The Best Home Improvement Financing Providers, 2025

Choosing the right home improvement financing partner in 2025 isn’t just about closing more sales, it’s about building trust, increasing conversion, and creating long-term value for your customers.

Designed for home improvement and home services providers, this article walks you through how to select the best lending partners for your financing offer. It covers:

- Why financing matters more than ever

- What to look for in your lending partners

- The best home improvement financing providers

- How to choose the best financing solution for your home improvement business

- Why ChargeAfter is the ideal multi-lender financing platform

Why financing matters more than ever

Choosing the right home improvement financing partner in 2025 isn’t just about closing more sales, it’s about building trust, increasing conversion, and creating long-term value for your customers. To maximize financing potential, contractors must offer a fast and simple solution that covers the full credit spectrum.

Prime lending partners help you serve creditworthy customers with long-term potential, the kind who come back to upgrade their kitchen after replacing the roof. Offering the best possible terms and experience is key to earning their loyalty.

But the real opportunity lies in also seamlessly serving non-prime customers, those who may not have perfect credit but are ready to move forward with their project today. By partnering with trusted non-prime lenders, you can extend financing to a broader range of homeowners, boost approval rates, and avoid leaving money on the table.

This guide profiles the best home improvement financing providers, helping you see which lending partners can help you drive approvals and lift average ticket values, especially when offered through a multi-lender platform that simplifies the lending process.

“The real opportunity lies in also seamlessly serving non-prime customers, those who may not have perfect credit but are ready to move forward with their project today.”

What to look for in your lending partners

With home improvement project costs often exceeding $30,000, most customers rely on financing.

When done well, financing becomes a strategic growth lever. By choosing the right lending partners, you don’t just offer your customers competitive rates, you enable them to access terms tailored for specific project types, helping you build trust and close sales.

Whether you’re just building a financing strategy or looking to optimize your current setup, this guide will help you evaluate the best lending partners to support your growth.

