Get Ready for Black Friday with POS financing

Black Friday is characterized by deeply discounted deals, early store openings, and unparalleled consumer enthusiasm, it’s been consistently marked as the busiest shopping day in America with merchants preparing for months in advance.

What is Black Friday?

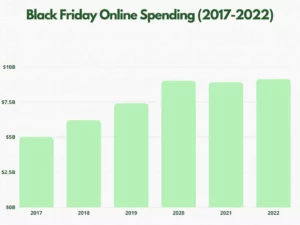

Black Friday, the day following the U.S. Thanksgiving holiday heralds the onset of the Christmas shopping season. This year it falls on Friday 24 November. In 2022 more money was spent than in the previous year with a rise in both instore and online sales.

In 2022:

- In-store sales in the US increased 12% YoY (Mastercard)

- Ecommerce sales in the US grew 14% YoY (Mastercard)

- Global online sales on Black Friday grew by 3.5 in 2022 to reach $65.3 billion (Salesforce)

- Payments made using BNPL increased by 78% (Amazon)

Why is Black Friday Important?

While the shopping spree typically extends to the subsequent “Cyber Monday” and spans an entire “Cyber Week” for many retailers, Black Friday remains emblematic. Beyond retail, this day offers an economic snapshot, a barometer for the nation’s financial health. Through the lens of Keynesian economics, which posits that consumer spending fuels economic activity, Black Friday’s sales figures can provide insights into the nation’s economic trajectory and consumer confidence.

Challenges Shoppers Face on Black Friday

Merchants meticulously prepare to cater to an influx of shoppers. This involves bolstering their eCommerce platform’s performance to prevent site slowdowns or crashes, diversifying payment options, especially with POS financing to enhance transaction success, and leveraging the efficacy of email marketing, which boasts a 4.1% conversion rate. Moreover, they strategize their discounts well in advance and prioritize a seamless online shopping and checkout experience to ensure customers enjoy an uninterrupted journey, optimizing both satisfaction and sales.

Synonymous with mega deals, Black Friday also comes with its own set of challenges for eager shoppers. One of the primary concerns is the potential for overspending. The alluring discounts and limited-time offers make deviating from a pre-decided budget easy. Shoppers might spend more than intended, especially if shopping with a credit card.

Another significant challenge is the chaotic in-store experience. Packed aisles, long queues, and overwhelming crowds can be a deterrent for many. In some cases, enthusiastic shoppers brave the cold and stand in queues for hours, only to discover that their desired product is out of stock or they get to the till only to be declined for financing.

Demand for consumer financing at the point of sale continues to rise, yet many retailers still struggle to seamlessly provide adequate financing options. Low approval rates and a subpar customer experience can result in cart abandonments, causing both frustration for the shopper and lost sales for the store.

Overcome POS Financing Challenges in Time for Black Friday

Point-of-sale financing has rapidly evolved, with consumer demands shifting and the economy showing stress. Black Friday, the shopping bonanza, is just around the corner, and merchants must be prepared to face the challenges this presents, especially with their point-of-sale financing offers. A recent survey from ChargeAfter, the embedded lending platform for point-of-sale financing, highlights the challenges that merchants face with their POS financing, including low approval rates, difficulties integrating multiple lenders, challenges with post-sale management and more.

Consumer financing is increasingly playing a strategic role for merchants as consumer demand grows. This makes perfect sense in a tumultuous economy with high inflation and soaring interest rates. For consumers, the assurance of personalized financing choices that can include spread-out payments with little to no interest, or access to other lending options such as lease-to-own, revolving credit and so on can be a beacon of hope, enabling them to commit to bigger purchases they otherwise might have foregone.

It is no longer possible for merchants to manage a robust financing offer. To provide customers with an omnichannel waterfall financing experience, they need a technology provider.

How Jerome’s Furniture Tamed Their POS Financing Challenges

Merchants who’ve recognized and adapted a platform-first approach to this trend are reaping considerable benefits. According to a case study of Jerome’s Furniture experienced a substantial uptick in sales – up a staggering 67%. These figures become even more compelling when you factor in the economic decline.

By weaving consumer financing seamlessly into their business model, Jerome’s Furniture underscored their commitment to customer empowerment and saw a surge in customer financing adoption. This indicates a vast segment of their clientele is now leveraging the store’s flexible payment options. The most commendable aspect? Despite the market turbulence in 2022 and 2023, Jerome’s Furniture maintained high approval rates, thus ensuring that customers had undeterred access to a more manageable and less burdensome financial framework.

So, as Black Friday looms, merchants have a clear strategy laid out for them: embed multiple lenders into the point of sale through an embedded lending platform. Not only does it promise to increase sales, but it also fosters brand loyalty and trust. In these unpredictable times, providing customers with financial ease can set a brand apart, making it a beacon for those looking to make the most of their Black Friday shopping.

Ready to upgrade your financing for Black Friday? Request a demo.