/24 Months): The interest is deferred during the promotional period. To avoid paying finance charges, the entire balance must be paid off, in full, at the end of the promotional period.

- Equal pay: Equal monthly payments are required during the promotional period. Interest does not accrue during the promotional period. This type of financing is designed to pay off promotional balance in full within the promotional period.

- Fixed pay: Fixed monthly payments are required during the promotional period. APR is assessed during the promotional period.

- B2B financing: B2B financing can take many forms, including trade credit that can help businesses manage their cash flow, invest in new equipment or technology, and fund growth initiatives. B2B financing can benefit both the lender and the borrower. It can help businesses maintain strong relationships with their suppliers and customers while accessing the capital they need to succeed.

- LTO: Lease-to-own (LTO) is a financing option to lease a product or equipment with the option to buy it at the end of the lease term. This financing option is also available for businesses or merchants.

- Private label credit cards: A retailer or brand issues private-label credit cards that can only be used to purchase at that specific retailer or brand. These credit cards may offer rewards, discounts, or other benefits to incentivize customers to use the card for purchases. Private-label credit cards can help retailers build brand loyalty and increase sales by providing customers with a convenient financing option and encouraging repeat purchases.

Supports all platforms

Easily integrate point-of-sale financing options on your Magento, Shopify, WooCommerce, BigCommerce, hybris, custom platforms, and more with simple-to-connect extensions or basic JavaScript code.

Providing POS checkout financing for your website or physical store has always been more complex.

Credit spectrum

Credit spectrum refers to the consumer’s creditworthiness range, from those with excellent credit to those with poor credit. Lenders use credit scores and credit reports to determine a consumer’s creditworthiness, and this information is used to determine the interest rate and terms of a loan. The credit spectrum typically includes different categories, such as prime, near-prime, subprime, and deep subprime, each reflecting a different level of creditworthiness.

Post-Sale management

ChargeAfter offers all-around performance and transaction reporting through an intuitive dashboard. Access your transaction history, monitor live trades, and effortlessly handle settlements, up-selling, refunds, and partial credits with just a click of a button.

White-label consumer finance platforms

As a large retailer or established brand, ChargeAfter is dedicated to promoting your brand rather than ours. Tailor the entire point-of-sale checkout financing experience to align with your brand identity and provide customized Point of Sale finance offers that your customers will easily recognize.

Support

ChargeAfter prioritizes the success of our merchants by offering 24/7 support and assistance. Whether you require aid with processing financing settlements, custom reporting, or developing creative for your next buy now pay later financing campaign, we’re here to assist you in achieving your goals.

About ChargeAfter

ChargeAfter’s headquarters is in New York. The company’s investors comprise prominent entities such as The Phoenix, Citi Ventures, Banco Bradesco, VISA, MUFG, BBVA, Synchrony Financial, PICO Venture Partners, Propel Venture Partners, Plug and Play VC.

For more information & or to Schedule a Demo, visit- https://chargeafter.com/contact-us/