With ChargeAfter, we have the peace of mind that our point-of-sale financing is powered by a proven platform and deep industry expertise, so we can focus on giving our customers a superb furniture buying experience.

Retail financing refers to various lending solutions offered to consumers at the point of sale, allowing them to purchase products or services without having to pay the full amount upfront. This type of financing often involves installment payments, lines of credit , lease-to-own, and more, and is designed to make purchasing more accessible by spreading the cost over time. Retail financing can increase sales for merchants by offering customers greater flexibility and purchasing power at their moment of need.

Request a demo

Appliance financing helps your customers purchase the appliances they want without the immediate financial burden by enabling consumers to spread cost over time. Deliver higher financing approval rates with our waterfall financing embedded lending platform. It’s the only tool merchants need to manage POS financing from application to post-sale management.

Say goodbye to painful integrations and declined financing

Sales are materially impacted when merchants fail to meet their customers’ financing needs. Indeed,most merchants believe that their sales have suffered due to a lack of available retail financing options for their customers.

Integrating retail financing solutions is complicated, requiring technical expertise and resources. The top challenges merchants face in managing lenders and retail financing funnels are technical and operational difficulties.

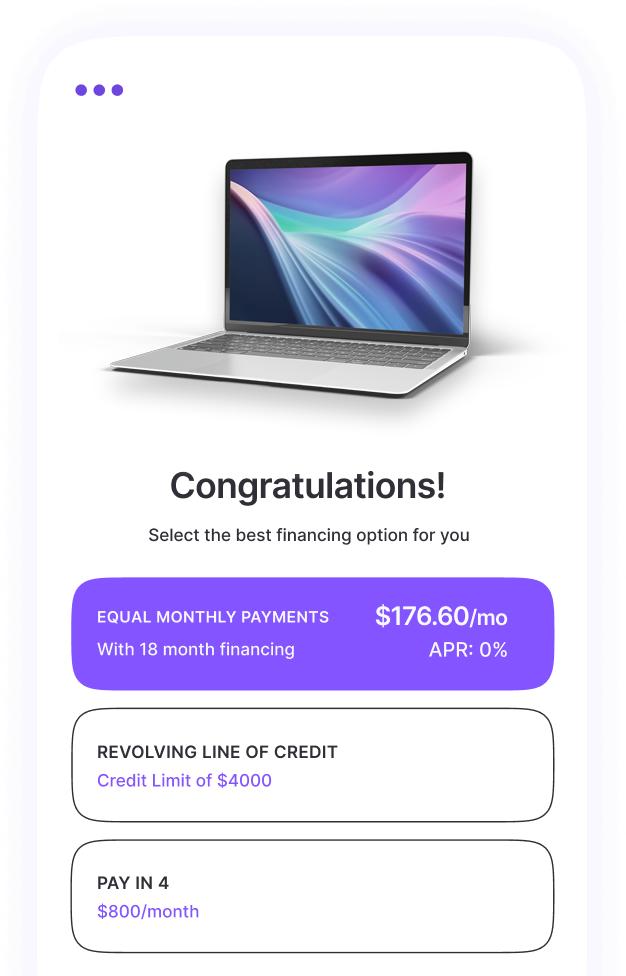

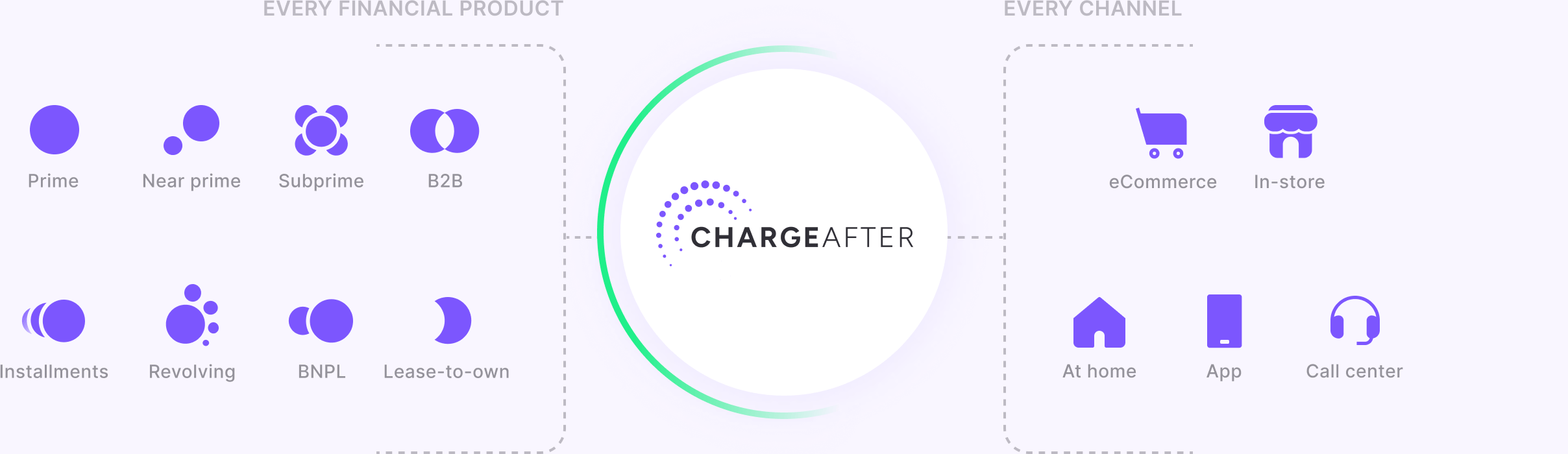

The best solution for retailers to easily implement, offer, and manage retail financing is through an embedded lending platform. ChargeAfter is the platform of choice for enterprise and mid-size merchants to manage their retail financing at omnichannel points of sale. It provides a fast and easy process for customers and supports post-sale management and data in a single platform. Additionally, its network of lenders provide diverse lending products, catering to the entire credit spectrum delivering customer choice and personalization.

People also ask:

Retail customer finance, also known as retail consumer financing, is the same as retail financing and is an essential tool for merchants to increase their customers’ purchasing power. Retail customer finance usually involves partnerships with third-party lenders and credit providers. This arrangement allows customers to pay for purchases over time rather than upfront.

If you would like to know how retail consumer financing can help your business, please contact us for a demo.

Effortlessly connect with lenders in multiple countries through our embedded lending network. Our platform makes it simple and straightforward to add, remove, and manage financial products.

Join merchants across the globe reporting approvals of over 80%.

We are fully secure and protected, giving you peace of mind.

Build your customer base with more approvals - they’ll remember you for it.

Optimize your financing

offers with powerful consumer

financing analytics.

Our embedded lending network accommodates any customer, regardless of their credit history or score.

Integrate any lender and consumer finance product into your embedded lending offer.