With ChargeAfter, we have the peace of mind that our point-of-sale financing is powered by a proven platform and deep industry expertise, so we can focus on giving our customers a superb furniture buying experience.

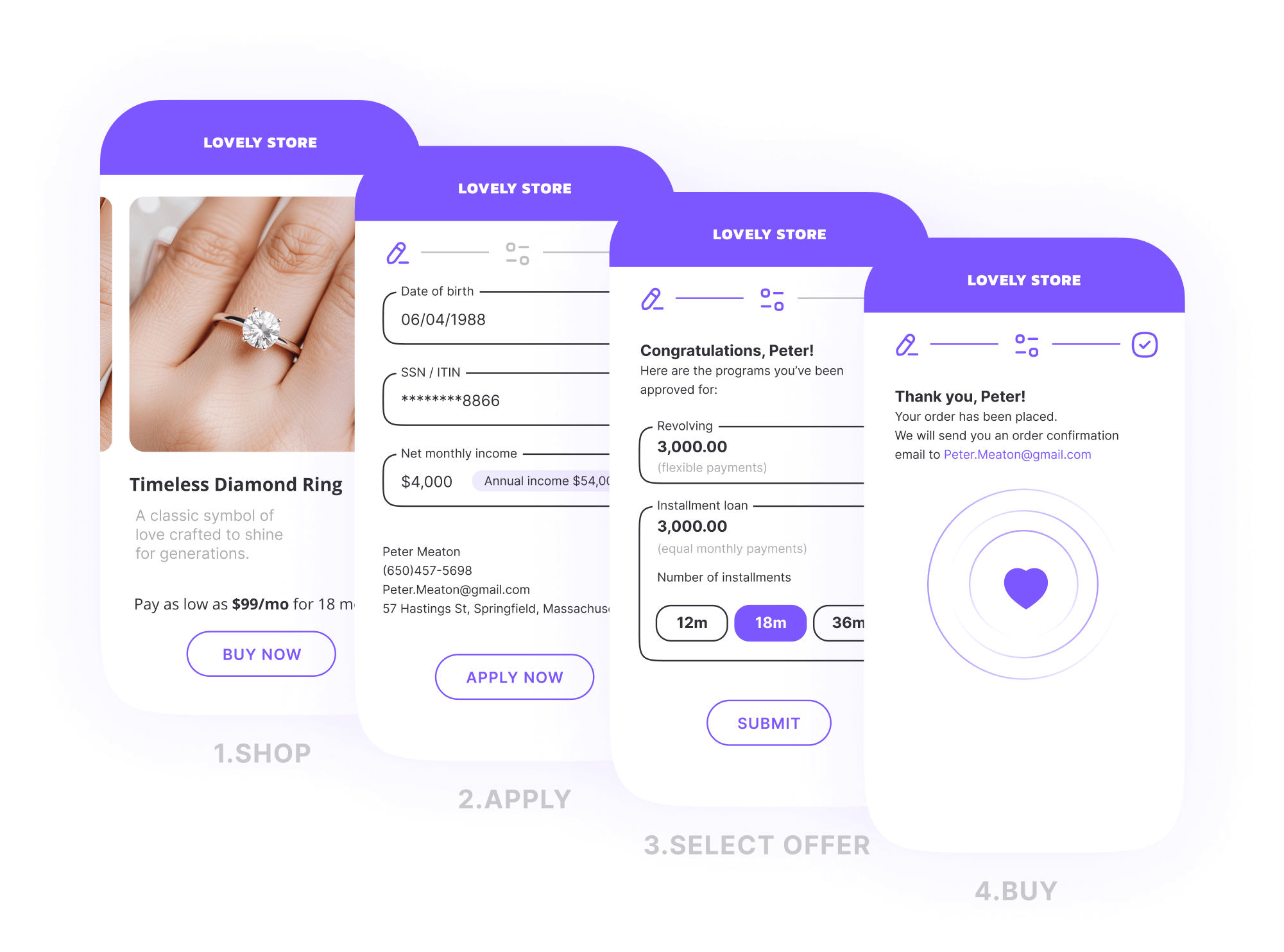

From engagement rings to high-end watches, luxury purchases deserve a financing experience that matches their significance. ChargeAfter’s embedded lending platform empowers jewelers and luxury retailers to offer instant, seamless financing at the point of sale—online or in-store. With access to multiple lenders through a single application, you can approve more customers, boost conversions, and keep your brand as polished as your products.

