ChargeAfter: Expanding globally with a scalable and reliable multi-regional architecture

Archives: News & Press

Exclusive research shows brick-and-mortar stores still key in shopping journey

Exclusive research shows brick-and-mortar stores still key in shopping journey.

Fortiva Retail Credit Expands partnership with ChargeAfter BNPL Consumer Financing Network

The market-leading Buy Now Pay Later (BNPL) consumer finance network ChargeAfter and Fortiva® Retail Credit, the leading technology-enabled consumer financing program, announced the expansion of their current relationship, which began in 2018. To give more customers the chance to be authorized for financing, the Fortiva Retail Credit can now be used across ChargeAfter’s complete network of merchants, channel platforms, and financial institutions.

How Does Fortiva Retail Credit Works?

Thanks to the Fortiva® Retail Credit program, the Bank of Missouri can offer a seamless transition from prime financing to a second-look program with affordable payment alternatives, which makes use of the flexible technology capabilities of Atlanticus Services Corporation. Both online and in-store, Fortiva Retail Credit can offer its customers the greatest retail finance options.

Fortiva Retail Credit is a great opportunity for consumers with low credit scores, if the clients are declined to get prime consumer financing option, they are automatically transferred to the Fortiva program where they have a higher chance to get the funds they need with a better payment plan.

Atlanticus’ technology platform allows more inclusive financing alternatives that help merchants to say “yes” more frequently to customers with not good enough credit by drawing on insights garnered from over 25 years of data collection and consumer behavior.

The United States, Puerto Rico, and the U.S. Virgin Islands are among the territories where the Fortiva® Retail Credit program is accessible. Subsidiaries of Atlanticus Holdings Corporation are in charge of running the Fortiva® Retail Credit program.

What is ChargeAfter

ChargeAfter is a leading platform and network for Buy Now Pay Later (BNPL) consumer financing that links merchants and lenders to provide customers with responsible, individualized financing choices. Up to 85% of applications are approved after ChargeAfter presents the most pertinent loan alternatives from various lenders to customers based on their credit types. ChargeAfter unifies the credit distribution process onto a single platform, which shops can quickly adopt both online and offline. ChargeAfter’s huge lender network guarantees any business to increase their sales and grow its customer base.

Expanding the Partnership

The market-leading BNPL network ChargeAfter links merchants and lenders to provide customers with individualized point-of-sale financing alternatives during checkout from a variety of lenders. By working together, Fortiva® Retail Credit and ChargeAfter will enable a simple, digital application process for financing and transaction funding, empowering both consumers and retailers.

Despite ChargeAfter’s constant efforts to provide shops with the finest options for their consumers, some buyers were still unable to use financing systems to obtain the funds they require. With the increased relationship with Fortiva, ChangeAfter may now provide its services to customers with a low credit score, since buyers who apply for consumer financing occasionally have a terrible credit history and are turned down for the funds they need. Fortiva Retail Credit and ChargeAfter will benefit customers and merchants through this relationship, enabling the quick and easy application for financing and transaction finance online. Any business using ChargeAfter as its financing platform will see their customer base grow as a result of this.

On the other side, Fortiva Retail Credit anticipates expanding its audience as well, given that ChargeAfter has opened up new opportunities for them. Customers all around the nation will be able to use Fortiva credit as a consumer financing option to buy the things they need and use BNPL to gradually pay back the purchase money.

“As the first credit program to integrate with ChargeAfter, we are excited to extend and expand our relationship,” said Dave Caruso, Chief Commercial Officer of Atlanticus Services Corporation.

Mark Denman, EVP of Merchant Sales & Success at ChargeAfter said: “As ChargeAfter continues to disrupt the BNPL space, Fortiva® Retail Credit’s premier services and offerings will continue to help set us apart from the competition. We look forward to our continued rapid expansion with the Fortiva program and appreciate the longstanding partnership we have with them.”

Due to the fact that ChargeAfter and Fortiva Retail Credit are extending their relationship, businesses will now be able to offer their clients more comfortable retail finance options. On the other side, clients will have more opportunities to finance their demands through BNPL and consumer financing.

Want to learn more? Reach out to us here.

Buy now/pay later matchmaker raises $44 million

Buy now/pay later matchmaker raises $44 million.

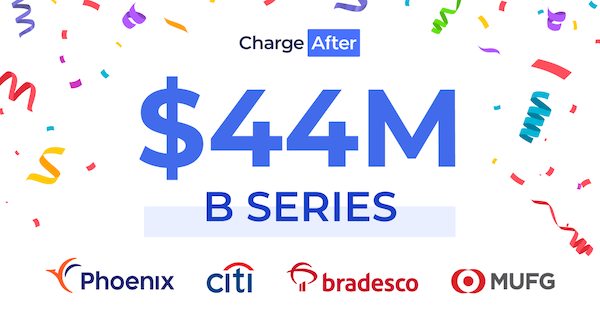

ChargeAfter Raises $44M in Series B From World’s Leading Banks to Scale Global BNPL Financing Network

