The Practical Guide to Home Improvement Financing

For contractors and home improvement providers, offering seamless

financing is crucial to closing sales. However, traditional financing

processes are often fragmented and complex, leaving customers

unsure of their options and adding pressure on contractors.

Find out how a leading home improvement company transformed its

in-home financing with ChargeAfter, making it faster, frictionless,

and easier for both contractors and customers.

-

Faster, frictionless financing

-

33% increase in financing approvals

-

Higher sales conversion

In-Home Financing Challenges

-

Fragmented Experience

-

Awkward Interactions

-

Lost Sales Opportunities

With home improvement projects averaging around $30,000, and

most customers lacking immediate access to funds, financing plays

a crucial role in closing sales.

Existing financing processes are often difficult to manage.

Contractors struggle to direct customers to relevant lenders and

guide them through confusing application processes.

Unfortunately, this can result in a frustrating experience, which is

especially awkward when sitting at the customerʼs kitchen table, and

ultimately leads to lost sales.

-

Single application

-

Instant access to financing options

-

Post-sale management & analytics

Client Requirements

The clientʼs financing process was disjointed, with contractors navigating multiple lenders, each with its own process and service category limitations. They needed a streamlined, intuitive solution to simplify financing and maximize its impact on sales with the following requirements.

Simple & secure process

An easy financing process for contractors and customers that allows customers to apply securely from their own device.

Network of lenders

Seamless access to multiple lenders to cover all home improvement categories and serve all credit profiles.

Fast & flexible

Customers need instant access to financing choices, and contractors require real-time approval updates.

White-label

A fully branded and integrated experience that integrates into the client’s existing technology and workflow.

A strategic partnership

The client sought more than just a technology provider, they required a trusted partner capable of meeting multiple demands.

The Solution ChargeAfter's Embedded Lending Platform

By integrating ChargeAfterʼs multi-lender financing platform, the client transformed its financing offer into a fast, flexible, and frictionless experience with higher approval rates.

In-home integration

ChargeAfterʼs API integration seamlessly embedded financing into the clientʼs platform, simplifying operations for contractors across all service visits and projects.

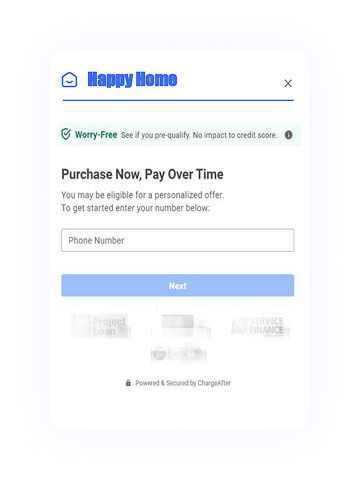

With a single click, contractors generate a financing link and send it directly to customers via QR code, email or SMS—offering a secure, hassle-free application process.

Simple customer application

The customer clicks a white-labeled link that matches the clientʼs branding. They then enter their phone number and basic personal information to pre-qualify for financing without impacting their credit score.

Personalized financing choices

The platformʼs technology enables real-time waterfall financing—first assessing customers for a prime loan, then seamlessly connecting those who donʼt qualify to near-prime lenders and beyond.

Additionally, the platform supports a lender marketplace, allowing customers to choose the offer that best suits their credit profile and

preferences.

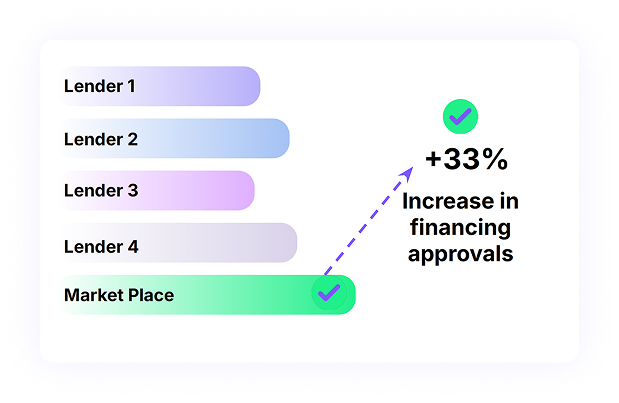

Offering multiple primelenders through a marketplace boosted approval rates by 33%.

Financing management & analytics

When the job is complete, contractors easily trigger fund disbursement, ensuring a smooth and secure transaction.

Beyond payments, the platform streamlines post-sale management, handling disputes, reconciliations, and lender communications—all within a single interface.

Additionally, real-time data insights help optimize financing programs and drive strategic business growth. Financing management & analytics

Promotion management

ChargeAfter enables companies to customize promotions by

program, category, or contractor, making it easy to deploy offers, including monthly promotions, to drive higher engagement and conversions.

The platform delivers powerful analytics to answer all your financing questions including which contractor, plan, or category is driving the most sales.

Embedded Lending Network

ChargeAfter partners with top lenders to provide a flexible financing network that meets diverse customer needs, offering personalization, choice, and greater control.

Installments

Revolving

Lease-to-Own

B2B

The Magic of the Marketplace

ChargeAfterʼs lending marketplace connects customers with

multiple lenders that serve their credit profile, empowering them

with choices. This customer-first approach improves both the

user experience and approval rates.

By adopting this model, the company increased approval rates

by 33%, enabling more customers to secure financing for their

home improvement projects.

The Outcome

An Exceptional Customer Experience with High Approval Rates

-

Single application

-

Instant access to financing options

-

Post-sale management

ChargeAfter's embedded lending platform has transformed this leading

home improvement companyʼs financing offer.

Contractors now easily provide customers with instant access to

financing options straight to the customerʼs personal device. In a single

application customers are connected to multiple lenders that cover the

credit spectrum.

The platformʼs ease of use for customers and contractors has

significantly improved KPIs including higher completion rates for

applications and increased approval rates.

Unlock the Future of Home Improvement Financing

Weʼd love to show you how ChargeAfterʼs embedded lending platform can help you transform your financing into a seamless, flexible, and frictionless experience that empowers contractors, improves customer satisfaction, and increases approval rates.