Why Multi-Lender Platforms Are the Future of Home Improvement Financing

Your financing strategy is a critical differentiator. This article explores how multi-lender platforms are fundamentally changing the home improvement industry by giving contractors a powerful tool to close sales and boost revenue.

Why Financing Is Essential in Today’s Home Improvement Market

Home improvement contractors face a critical challenge when interest rates are high and budgets are tight: how to help homeowners move forward with big-ticket projects. For many contractors, this challenge boils down to the moment they leave a consultation without a signed contract, knowing that the likelihood of closing the job has most likely passed. A successful in-home visit now involves finding a way to overcome the client’s biggest hesitation right at the kitchen table, namely how to fund their project.

This is where a powerful home improvement financing strategy becomes your most valuable tool. This article will explore how building the right home improvement financing offer can transform your business. It will also discuss the different home improvement finance partners that can help you achieve such success, empowering you to close more deals, increase ticket sizes, and build brand loyalty.

What You Will Learn

- Why financing is an essential tool for home improvement contractors in today’s market.

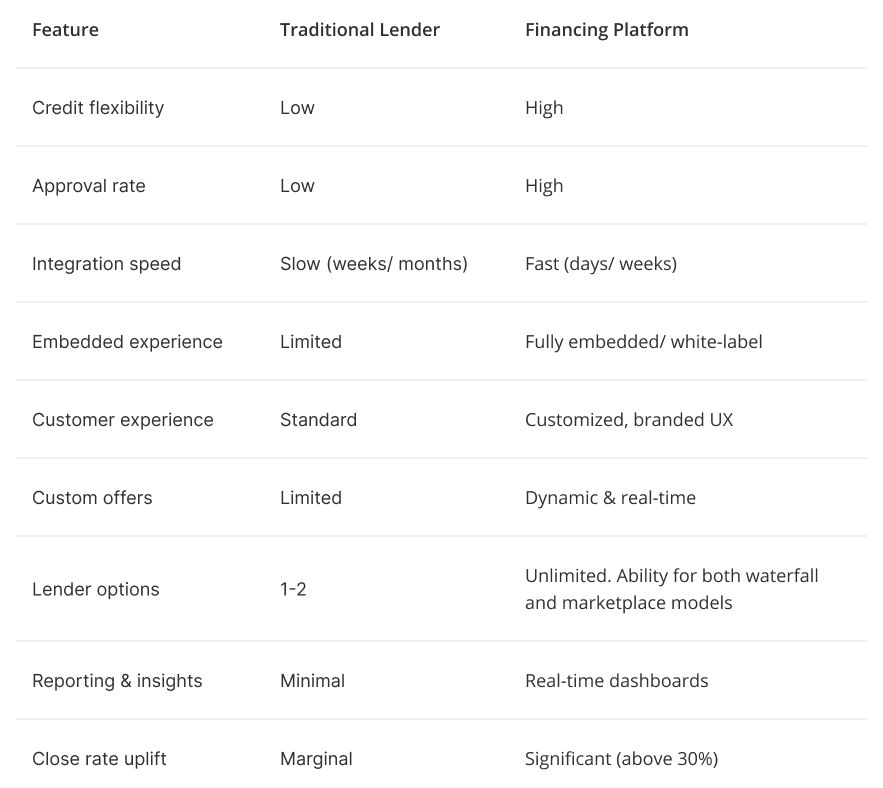

- The key differences between traditional lenders and multi-lender financing platforms.

- How choosing the right financing partner can directly increase your close rates and average project size.

- Why multi-lender platforms are the future of home improvement financing.

What Is a Home Improvement Finance Partner?

A home improvement finance partner is a company that enables contractors to provide their customers with financing during the consultation process. This is often an alternative to a homeowner applying for a loan from a bank or other lender independently. There are two primary types of home improvement financing partners: traditional lenders and financing platforms.

Traditional lenders

Lenders play a significant and established role in the home improvement industry. There are two types of lenders, direct and indirect. Direct lenders include banks and other financial institutions. Indirect lenders are finance technology providers that link with banks, credit unions and other institutions to provide loans.