Funding will expedite the onboarding of thousands of additional retailers to provide responsible financing to millions of shoppers worldwide – anywhere they shop

New York, NY, March 22, 2022 – ChargeAfter, the market-leading Buy Now Pay Later (BNPL) consumer financing network that provides shoppers with responsible, approved financing offers from multiple lenders with a single application, and bespoke white-labeled BNPL platform services for global banks and financial institutions has announced the completion of their $44M Series B. The round was led by The Phoenix, with participation from global banking giants Citi Ventures (Citigroup), Banco Bradesco, MUFG (Mitsubishi UFJ Financial Group), and existing investors. ChargeAfter’s new funding follows a strategic investment and partnership with Visa bringing the company’s total amount raised to $60 million.

“While BNPL has exploded in popularity in recent years, the marketplace often gives consumers limited options and up to a 70 percent decline rate,” said Meidad Sharon, CEO, and founder of ChargeAfter. “Investor interest in ChargeAfter is a testament to the growing need for a network-driven financing platform made for merchants, banks, and financial institutions, as the industry rapidly shifts from a single lender, low-approval reality to a multi-lender experience where responsible lending and approvals rates upwards of 85% or more are the new norm,”

With dozens of pre-integrated global financing lenders and banks already on the platform, ChargeAfter offers shoppers approved and personalized consumer financing from multiple lenders through a single, quick application, wherever they shop. With the distribution of credit streamlined into a single platform, retailers can easily implement ChargeAfter’s BNPL offering both online and in-store. Plus the company’s growing lender network offers seamless integration to lenders seeking to grow their customer base while expanding into new retail markets.

ChargeAfter also provides global banks, acquirers, financial institutions, and strategic partners with a fully branded white label BNPL platform. The network provides retailers and businesses access to leading financing partners across the full-credit spectrum with BNPL products such as card-based installments, split pay, long and short-term installments, 0% APR financing, revolving credit, B2B financing, lease to own, and more, in a single integration.

“The investment will enable us to accelerate growth and further diversify our global lender and merchant networks while scaling strategic partnerships by providing leading banks, lenders, financial institutions, and industry partners a turnkey white label BNPL platform of their own.” continued Mr. Sharon. “Our ongoing investment in the platform will expedite the onboarding of thousands of additional retailers to provide responsible financing to millions of shoppers worldwide – anywhere they shop.”

“As consumer interest in BNPL accelerates, it is critical for merchants, banks, and financial institutions to offer tailored solutions that meet their customer’s evolving needs. ChargeAfter’s white-labeled, multi-lender platform represents the next generation in consumer lending and enables any business to seamlessly embed diverse credit solutions in their product offering. We are excited to partner with ChargeAfter as they execute on their vision to unify this massive but fragmented space,” said Boaz Morris, Investment Manager, VC at The Phoenix.

“Given the growing usage and popularity of Buy Now Pay Later solutions, a multi-lender platform that provides more flexibility at checkout is imperative for ensuring clients have choices when completing purchases. This requires nimble and innovative consumer shopping experiences. We are thrilled Citi Ventures has invested in ChargeAfter, a Citi accelerator graduate,” said Carol Grunberg, Global Head of Strategic Partnerships and Innovation at Citi’s Treasury and Trade Solutions.

“For nearly 30 years, the Boleto has been the dominant form of BNPL or consumer credit in Brazil. Our investment in ChargeAfter stems from our need as the leading bank in Brazil to redefine local BNPL and consumer financing and stand behind payment innovation for merchants and lending technologies for banks and financial institutions,” said Rafael Padilha, Director of Bradesco PE & VC, Bradesco.

About ChargeAfter

ChargeAfter is the leading multi-lender buy now pay later consumer financing platform and network connecting retailers and lenders to offer shoppers responsible, personalized financing options.

Powered by a data-driven decisioning engine and network of global lenders, ChargeAfter delivers the most relevant financing offers to consumers from multiple lenders based on credit type – resulting in approvals for up to 85% of applications. ChargeAfter streamlines the distribution of credit into a single platform that retailers can implement rapidly both online and in-store. The company’s growing lender network offers seamless integration to lenders seeking to grow their customer base while expanding into new retail markets.

ChargeAfter investors include PICO Venture Partners, Propel Venture Partners, The Phoenix, Citi Ventures, Banco Bradesco, Visa, MUFG, BBVA, Synchrony Financial, and Plug and Play VC. Headquartered in New York, ChargeAfter has offices in New York, California, and Tel Aviv.

For more information, visit https://chargeafter.com/about-us/

Want to learn more? Reach out to us here.

Banks invest in multi-lender BNPL platform ChargeAfter

Banks invest in multi-lender BNPL platform ChargeAfter.

BNPL platform ChargeAfter raises $44m Series B

BNPL platform ChargeAfter raises $44m Series B.

BNPL Startup ChargeAfter Raises $44M Series B for Expansion

BNPL Startup ChargeAfter Raises $44M Series B for Expansion.