Say goodbye to painful integrations and declined financing

Luxury purchases often come with high expectations—and high price tags. Yet many jewelers and high-end retailers still rely on limited financing options that exclude customers across the credit spectrum. Without flexible solutions, prime buyers may walk away for better terms, and non-prime customers are left without options, leading to lost sales and missed loyalty opportunities

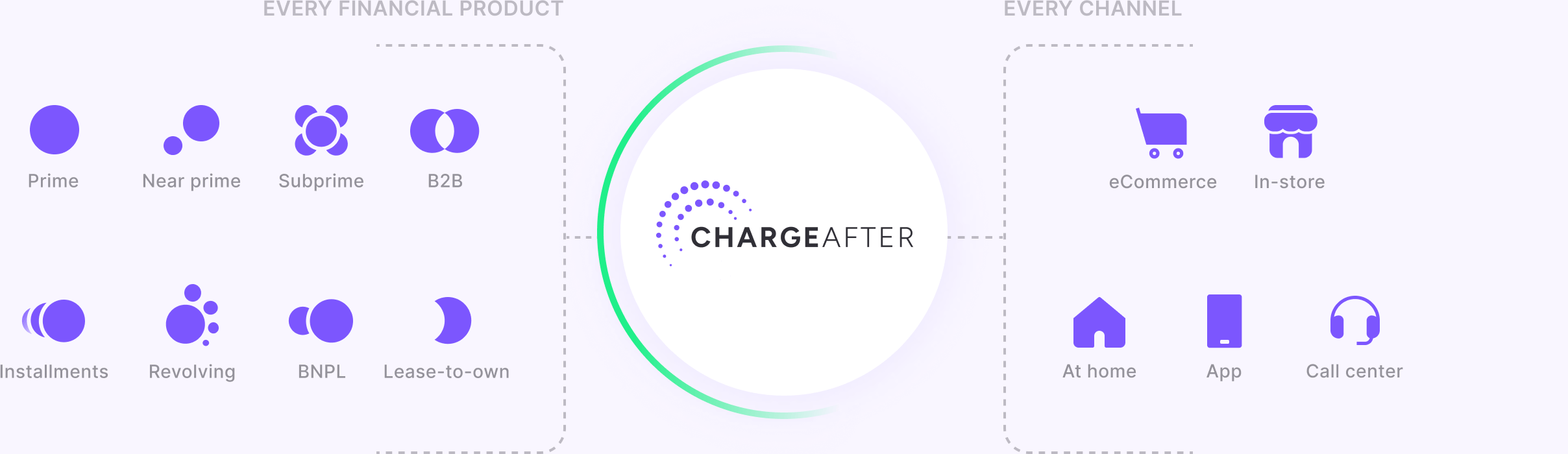

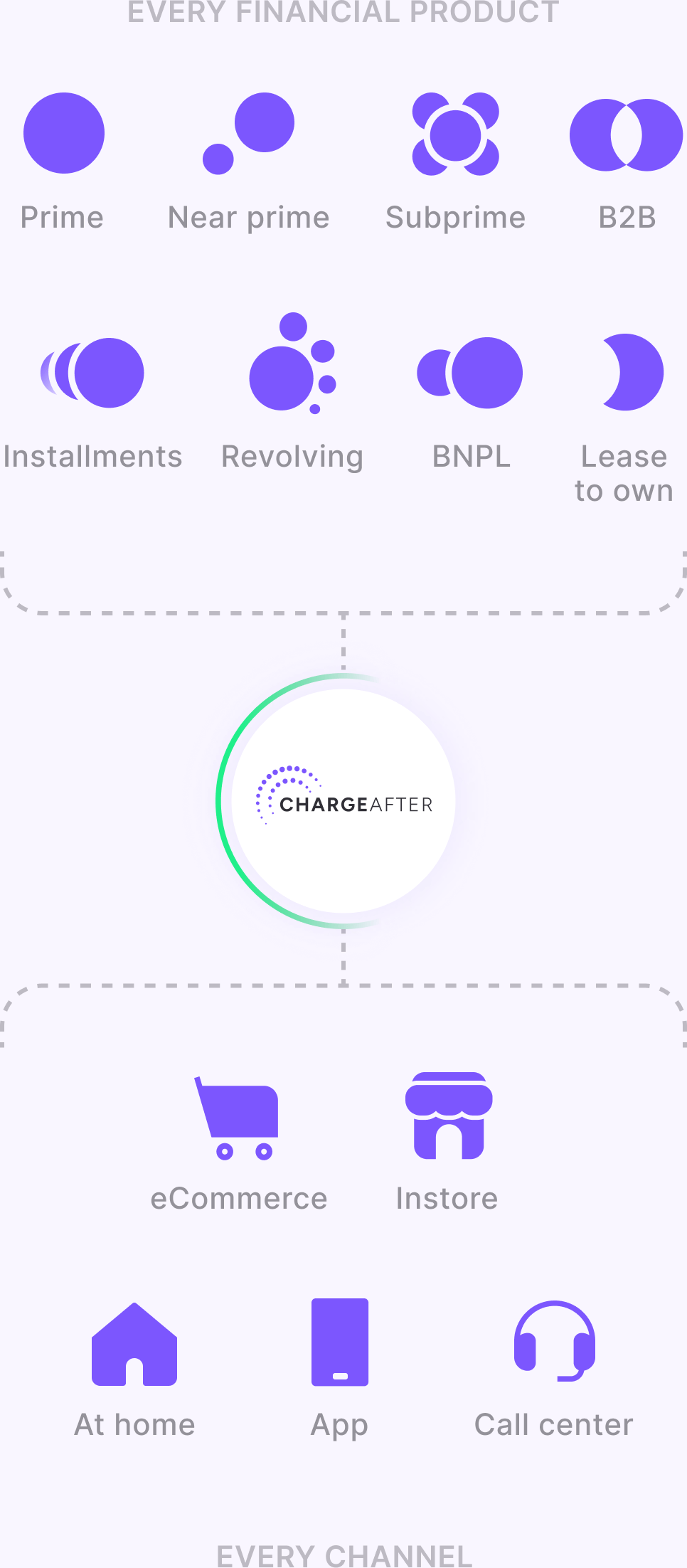

ChargeAfter’s embedded lending platform solves this with waterfall financing—one seamless application that connects customers to a network of lenders, from prime to lease-to-own. By offering inclusive, tailored financing at the point of sale, you can maximize approvals, increase conversions, and deliver an experience that reflects the quality of your brand.