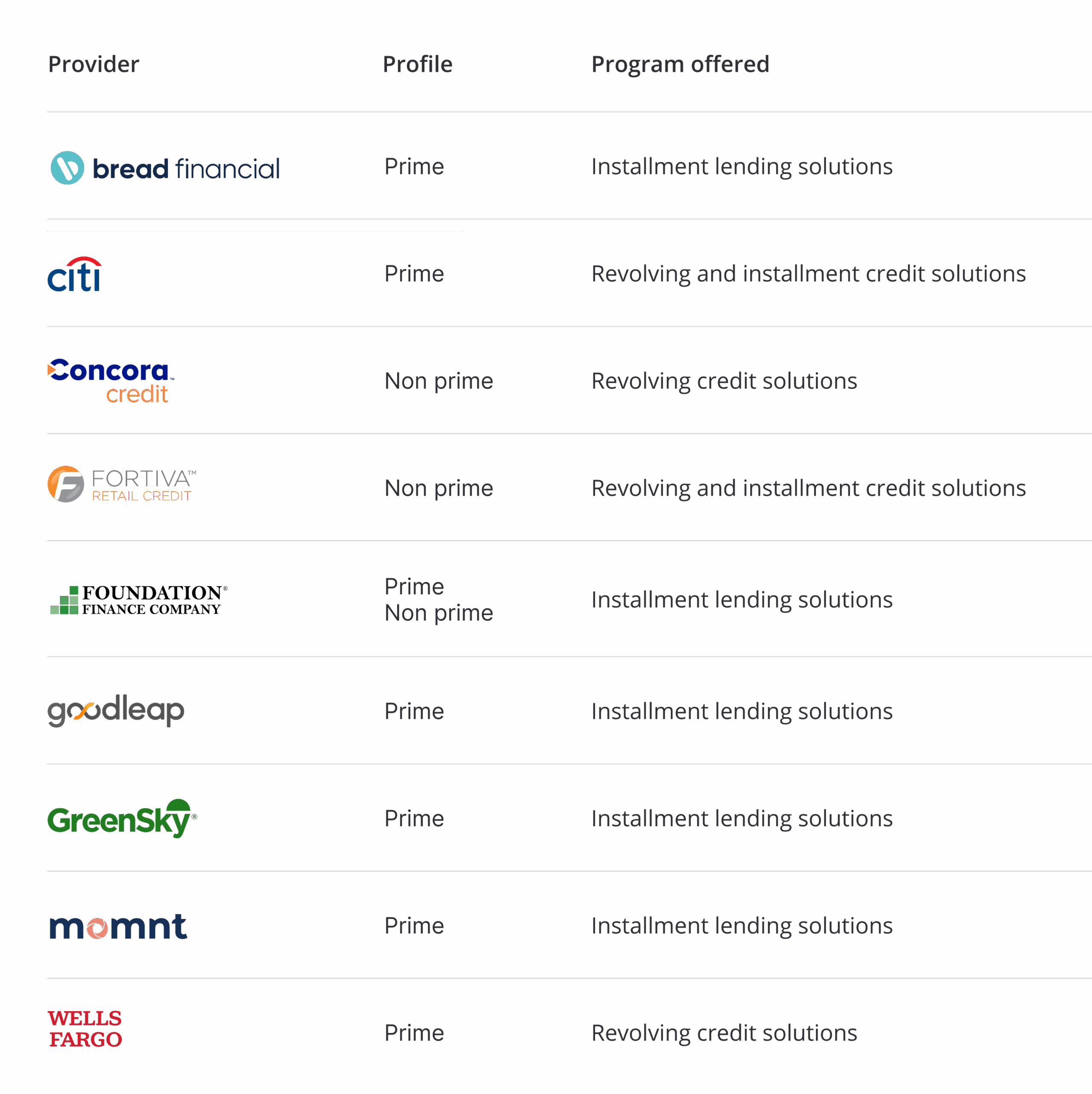

The best financing providers for home improvement: Top 10 in 2025

We’ve compiled a list of the top financing providers serving home improvement and home services contractors. These lenders partner with multi-lender platforms to offer both revolving and installment financing solutions for prime and non-prime consumers alike.

With loan amounts up to $100,000, terms extending up to 20 years, and instant credit decisions, contractors can deliver flexible financing options across virtually any project category, ensuring more approvals, higher conversions, and greater customer satisfaction.

How to choose the best financing solution for your home improvement business

This section walks you through how to evaluate providers strategically, what common mistakes to avoid, and why more contractors are turning to multi-lender platforms to meet today’s demands.

-

Cover your entire customer base

You know your customers best ,and your top priority should be finding the right lenders to serve them. In home improvement, most financing volume comes from prime and near-prime lenders, so it’s critical to work with partners who offer competitive rates and flexible terms for these segments. In certain categories, like HVAC, no-credit-required options such as lease-to-own can also play an important role. If you serve both homeowners and professionals, B2B financing solutions are a must. A well-rounded lender mix ensures you’re ready to support every customer, from a homeowner replacing a water heater to a contractor outfitting an entire building.

-

Assess lending models

Do your customers prefer fixed monthly payments with a clear end date? Then installment loans may be key. However, if you’re in a trade that sees ongoing or recurring work, like maintenance or landscaping, revolving credit might be a better fit. A strong financing partner will offer programs that suit the rhythm of your business.

-

Evaluate integration options

Individual lenders may work for some smaller contractors with a narrow range of customer credit types, but many home improvement providers are moving toward multi-lender platforms like ChargeAfter. ChargeAfter streamlines the financing journey, providing access to a broader network of lenders, and reducing operational complexity through a single integration.

-

Check approval rates & terms

Go beyond the headline numbers. Ask how approval rates vary across FICO bands and how well the lender aligns with your core customer credit profile. Promotional terms, loan amounts, and fees also affect the customer’s willingness to accept the offer.

-

Review support & dispute management

Financing doesn’t end at checkout. Look for providers that offer dedicated support teams, efficient dispute resolution, and a transparent process. A responsive partner reduces back-end stress and helps protect your brand.

Pitfalls to avoid when evaluating your financing offer

There are common pitfalls that can limit approvals, create friction, or slow your growth to look out for.

-

Choosing a single-lender solution without backup

If that lender changes direction or tightens criteria, your sales may suffer, and without a backup, some customers may have no financing option at all. A platform with an embedded multi-lender network ensures you’re never reliant on a single lender and can continue serving a wider range of customers, even when market conditions shift.

-

Overlooking the customer experience

A complicated application process or unclear terms can lead to opt outs. A single application through a platform that instantly matches your customer to the best-fit financing choices with clear terms will maximize sales.

-

Ignoring integration and operational complexity

What seems simple up front can quickly turn into a headache if the financing solution isn’t built to scale with your systems. Manual processes, or limited visibility across teams can slow down approvals and frustrate both your team and your customers. That’s why more home improvement providers are moving toward a platform-first approach that streamlines integrations, centralizes operations, and makes it easier to manage financing across locations, teams, and customer touchpoints.

