With ChargeAfter, we have the peace of mind that our point-of-sale financing is powered by a proven platform and deep industry expertise, so we can focus on giving our customers a superb furniture buying experience.

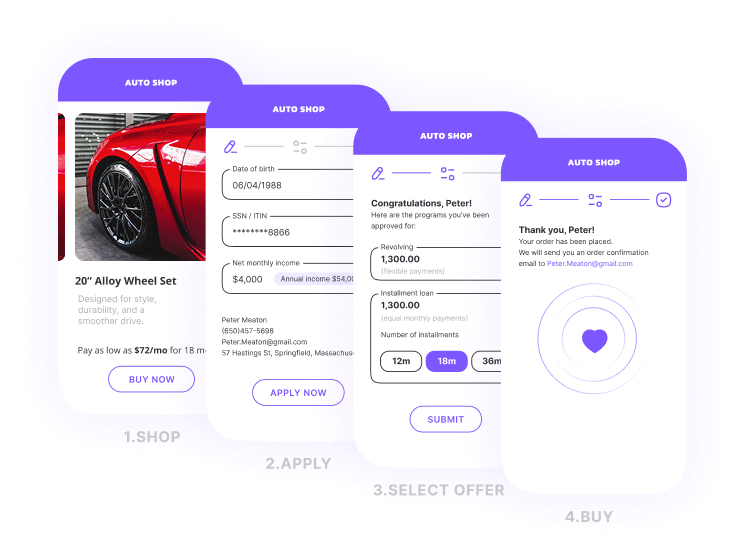

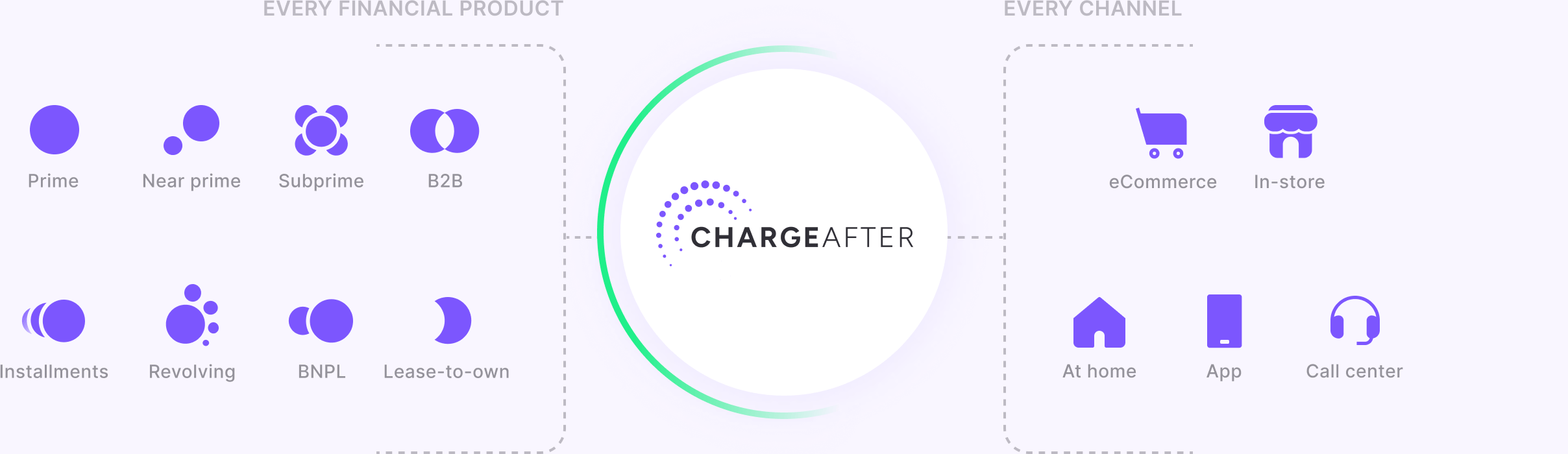

ChargeAfter empowers you to offer seamless consumer financing across all channels — online, in-store, or at the service center. With a single integration, you can provide financing options like 0% APR, installment loans, BNPL, and lease-to-own. Our multi-lender platform helps boost approval rates, increase average order value, and gives you real-time data and post-sale tools for reconciliation and performance tracking.

Say goodbye to painful integrations and declined financing

Traditional consumer financing models, especially those relying on single lenders often lead to high decline rates, frustrated customers, and lost sales. For aftermarket car part retailers, this means missed opportunities both online and in-store, and added complexity in managing financing programs that don’t serve the full credit spectrum.