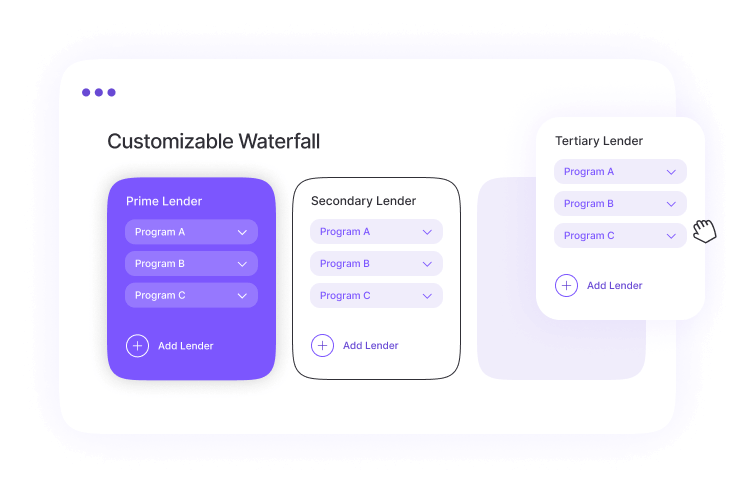

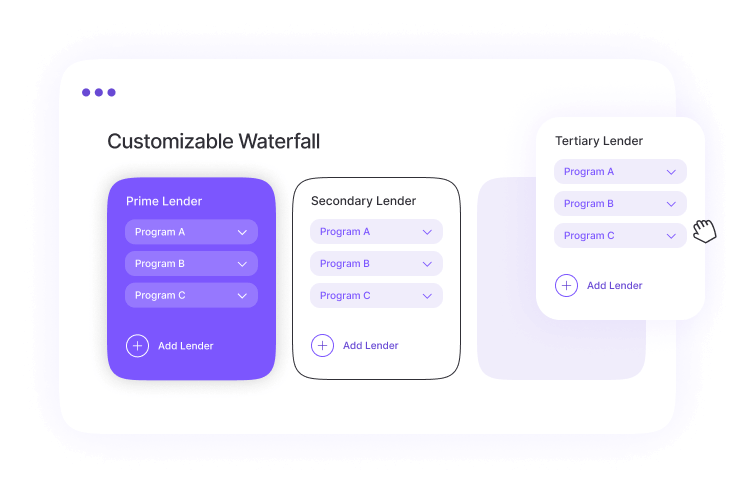

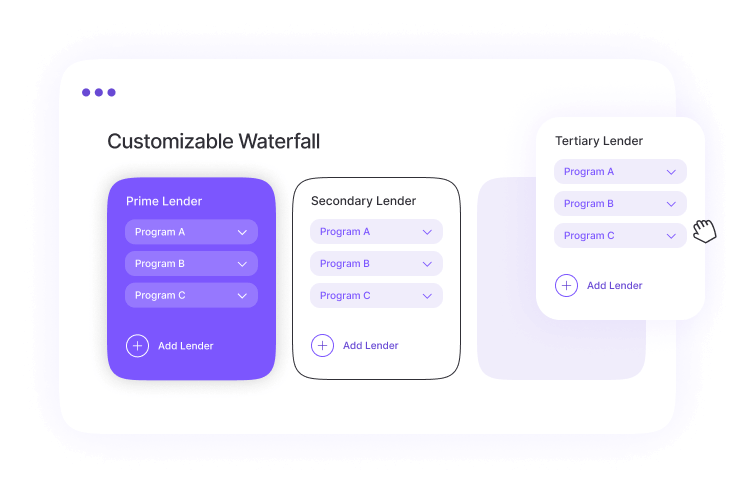

Business users can easily customize the platform to adapt for any needed changes. For example, they can switch lenders, update policies, and connect to new lending products, empowering them with greater flexibility and control.

Business users can easily customize the platform to adapt for any needed changes. For example, they can switch lenders, update policies, and connect to new lending products, empowering them with greater flexibility and control.

Business users can easily customize the platform to adapt for any needed changes. For example, they can switch lenders, update policies, and connect to new lending products, empowering them with greater flexibility and control.

Check out the financial partners driving more approvals at your point of sale

Join merchants across the globe reporting approvals of over 80%.

We are fully secure and protected, giving you peace of mind.

Build your customer base with more approvals - they’ll remember you for it.

Optimize your financing

offers with powerful consumer

financing analytics.

Our embedded lending network accommodates any customer, regardless of their credit history or score.

Integrate any lender and consumer finance product into your embedded lending offer.