In-store finance, often called point-of-sale financing, is pivotal in consumer purchasing. It gives customers the flexibility to buy products immediately and pay for them over time, using various payment plans tailored to their financial situations. This financing method has become increasingly popular among retailers looking to enhance customer satisfaction and drive sales. By offering direct credit options or partnering with financial institutions to provide loans or credit facilities, stores can cater to a broader audience, including those needing more immediate funds to make significant purchases.

The importance of in-store finance extends beyond just consumer convenience. For retailers, it’s a strategic tool that boosts customer loyalty and increases the average order value, encouraging larger purchases that might otherwise be unfeasible. Additionally, in-store finance programs can attract a more diverse clientele base, expanding market reach and improving overall business growth. Integrating these financial services at the retail point of sale reshapes how consumers interact with product financing and significantly impacts retail economics.

What is In-Store Finance?

In-store finance refers to the financial services retailers offer customers to facilitate on-the-spot purchases. These services typically include loans, credit facilities, and layaway plans that customers can apply for directly at the checkout counter or during shopping. This form of financing is designed to make shopping more accessible and convenient by allowing consumers to spread a product’s cost over time rather than paying the entire amount upfront.

Unlike traditional credit card purchases, in-store finance is often managed through third-party providers specializing in short-term retail loans. These agreements are tailored to consumers’ specific needs and retailers’ strategic goals. The primary appeal of in-store finance lies in its ability to remove financial barriers for consumers, enabling immediate acquisition of goods, which can be particularly advantageous for oversized, more expensive items. As such, it plays a critical role in consumer decision-making, offering a manageable way to afford new products without depleting personal savings or resorting to high-interest credit options.

Types of In-Store Finance Options

In-store financing is diverse, encompassing various models that cater to different customer needs and shopping scenarios. One of the most traditional forms is the layaway plan, where a customer reserves a product by paying a deposit and then completes the payment in installments over time. Once the total price has been paid, the customer can take possession of the item. This method is particularly beneficial during the holiday season or for buying high-demand products that may sell out quickly.

Another popular option is installment loans, where the total purchase cost is divided into several smaller, manageable payments, typically with interest charged on the remaining balance. This method is often facilitated by partnering with financial technology companies that can instantly approve and manage these loans, providing a seamless integration with the retailer’s checkout process.

Credit cards designed for store use are another common type of in-store finance. These cards often come with special incentives such as discounts, loyalty points, and promotional periods with zero interest. These benefits make them an attractive option for regular shoppers who frequent the store and can manage their credit effectively.

Each of these financing types has its own pros and cons. Layaway plans, for instance, can help with budget management but may involve cancellation or service fees if the purchase still needs to be completed. Installment loans can provide immediate possession of products but might carry higher interest rates compared to conventional loans, depending on the terms. Store cards offer rewards but can also tempt consumers to spend more than they might be able to afford.

Benefits of In-Store Finance for Shoppers

In-store finance offers significant advantages to consumers, primarily by enhancing their purchasing power. This type of financing is particularly appealing because it allows buyers to acquire goods immediately—whether electronics, furniture, or personal items—without the upfront financial burden. By breaking down a purchase into smaller, more manageable installments, consumers can better manage their budgets while enjoying the products they need or desire sooner rather than later.

Moreover, the convenience of in-store financing cannot be overstated. For many consumers, the ability to apply for and receive funding directly at the point of sale simplifies the buying process. Visiting a bank or filling out lengthy loan applications beforehand is unnecessary. This streamlined approach saves time and reduces the mental and logistical barriers to making significant purchases. Additionally, for consumers who are carefully managing their credit scores, many in-store financing options offer the chance to build or improve credit, provided payments are made promptly.