-

Focusing only on rates

While competitive rates are important, they don’t matter if your customers aren’t getting approved, or are not offered sufficient loan amounts . And if the application is confusing, slow, or redirects customers offsite, many will abandon the process altogether. To truly drive revenue, you need a financing solution that balances strong rates with high approvals, user-friendly applications, and post-sale support.

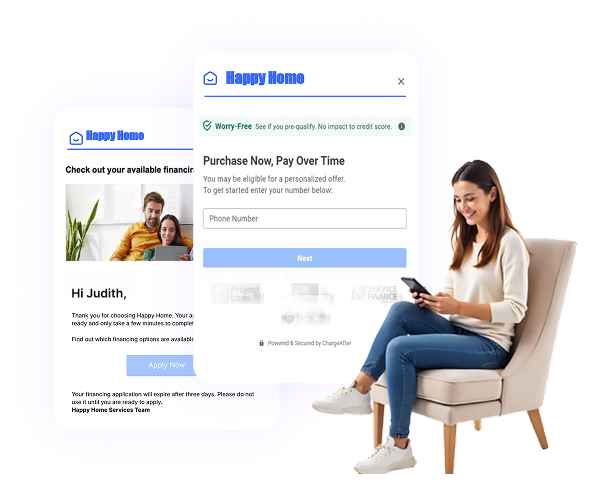

Why ChargeAfter is the ideal multi-lender financing platform for contractors

When it comes to home improvement and home services financing, choosing the right technology partner is just as important as selecting the right lenders. ChargeAfter is the leading multi-lender financing platform built for enterprise and large-scale contractors and service providers. Whether you’re looking to increase approval rates, tickets, or simplify operations, ChargeAfter delivers measurable results. The platform supports:

Easy integration and fast time-to-value

With flexible APIs, SDKs, and pre-built modules for in-home workflows, ChargeAfter integrates seamlessly into your existing systems. Providers typically go live in just weeks, so you can start seeing results faster.

Proven AOV uplift and better conversion

By offering customers access to financing at the kitchen table, ChargeAfter helps you increase tickets and reduce abandonment. In fact, one leading home improvement provider saw a 33% increase in approval rates and significantly higher conversion after switching to ChargeAfter.

Trusted by leading contractors

ChargeAfter powers financing for some of the world’s most recognized home improvement and home services brands, national retailers, and regional contractors. Whether you’re running an enterprise operation or managing a multi-location service business, you’re in good company.

Scalable and future-proof platform

As your business evolves, we are here to support you. From custom lender rules to full white-labeling and operational tools like dispute management and analytics, the platform is designed to grow with you.

Make a Confident Decision with ChargeAfter

Creating your financing offer is a strategic activity that impacts every part of your customer journey, from the first quote to the final payment. With ChargeAfter, you’re accessing a network of top lenders that cover the credit spectrum, partnering with a platform built for long-term growth, seamless integration, and better business outcomes. Whether you’re looking to increase approval rates, improve conversions, or future-proof your financing strategy, ChargeAfter gives you the tools to move forward with confidence.

Recap of what to prioritize when choosing the best financing solution

- Building a lender stack that fits all your customers’ needs, prime and near-prime, as well as subprime and B2B, if needed.

- Offering a mix of installment and revolving credit where relevant.

- Seamless integration to multiple lenders that supports in-home sales.

- Strong lender relationships and operational support.

- A platform that simplifies integration and management, and scales with your business.

FAQs

Choosing the right mix of lenders is critical to meeting your customers’ needs. Prime lenders serve borrowers with strong credit, while non-prime lenders help you approve more customers overall. A strong financing strategy includes options for every credit tier, so you don’t miss out on sales due to limited eligibility.

Yes, especially in home improvement, where customer credit profiles vary widely. While prime lenders are important for offering competitive rates to high-credit customers, near-prime and no-credit-required options (like lease-to-own) are essential in categories such as HVAC and roofing. With a multi-lender platform like ChargeAfter, you can serve the full credit spectrum with one seamless experience.

Approval rates vary based on the lender’s risk model and your customer profile. Instead of looking only at overall averages, ask for FICO-specific approval rates and evaluate how those align with your audience. Platforms that offer waterfall models typically yield higher total approval rates.

Installment loans are structured with fixed payments over a set term and are ideal for one-time, high-cost projects. Revolving credit lines are more flexible and work well for recurring services like HVAC maintenance or seasonal upgrades. The best option depends on your trade and how often customers need your services.

Implementation time depends on your existing systems and workflows, but with ChargeAfter’s flexible APIs and in-home modules, many providers go live in just a few weeks. The platform is designed for fast deployment and minimal disruption, so you can start seeing results quickly.