Both specialize in offering a variety of loan products, such as flexible installment plans, lines of credit, and deferred interest options. By partnering with these lenders, contractors are able to provide their customers with the financing needed to move forward with projects.

Multi-Lender Financing Platforms – The Focused Approach

A financing platform is a single technological solution that connects contractors to a network of specialized lenders. Instead of juggling separate relationships, applications, and integrations for each lender, a platform allows a contractor to access diverse loan products and support a broad range of credit requirements through one streamlined system. This approach provides greater flexibility and a higher chance of approval by automatically matching customers with the best options for their financial profile.

Home Improvement Lenders: Pros & Cons

Lenders play an essential role in enabling financing for contractors by offering reliable, specialized loan products. These partners provide access to a wide range of financing options, and usually serve a particular credit profile, prime or non-prime. They are dependable partners, ensuring that contractors can offer financing solutions to their customers with confidence.

Pros

- Brand recognition: Partnering with a well-known financial institution can instill trust in homeowners, who are already familiar with the brand.

- Attractive terms: The ability to access large loan amounts, sometimes up to $100,000, and terms extending up to 20 years, makes them an attractive option to fund large projects.

- Specialization: many home improvement lenders have deep expertise in a specific niche, such as financing for solar panel installations, HVAC systems, or large-scale renovations. This specialization can lead to a more tailored and efficient process, as they are often very familiar with the unique needs and underwriting requirements of a particular industry segment.

Cons

- Limited credit spectrum: Strict lending criteria can result in lower approval rates, potentially denying financing to a significant number of customers. Since applications are submitted directly to a single lender, if a customer is denied, the contractor must then guide them through another application process with a new lender which can be a frustrating experience for both the contractor and their client.

- Slower & more rigid integration: The technology and integration processes can be less flexible and slower to implement.

- Less flexibility: With a single-lender relationship, you have limited flexibility to offer personalized or custom financing options beyond their specific product suite.

Multi-Lender Financing Platforms

Financing platforms address the complexities of managing multiple lender relationships by integrating them into a single, unified solution. By streamlining the financing process, platforms simplify access to a diverse range of financing options and offer greater flexibility for both businesses and homeowners. They help contractors enhance customer satisfaction by providing a more personalized financing journey and reducing the friction that comes with juggling separate lender systems. This approach allows contractors to focus on their core business while offering a seamless and modern financing experience.

Pros

- Higher approval rates: A platform’s greatest strength is its ability to route a single application to a network of different lenders. This dramatically increases the chances of a customer getting approved, as the system can automatically find a match across a much broader credit spectrum, from prime to near-prime and even subprime.

- Faster time-to-market: Unlike the time-consuming process of integrating with each individual lender, a platform is designed for fast, turnkey implementation. With API-based or out-of-the-box solutions, contractors can start offering a full suite of financing options almost immediately.

- Embedded & seamless experience: Platforms provide a cohesive, embedded financing experience that integrates directly into your existing sales process, whether it’s on a tablet in a customer’s home or on their personal device. This eliminates the need for separate applications and ensures a professional, streamlined checkout process.

- Ability to serve more customer profiles: By accessing a multi-lender network, you are no longer limited by one lender’s criteria. This allows you to offer an option to almost every customer, regardless of their credit history, which is critical for capturing a larger share of the market.

Cons

- Requires vetting: With a growing number of financing platforms on the market, it’s crucial to properly vet a potential partner. You must ensure they have a robust and diverse lender network, a proven track record, and robust post-sales management and reporting capabilities to avoid issues down the line.

- Lack of specialization: Not all platforms are designed for the unique needs of the home improvement industry. Many are general-purpose solutions that lack key features such as in-home mobile applications, the ability to manage staged funding for multi-phase projects, or access to specialized loans.

How the Right Financing Partner Impacts Close Rates & Revenue

Choosing the right home improvement finance partner can be a direct lever for revenue growth. The key lies in creating a seamless customer experience that removes financial barriers at the precise moment of decision. For contractors, this means having the right tools at your fingertips during an in-home consultation. Offering instant loan offers that are embedded into your sales process can significantly accelerate the decision-making process.