How Retailers Implement In-Store Finance

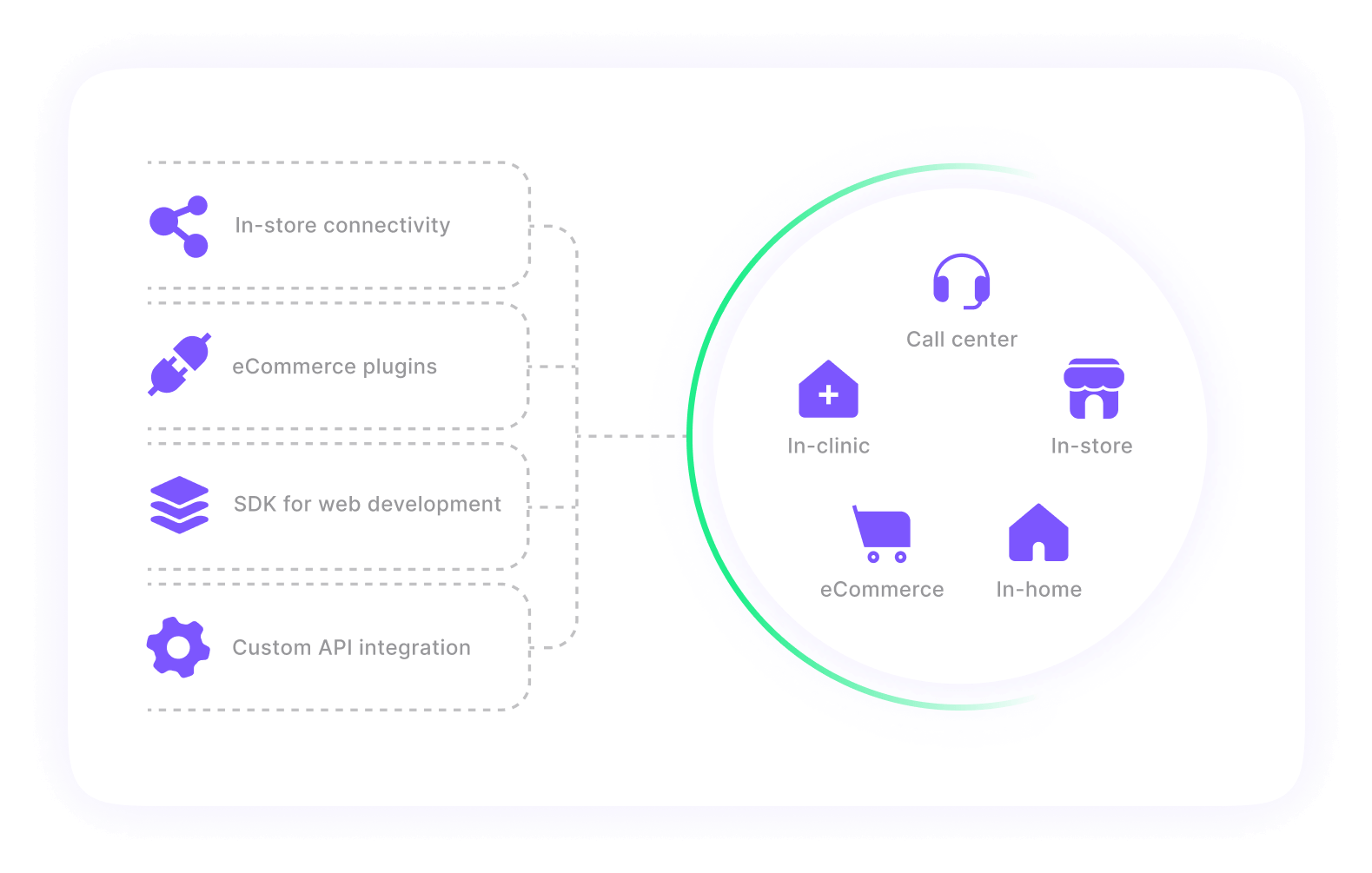

Implementing in-store finance requires careful planning and strategic partnerships from retailers. The first step typically involves choosing the right financial service providers. This selection can depend on various factors, including the ease of integration with existing point-of-sale systems, the provider’s economic stability, the cost to the retailer, and the terms and conditions offered to the consumers.

Once a partner is selected, the next crucial step is integrating these services into the retailer’s sales process. This integration often involves technical adjustments to accommodate new payment systems and staff training to ensure employees are well-versed in explaining and managing the finance options. Effective communication is critical, as staff must be able to convey the benefits and terms of financing clearly and accurately to customers.

Technology also plays a significant role in the deployment of in-store finance. Modern POS systems can seamlessly connect with financing applications, allowing for instant credit approvals and enabling customers to complete their transactions without delays. This integration must be secure to protect customer data and comply with financial regulations, requiring continuous updates and monitoring to safeguard against breaches.

In-Store Finance and Consumer Protection

As in-store finance grows in popularity, there is an increased need for regulation and consumer protection. Various laws and guidelines govern these practices to ensure the fair treatment of consumers. For instance, the Truth in Lending Act in the United States requires lenders to disclose credit terms clearly and understandably, allowing consumers to make informed decisions.

Consumers must remain vigilant about the terms of their financing agreements to avoid falling prey to predatory lending practices. Customers must understand the interest rates, potential fees (such as late fees, origination fees, or prepayment penalties), and the total cost of the item after all payments are made. Retailers and financial institutions offering these services must also uphold high ethical standards, ensuring they do not exploit consumer vulnerabilities but provide genuinely beneficial financial products.

Conclusion: The Role of In-Store Finance in Modern Retail

In-store finance is more than just a business tool; it transforms how consumers interact with retail environments and manage personal finances. By offering flexible payment options, retailers can increase sales and customer loyalty and contribute to broader economic access and equity. This model benefits consumers and retailers, creating opportunities for growth and innovation in retail practices.

For consumers, understanding the full scope of in-store finance—its benefits, risks, and how to navigate the offerings responsibly—is critical to making empowered purchasing decisions. For retailers, providing these services means embracing transparency, customer education, and strategic partnerships that enhance the shopping experience and foster long-term customer relationships.