Traditional consumer financing models, especially those relying on single lenders often lead to high decline rates, frustrated customers, and lost sales. For aftermarket car part retailers, this means missed opportunities both online and in-store, and added complexity in managing financing programs that don’t serve the full credit spectrum.

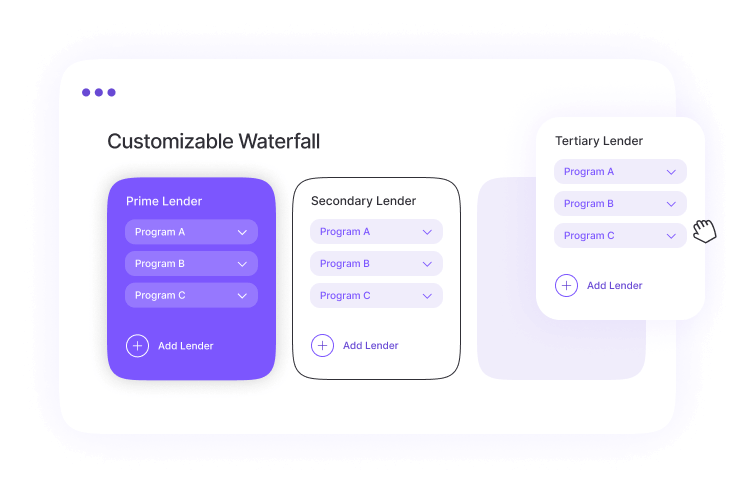

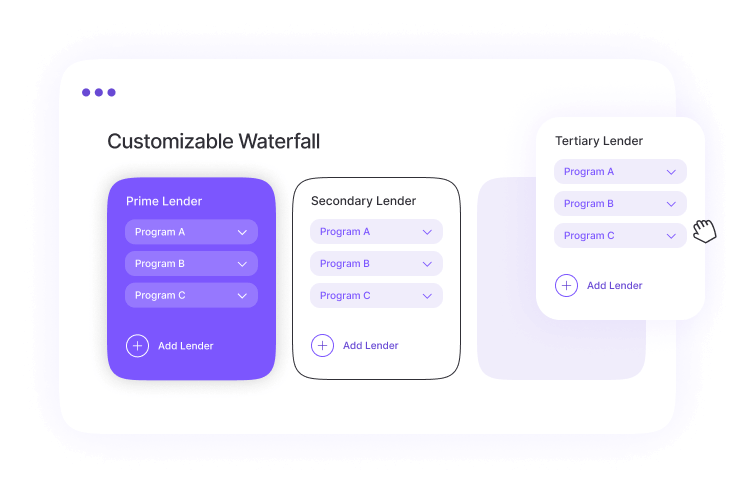

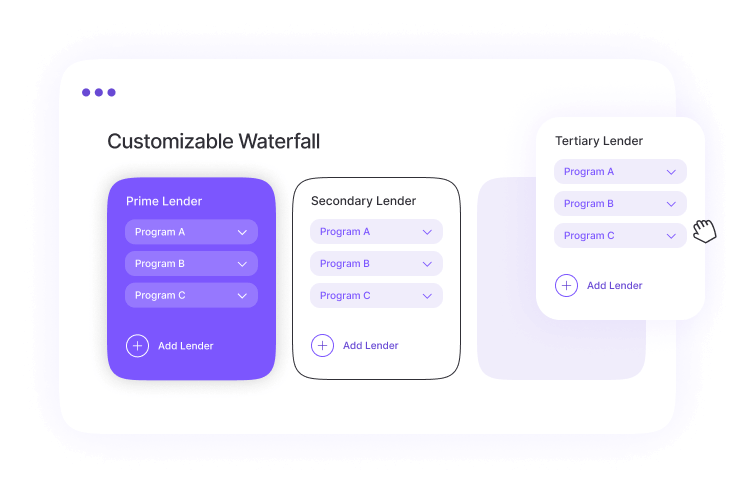

Business users can easily customize the platform to adapt for any needed changes. For example, they can switch lenders, update policies, and connect to new lending products, empowering them with greater flexibility and control.

Business users can easily customize the platform to adapt for any needed changes. For example, they can switch lenders, update policies, and connect to new lending products, empowering them with greater flexibility and control.

Business users can easily customize the platform to adapt for any needed changes. For example, they can switch lenders, update policies, and connect to new lending products, empowering them with greater flexibility and control.

Check out the financial partners driving more approvals at your point of sale

Join merchants across the globe reporting approvals of over 80%.

We are fully secure and protected, giving you peace of mind.

Build your customer base with more approvals - they’ll remember you for it.

Optimize your financing

offers with powerful consumer

financing analytics.

Our embedded lending network accommodates any customer, regardless of their credit history or score.

Integrate any lender and consumer finance product into your embedded lending offer.