This approach delivers tangible results. Data shows that contractors who proactively offer financing at the point of sale often see a 20-30% increase in their close rates. Furthermore, a financing partner can directly boost your revenue by increasing the average project size. When a homeowner sees their project’s total cost broken down into an affordable monthly payment, they are more likely to say “yes” to premium materials, additional upgrades, or an even bigger project than they initially planned. In fact, many businesses report seeing a 30-50% increase in their average job size after implementing an effective financing strategy.

Why ChargeAfter Is the Ideal Home Improvement Finance Partner

The right technology partner can be the key to unlocking your revenue strategy, and ChargeAfter is built to meet the unique needs of the home improvement industry. As the leading multi-lender financing platform, one of ChargeAfter’s core strengths is its ability to access a broad network of lenders through a single, seamless application. This approach directly tackles the approval rate challenge, with one leading home improvement provider reporting a 33% increase in financing approvals after switching to the platform.

ChargeAfter’s technology is designed for the modern contractor’s workflow. It offers an embedded, brandable user experience across all sales channels, from a website to a tablet at a customer’s kitchen table, which helps to reduce abandonment and create a frictionless checkout. With fast onboarding, you can go live and start closing more sales in a matter of weeks. The platform also provides real-time analytics, empowering you with data to optimize your offers, while handling all compliance and post-sale management in one unified dashboard. By helping you deliver a personalized financing experience, ChargeAfter not only increases your approval rates but also drives a significant uplift in average ticket size and customer satisfaction.

Final Thoughts: How to Choose a Partner for Growth

If you’re looking for a financing strategy that can make a positive impact on your business, the choice is clear: financing platforms outperform traditional single-lender relationships.

For home improvement contractors focused on flexibility, speed, and high conversion rates, this technology is a must-have tool. ChargeAfter combines the best of advanced technology with an expansive lender network, offering a single, powerful solution that is purpose-built for the demands of today’s home improvement finance partners.

Key Takeaways

- Financing is a critical tool for conversion. Offering a seamless multi-lender financing experience within the consultation process is the most effective way to convert customers and reduce the number of lost opportunities.

- Relying on a single lender can limit your close rates due to ,multiple integrations and relationships, strict credit criteria, and a cumbersome application process.

- Multi-lender platforms are the solution. A financing platform streamlines the process, connects you to a network of diverse lenders, and empowers you to offer financing choices to more customers than ever before.

- ChargeAfter combines the best of technology and lender reach. By offering a unified, embedded solution with a broad lender network, ChargeAfter provides the speed, flexibility, and high approval rates needed to transform your sales process and grow your business.

Watch Andrea McCullion, Chief Business Development Officer at Foundation Finance, talk with us about financing in the home improvement industry.

FAQs

Financing platforms enable merchants to connect customers to a network of multiple lenders in a single application. A customer declined by the prime lender will be automatically directed to the near-prime, and subprimeproviders. This maximizes approval rates.

Embedded financing allows you to offer loan options seamlessly within your existing sales process. This frictionless experience removes a key point of hesitation for customers, which can significantly increase close rates and prevent a potential sale from being lost.

Managing customer financing can be a complex and manual process involving multiple lender relationships, disjointed data, and inefficient workflows. A financing platform centralizes this entire operation, drastically reducing the administrative burden.

Instead of managing individual integrations, applications, and reporting for each lender, merchants rely on a single, unified solution. The platform automates the entire application process, from credit checks and approvals to the seamless transfer of customer data and final payment processing.

Furthermore, the platform provides a single dashboard for real-time analytics and reporting. This eliminates the need to manually compile data from various sources to track performance, sales trends, and financing activity. By automating these tasks, the enterprise can reallocate valuable human resources from administrative work to strategic, growth-focused initiatives.

ChargeAfter is a leader in the space because it combines a broad network of lenders with a purpose-built, embedded technology platform. This unique combination helps contractors achieve higher approval rates and average ticket sizes, all through a single, easy-to-use solution designed for the specific needs of the home improvement industry.